Cycles showed that more time is needed and we saw it this week. Short term pattern and cycles are not very clear. Maybe iv-v/c subwaves or some complex topping pattern - diagonal,triangle. Intermediate term the market looks tired with indicator divergences and it is time for 20w cycle high even if you use different approaches to count the highs(see the last two charts). Long term my opinion is clear this is B-wave stretched in time with top in the middle of the 4y cycle high - the same pattern and cycles like 2019.

TRADING

Trading trigger - buy signal.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

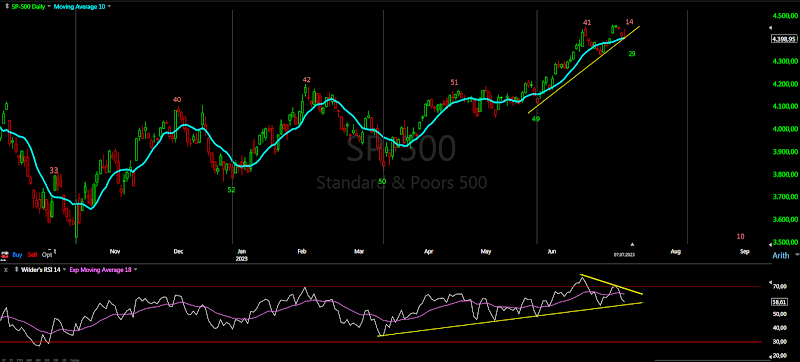

Short term - now we have two zig-zags with triangle in the middle. Some are trying to count impulse c from b(red) we saw iv/c flat and final wave v/c/y/B has started. I am not convinced.... have not seen impulse for a long time, but lets see what happens.

Intermediate term - some kind of w-x-y/B or a-b-c/B better visible on the NDX - at the end only the labels are different.The indicators are showing divergences

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - oscillators turned lower, lets see continuation or divergence will follow.

McClellan Oscillator - around zero.

McClellan Summation Index - buy signal with divergence.

Weekly Stochastic of the Summation Index - buy signal, reached overbought level.

Bullish Percentage - turned lower.

Percent of Stocks above MA50 - turned lower.

Fear Indicator VIX - double bottom.

Advance-Decline Issues - turned lower.

HURST CYCLES

Short term cycles - not really clear maybe 20d low on Thursday and final 20d cycle high has started to complete the 20w high.

Week 3 for the 20w cycle? We do not have clear cycles - if I stick to the average length we have 10w/20w cycles shown above. In this case there is no clear 40w cycle low - it happens when the cycle of higher degree is dominant in this case the 18m cycle.

For the highs most likely we have 4y cycle consisting of two longer cycles instead of 3x18m cycles like the previous one 2018-2021 with high in the middle 2019.

Jul 29, 2023

Jul 22, 2023

Weekly preview

It took a few days, but we have turn lower. Based on pattern this looks like the top - we have the usual double zig-zag. Looking the cycles I would say one more 20d cycle - we have right translated 20d cycle which usualy means another higher high. So waiting to see what happens in the next 1-2 weeks.

TRADING

Trading trigger - buy signal.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - double zig-zag w, triangle x(completes in sync with NYSE when it makes its low), another double zig-zag y. It can extend longer if b/y is triangle too and the index is in the middle of the c/y zig-zag. Right translated 20d cycle points to such outcome.

Intermediate term - some kind of w-x-y/B or a-b-c/B better visible on the NDX - at the end only the labels are different.

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - overbought, time for topping and reversal.

McClellan Oscillator - turned lower after short term divergence.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - overbought.

Percent of Stocks above MA50 - overbought.

Fear Indicator VIX - turning higher after short term divergence.

Advance-Decline Issues - touched overbought level, double divergence.

HURST CYCLES

Short term cycles - extended 20d cycle high, next is 20d cycle low which is already 9 days long so right translated. Probably 20d low around FOMC. Right translated 20d cycle and trying to stick to the average cycle length points to one more 20d cycle high to complete 20w high.

The longer cycles especialy 40w cycle high/low are not clear. If I try to use the average length for the 10w/20w cycles the result is this shown on the chart. The question in this case is why there is no 40w/18m high around the end of March instead we have 3x20w cycles. The only answer I have - the same like 2019, 4y cycle consisting of two longer cycles instead of 3x18m cycles.

Week 2 for the 20w cycle? We do not have clear cycles - if I stick to the average length we have 10w/20w cycles shown above. In this case there is no clear 40w cycle low - it happens when the cycle of higher degree is dominant in this case the 18m cycle. For the highs most likely we have 4y cycle consisting of two longer cycles instead of 3x18m cycles.

Trading trigger - buy signal.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - double zig-zag w, triangle x(completes in sync with NYSE when it makes its low), another double zig-zag y. It can extend longer if b/y is triangle too and the index is in the middle of the c/y zig-zag. Right translated 20d cycle points to such outcome.

Intermediate term - some kind of w-x-y/B or a-b-c/B better visible on the NDX - at the end only the labels are different.

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - overbought, time for topping and reversal.

McClellan Oscillator - turned lower after short term divergence.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - overbought.

Percent of Stocks above MA50 - overbought.

Fear Indicator VIX - turning higher after short term divergence.

Advance-Decline Issues - touched overbought level, double divergence.

HURST CYCLES

Short term cycles - extended 20d cycle high, next is 20d cycle low which is already 9 days long so right translated. Probably 20d low around FOMC. Right translated 20d cycle and trying to stick to the average cycle length points to one more 20d cycle high to complete 20w high.

The longer cycles especialy 40w cycle high/low are not clear. If I try to use the average length for the 10w/20w cycles the result is this shown on the chart. The question in this case is why there is no 40w/18m high around the end of March instead we have 3x20w cycles. The only answer I have - the same like 2019, 4y cycle consisting of two longer cycles instead of 3x18m cycles.

Week 2 for the 20w cycle? We do not have clear cycles - if I stick to the average length we have 10w/20w cycles shown above. In this case there is no clear 40w cycle low - it happens when the cycle of higher degree is dominant in this case the 18m cycle. For the highs most likely we have 4y cycle consisting of two longer cycles instead of 3x18m cycles.

Jul 16, 2023

Weekly preview

20d low and higher into 5w high. It is the c/y zig-zag shown the previous week after all.

The 6000 dream is back again and sadly it is just a dream, not this time either... maybe next time in 2025.

The sentiment is more extreme at the b-wave high than the real top in 2021 exacly as in 2019 - do not get fooled it is the same corrective b-wave there is no bull markets of five stocks. Moves consist of at least three legs, every 3.5-4 years there is 4y high folowed by 4y low - the indices will move lower before moving higher. You can keep living in a dream world or look at a simple chart....maybe this time is different... NO ITS NOT.

TRADING

Trading trigger - buy signal.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - it is a double zig-zag after all shown two weeks ago... the other option is questionable impulse.

Intermediate term - some kind of w-x-y/B. The other option is a-b-c/B better visible on the NDX

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - hit overbought level at last.

McClellan Oscillator - touched overbought level and reversed, divergences.

McClellan Summation Index - buy signal, divergence with the previous high.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - reached overbought level.

Percent of Stocks above MA50 - reached overbought level.

Fear Indicator VIX - declining, short term divergences.

Advance-Decline Issues - almost reached overbought level and turned lower, divergences.

HURST CYCLES

Short term cycles - 20d/5w high next is decine into 20d/5w low.

Week 7 from the last 10w cycle low. We do not have clear 20w/40w cycles - since the August high/October low we have cycles longer than 20 weeks too long for 20w cycle too short for 40w cycle something in the middle. Maybe instead 2x40w cycles we will see 3x20w longer cycles 5-5.5 months each overall 15-16 months which is the average length for the 18m cycle.

It is the same with the highs - at the moment the indices are at such high again, from the August high we have cycle lasting 25 weeks and now second extended cycle at week 23.

Trading trigger - buy signal.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - it is a double zig-zag after all shown two weeks ago... the other option is questionable impulse.

Intermediate term - some kind of w-x-y/B. The other option is a-b-c/B better visible on the NDX

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - hit overbought level at last.

McClellan Oscillator - touched overbought level and reversed, divergences.

McClellan Summation Index - buy signal, divergence with the previous high.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - reached overbought level.

Percent of Stocks above MA50 - reached overbought level.

Fear Indicator VIX - declining, short term divergences.

Advance-Decline Issues - almost reached overbought level and turned lower, divergences.

HURST CYCLES

Short term cycles - 20d/5w high next is decine into 20d/5w low.

Week 7 from the last 10w cycle low. We do not have clear 20w/40w cycles - since the August high/October low we have cycles longer than 20 weeks too long for 20w cycle too short for 40w cycle something in the middle. Maybe instead 2x40w cycles we will see 3x20w longer cycles 5-5.5 months each overall 15-16 months which is the average length for the 18m cycle.

It is the same with the highs - at the moment the indices are at such high again, from the August high we have cycle lasting 25 weeks and now second extended cycle at week 23.

Jul 8, 2023

Weekly preview

Turn lower into 20d low as expected, a few more days for short term low. Some indices made higher high some lower high so it is not clear is this the top or b-wave high, maybe both depending of the concrete index. For the SPX I would say b-wave high as suggested last week.

Topping process has begun, most likely lasting through the summer. I have the feeling it will be rounded top and not a crash.

TRADING

Trading trigger - neutral.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - lower for a few days to complete a-b-c, then higher. When we see the size of the moves we can make some conclusions.

Intermediate term - some kind of w-x-y/B. Waiting to see the next few weeks where to pinpoint the top. I will not be surprised if it is behind us.

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - it looks like topping begun and there is important divergence with the previous high.

McClellan Oscillator - around zero.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - touched overbought and turned lower.

Percent of Stocks above MA50 - touched overbought and turned lower.

Fear Indicator VIX - big spike higher.

Advance-Decline Issues - in the middle of the range with miltiple divergences.

HURST CYCLES

Short term cycles - lower into 20d cycle low, probably a few more days then higher into 20d high. The longer cycles are not very clear. I think we have 10w high mid-June and now declining into 10w low.

Week 6 for the 20w cycle. We do not have clear 40w low... probably this three longer 10w cycles are part of something bigger. Maybe instead 2x40w cycles we will see 3x20w longer cycles 5-5.5 months each overall 15-16 months which is the average length for the 18m cycle. By the way it is the same with the highs - important high every 5 months +-2 weeks too.

Trading trigger - neutral.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - lower for a few days to complete a-b-c, then higher. When we see the size of the moves we can make some conclusions.

Intermediate term - some kind of w-x-y/B. Waiting to see the next few weeks where to pinpoint the top. I will not be surprised if it is behind us.

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - it looks like topping begun and there is important divergence with the previous high.

McClellan Oscillator - around zero.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - touched overbought and turned lower.

Percent of Stocks above MA50 - touched overbought and turned lower.

Fear Indicator VIX - big spike higher.

Advance-Decline Issues - in the middle of the range with miltiple divergences.

HURST CYCLES

Short term cycles - lower into 20d cycle low, probably a few more days then higher into 20d high. The longer cycles are not very clear. I think we have 10w high mid-June and now declining into 10w low.

Week 6 for the 20w cycle. We do not have clear 40w low... probably this three longer 10w cycles are part of something bigger. Maybe instead 2x40w cycles we will see 3x20w longer cycles 5-5.5 months each overall 15-16 months which is the average length for the 18m cycle. By the way it is the same with the highs - important high every 5 months +-2 weeks too.

Jul 2, 2023

Weekly preview

Higher into 20d cycle high as expected. Some count this as 4-5/c/B... I do not believe we have impulses. I will not be surprised even if this is b-wave part of the decline and not the top - just better looking numbers for the end of the quarter.

TRADING

Trading trigger - buy signal.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - many combinations possible. Some see this as 5/c I do not think so - very long and shallow wave(April-May) not very likely for wave 2. Either we have double zig-zag as usual or the previous high was the top.

Intermediate term - some kind of w-x-y/B. Waiting to see the next 1-2 weeks where to pinpoint the top. I will not be surprised if it is behind us.

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - turned higher, but not after reset to expect sustainable move - just topping and divergences.

McClellan Oscillator - above zero, divergences so far.

McClellan Summation Index - buy signal, divergences.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - turned higher.

Percent of Stocks above MA50 - turned higher.

Fear Indicator VIX - higher low, short term divergence.

Advance-Decline Issues - turned higher, divergences.

HURST CYCLES

Short term cycles - now at 20d high, next is decline into 20d low.

Week 5 for the 20w cycle. We do not have clear 40w low... probably this three longer 10w cycles are part of something bigger. Maybe instead 2x40w cycles we will see 3x20w longer cycles 5-5.5 months each overall 15-16 months which is the average length for the 18m cycle. By the way we have an important high every 5 months +-2 weeks too.

Trading trigger - buy signal.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - many combinations possible. Some see this as 5/c I do not think so - very long and shallow wave(April-May) not very likely for wave 2. Either we have double zig-zag as usual or the previous high was the top.

Intermediate term - some kind of w-x-y/B. Waiting to see the next 1-2 weeks where to pinpoint the top. I will not be surprised if it is behind us.

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - turned higher, but not after reset to expect sustainable move - just topping and divergences.

McClellan Oscillator - above zero, divergences so far.

McClellan Summation Index - buy signal, divergences.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - turned higher.

Percent of Stocks above MA50 - turned higher.

Fear Indicator VIX - higher low, short term divergence.

Advance-Decline Issues - turned higher, divergences.

HURST CYCLES

Short term cycles - now at 20d high, next is decline into 20d low.

Week 5 for the 20w cycle. We do not have clear 40w low... probably this three longer 10w cycles are part of something bigger. Maybe instead 2x40w cycles we will see 3x20w longer cycles 5-5.5 months each overall 15-16 months which is the average length for the 18m cycle. By the way we have an important high every 5 months +-2 weeks too.

Subscribe to:

Posts (Atom)