Short term view - more of the same then final push higher and reversal.

Intermediate term view - too many options the best for me is a triangle.

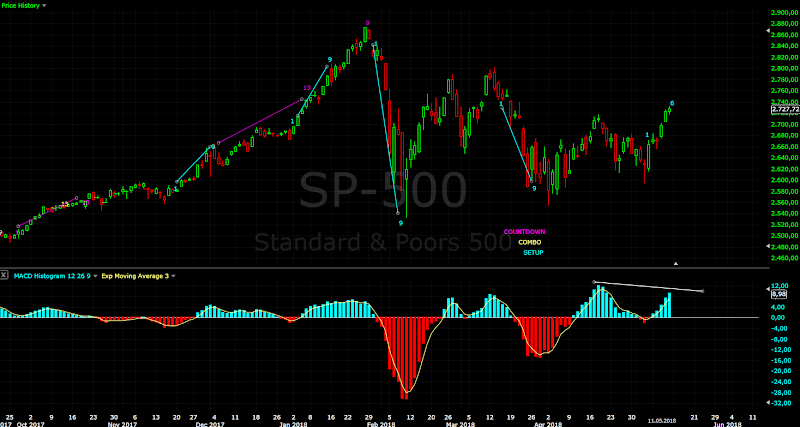

Another sideway week... the pattern looks like some b wave. I do not think it is small degree wave iv from an impulse lasting two weeks is way too long.

I doubt it is wave 2 market breadth and the indicators do not support wave 3. So sticking to the plan wave D of a triangle or alternate if we see deeper push lower to support it is possible that this is wave 4 of a diagonal.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - shallow pullback lasting for so long is most of the time some connecting wave x/b. The first leg up from the April low consists of two zig-zags. The leg lower consists again of two zig-zags. From the May low we have one zig-zag up and connecting wave running now - the odds are higher that we will see another zig-zag up for a double zig-zag like the previous two legs.

So as long as the price stays above MA200 the 2690-2700 area I expect another zig-zag to finish wave D of a triangle - main scenario.

If we see deeper retracement to support 2670-2680 area it is possible that we have a diagonal - alternate scenario.

If the price breaks below support wave E is running already - low probability at the moment because reversal pattern is missing.

Intermediate term - I just can not see impulses all corrective waves and too many options to trade with conviction. Just waiting and preferred scenarios is wave D from a triangle.

Long term - nothing new waiting for he market to reveal it's intentions. I do not see imminent reversal and sell off.

So far the move up is very disappointing - look at the angle of ascend for the price and RSI.... the histogram is resetting close to zero and price is doing nothing. This is not bullish price action.

MARKET BREADTH INDICATORS

Market Breadth Indicators - nothing impressive, in the middle of the range.... nothing bullish, nothing bearish.

McClellan Oscillator - series of lower highs and moving lower close to the zero line.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal in overbought territory.

Bullish Percentage - in the middle of the range.

Percent of Stocks above MA50 - in the middle of the range.

Fear Indicator VIX - complacency again I doubt that the indexes will rally higher.

Advance-Decline Issues - series of lower highs.

HURST CYCLES

Day 39 of the 40 day cycle - I think it made a top and now we are waiting for the low.

Week 15 from the last important low in February. If we have a triangle expect 20w/40w/18 month cycle low when it is finished and I will revert to my initial count.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

The setup could not be finished, it was negated at day 8. This is another signs for weakness and I doubt we have an impulse.

The histogram on the daily is resetting lower, but the price moves sideways - not a bearish price action. Most likely we will see a few more days to finish corrective pattern and a move higher.

May 26, 2018

May 19, 2018

Update

I was very busy this week and I am tired so just a short update... it does not happened anything anyway. It is basically the same like the last two posts.

We have a sideway move in a tight range for several days which does not favor neither of both triangle scenarios from the previous post. It is very unlikely that this is small wave iv(white labels previous chart) running 4-5 days so the impulse is dead for me. I did not believe in finished triangle anyway because the daily RSI shows a move has begun in early April and it is still running so the white triangle is dead for me. Now to focus what could it be.

We have a move which begun early April and it is obviously corrective so the both alive scenarios are wave D of a triangle or diagonal.

In the first case the price should start moving lower quickly and break below the support area then test it and drop again.

In the case of a diagonal we should see another choppy move lower correcting 50% and testing the support area for wave 4 of the diagonal.

I have shown this scenario as alternate option last week and with this "doing nothing" whole week the probability is rising rapidly.

May 16, 2018

Update

Here is how the triangle pattern should look like. Many think that the triangle is finished than we should see two more highs for finished impulse wave 1 of V(white labels).

I am not a big fan of this scenario. The triangle which I follow is the yellow one in this case we should see a drop lower for w3 of a of E. The move from the top is an impulse for me and the white triangle(E) has low probability.... who knows it could be even something completely different than a triangle.

May 12, 2018

Weekly preview

Short term view - short term top next week.

Intermediate term view - I see another zig-zag most likely part of wave D of a triangle and wave E to begin next week.

We have the move higher, but it escalated very quickly with a brief pause at resistance(the neckline of possible IHS). I see two legs higher for another a-b-c. To spin it bullish(wave V already running) - extended wave 5 or 1-2 i-ii or continuation higher for w3 followed by w4 and w5. I do not think the price action is so bullish and this counts do not fit so good. The plan seems to work so far, so sticking to the plan - another zig-zag for wave D. From trading perspective - closing again half of the position and waiting to see what happens. If it is E reducing even more the position if it is an impulse and we see only a correction I will add again to the position. Market breadth and the indicators need more time to reset and I do not see imminent bearish reversal. On the daily chart is shown bearish pattern if the top is really behind us. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - it looks to me like two legs up with the same size so I expect short term top next week. Usually such shallow short living pauses are wave b or 4 and not 2 and I do not like the bullish counts.

If the price action is really so bullish and impulse is running it should continue higher for wave 3.

Intermediate term - the plan looks ok so far - wave D. Looking at the RSI the whole move from the April low belongs to one bigger wave and not to two different waves(wave D and E for finished triangle).

Bearish option is shown in white I do not like the super bearish counts 1-2 i-ii. This is the alternate scenario which I have shown on the weekly cycle chart last week.

Long term - one more rally higher expected. The histogram needs more time to reset so in the next two months the price should still move higher.

MARKET BREADTH INDICATORS

Market Breadth Indicators - positive, but not showing much strength.

McClellan Oscillator - at elevated levels where we see a short term top and second lower high, not very bullish.

McClellan Summation Index - buy signal, but strength is missing.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - pointing up in the middle of the range.

Percent of Stocks above MA50 - pointing up in the middle of the range.

Fear Indicator VIX - below 13 a lot of complacency again.

Advance-Decline Issues - third lower high and divergences, not very bullish.

HURST CYCLES

Day 29 of the 40 day cycle. It looks mature now.

Week 13.... a few more weeks to finish 20 week cycle - wave E? (this is the bearish cycle count if the triangle plays out I will revert to my initial count with shorter cycles)

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Day 6 of a sell setup... waiting to see if it will be finished next week or not.

The daily histogram should finish second tower with divergences next week. It does not look like the acceleration to continue for wave 3.

Intermediate term view - I see another zig-zag most likely part of wave D of a triangle and wave E to begin next week.

We have the move higher, but it escalated very quickly with a brief pause at resistance(the neckline of possible IHS). I see two legs higher for another a-b-c. To spin it bullish(wave V already running) - extended wave 5 or 1-2 i-ii or continuation higher for w3 followed by w4 and w5. I do not think the price action is so bullish and this counts do not fit so good. The plan seems to work so far, so sticking to the plan - another zig-zag for wave D. From trading perspective - closing again half of the position and waiting to see what happens. If it is E reducing even more the position if it is an impulse and we see only a correction I will add again to the position. Market breadth and the indicators need more time to reset and I do not see imminent bearish reversal. On the daily chart is shown bearish pattern if the top is really behind us. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - it looks to me like two legs up with the same size so I expect short term top next week. Usually such shallow short living pauses are wave b or 4 and not 2 and I do not like the bullish counts.

If the price action is really so bullish and impulse is running it should continue higher for wave 3.

Intermediate term - the plan looks ok so far - wave D. Looking at the RSI the whole move from the April low belongs to one bigger wave and not to two different waves(wave D and E for finished triangle).

Bearish option is shown in white I do not like the super bearish counts 1-2 i-ii. This is the alternate scenario which I have shown on the weekly cycle chart last week.

Long term - one more rally higher expected. The histogram needs more time to reset so in the next two months the price should still move higher.

MARKET BREADTH INDICATORS

Market Breadth Indicators - positive, but not showing much strength.

McClellan Oscillator - at elevated levels where we see a short term top and second lower high, not very bullish.

McClellan Summation Index - buy signal, but strength is missing.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - pointing up in the middle of the range.

Percent of Stocks above MA50 - pointing up in the middle of the range.

Fear Indicator VIX - below 13 a lot of complacency again.

Advance-Decline Issues - third lower high and divergences, not very bullish.

HURST CYCLES

Day 29 of the 40 day cycle. It looks mature now.

Week 13.... a few more weeks to finish 20 week cycle - wave E? (this is the bearish cycle count if the triangle plays out I will revert to my initial count with shorter cycles)

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Day 6 of a sell setup... waiting to see if it will be finished next week or not.

The daily histogram should finish second tower with divergences next week. It does not look like the acceleration to continue for wave 3.

May 10, 2018

Update

SP500 10min chart - instead of a pullback we have another move higher. Now it looks way too much like another zig-zag, I do not believe in extended fifth wave or 1-2 i-ii.

May 5, 2018

Weekly preview

Short term view - one more high and pull back for inverted H&S.

Intermediate term view - higher in May.

We saw another zig-zag from a bigger double zig-zag and reversal.... it looks like the finished triangle the yellow one which I have shown the previous week. The problem is how the low occur - looking at indicators/market breadth/cycles I can not see important low... just some low, no fear, no oversold levels, nothing to suggest intermediate term low. So I do not think this is the pattern and I do not believe that wave V has begun. Back to the charts which I have shown a few weeks ago - bullish triangle and 18 month cycle low in June or the top is behind us and multi month bearish pattern. See the weekly cycle charts for a long term perspective.

Nevertheless I am long because the indexes should move higher in May - double zig-zag lower is corrective pattern. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - double zig-zag lower which is corrective and reversal. One more high is needed for a finished impulse. I think we will see one more high, the daily MA50 will be tested with impulse and the neckline of inverted H&S to be formed, then a pullback for the right shoulder.

Intermediate term - the price is still trapped between MA50 and MA200. I expect test of MA50 which will be sold, but I expect higher low and unsuccessful attempt to push below MA200.

The histogram did not made a trough, just dipped below 0. I would say this is not important low just the low of corrective wave from a bigger leg up - most likely b of D.

Long term - one more rally higher.... I think the bullish scenario is more likely.

MARKET BREADTH INDICATORS

Market Breadth Indicators - nothing interesting, nothing to suggest important low, just turned up in the middle of the ranges.

McClellan Oscillator - above zero with series of higher lows.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - turned up in the middle of the range.

Percent of Stocks above MA50 - turned up in the middle of the range.

Fear Indicator VIX - around 15... you can not register selling on this chart not to mention an important low.

Advance-Decline Issues - turned up in the middle of the range.

HURST CYCLES

Day 24, I think we have mid cycle low at day 23, it is too early for a 40 day cycle low.

Bearish view - logarithmic scale, the trend line is broken and it will be tested with some bearish pattern. We have 40 week cycle low and the next one is running, but weak and it will make lower high.

Bullish view - arithmetic scale, still in the trend lines and a bigger triangle to make a 18 month cycle low followed by final rally. I do not like how the RSI looks like and that the triangle will finish outside of the trend lines, but at the moment this scenario feels better.

Intermediate term view - higher in May.

We saw another zig-zag from a bigger double zig-zag and reversal.... it looks like the finished triangle the yellow one which I have shown the previous week. The problem is how the low occur - looking at indicators/market breadth/cycles I can not see important low... just some low, no fear, no oversold levels, nothing to suggest intermediate term low. So I do not think this is the pattern and I do not believe that wave V has begun. Back to the charts which I have shown a few weeks ago - bullish triangle and 18 month cycle low in June or the top is behind us and multi month bearish pattern. See the weekly cycle charts for a long term perspective.

Nevertheless I am long because the indexes should move higher in May - double zig-zag lower is corrective pattern. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - double zig-zag lower which is corrective and reversal. One more high is needed for a finished impulse. I think we will see one more high, the daily MA50 will be tested with impulse and the neckline of inverted H&S to be formed, then a pullback for the right shoulder.

Intermediate term - the price is still trapped between MA50 and MA200. I expect test of MA50 which will be sold, but I expect higher low and unsuccessful attempt to push below MA200.

The histogram did not made a trough, just dipped below 0. I would say this is not important low just the low of corrective wave from a bigger leg up - most likely b of D.

Long term - one more rally higher.... I think the bullish scenario is more likely.

MARKET BREADTH INDICATORS

Market Breadth Indicators - nothing interesting, nothing to suggest important low, just turned up in the middle of the ranges.

McClellan Oscillator - above zero with series of higher lows.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - turned up in the middle of the range.

Percent of Stocks above MA50 - turned up in the middle of the range.

Fear Indicator VIX - around 15... you can not register selling on this chart not to mention an important low.

Advance-Decline Issues - turned up in the middle of the range.

HURST CYCLES

Day 24, I think we have mid cycle low at day 23, it is too early for a 40 day cycle low.

Bearish view - logarithmic scale, the trend line is broken and it will be tested with some bearish pattern. We have 40 week cycle low and the next one is running, but weak and it will make lower high.

Bullish view - arithmetic scale, still in the trend lines and a bigger triangle to make a 18 month cycle low followed by final rally. I do not like how the RSI looks like and that the triangle will finish outside of the trend lines, but at the moment this scenario feels better.

Subscribe to:

Comments (Atom)