The 20w cycle turned lower, which is not a big surprise. In fact if you look at DAX or DJI most likely the correction is running from 8th of January, but the tech stocks messing up the SP500.

I think we should see one more 20d cycle lower to complete the 20w cycle followed by final rally.

I do not see this as reversal it does not fit, but the end game has begun - red monthly candle and RSI weekly braking below the trend line.

TRADING

Trading cycle - sell signal. The price is below MA10 for three days and RSI broke below the trend line. We saw a turn lower into daily cycle low, but 26 days is too short another 1-2 weeks lower will look better.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - I see corrective pattern lower... more of this double zig-zags. Smaller one with the white labels for b/f-wave. Bigger one the green a-b-c for B/F-wave.

Intermediate term - waiting to see the size of the decline for the degree of the waves - b/f or B/F.

I see only corrective declines so expect one more high to complete the move from the March low. Interesting is if RSI will touch/break the major trend line from the March low - this already occurred on the weekly chart.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle.

MARKET BREADTH INDICATORS

Market Breadth Indicators - pointing lower, most of them in the middle of their ranges so no signs for a bottom.

McClellan Oscillator - slightly oversold with small divergence so probably higher for a few days.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - in the middle of the range.

Percent of Stocks above MA50 - in the middle of the range.

Fear Indicator VIX - spike higher.

Advance-Decline Issues - in the middle of the range.

HURST CYCLES

Short term cycles - next week we should see 2-3 days up for 20d high, then final turn lower for 20d/5w/10w/20w low.

Week 13 for the 20 week cycle. It turned lower and RSI confirms it.

Jan 30, 2021

Jan 23, 2021

Weekly preview

No confirmation and we saw another high... tech stocks masking weakness, other indices like DJ,NYSE,DAX do not show much strength neither market breadth. It is still new information and below I have adjusted the charts accordingly.

TRADING

Trading cycle - buy signal. Now you know why the confirmation is two closes you need to filter the false breaks below/above MA10.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - the last zig-zag from the January low is too short in time to be e-f-g compared to the previous a-b-c. It is more likely this is just e and next we will see f for 20w low followed by final g.

Intermediate term - spending more time up/sideways is important information. Now I think the pattern with the white labels is more likely. The difference is the decline for the 20w low will be of a lower degree b not B. For the neowave pattern this is f from the November low and not F from the March low.

As long as the price stays above 3650 watching the white labels. If we see bigger drop to the lower trend line than the red labels.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle.

MARKET BREADTH INDICATORS

Market Breadth Indicators - very weak, pointing lower with divergences.

McClellan Oscillator - below zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - short term divergence, but still above 70.

Percent of Stocks above MA50 - heading lower and sligthly below 75.

Fear Indicator VIX - higher lows, building divergences.

Advance-Decline Issues - turned lower after lower highs and divergence.

HURST CYCLES

Short term cycles - low-to-low count looks ok, next we should see decline into 20d low, which will mean the 20w cycle turning lower.

High-to-high two options - 20w cycle with 21+ weeks length or three 10w cycles with length 7 weeks. They are even shorter than low-to-low cycles so the second option makes more sense and fit with the pattern. Anyway the point is 10w or 20w high and turn lower into 10w/20w low.

Week 12 for the 20 week cycle.

Trading cycle - buy signal. Now you know why the confirmation is two closes you need to filter the false breaks below/above MA10.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - the last zig-zag from the January low is too short in time to be e-f-g compared to the previous a-b-c. It is more likely this is just e and next we will see f for 20w low followed by final g.

Intermediate term - spending more time up/sideways is important information. Now I think the pattern with the white labels is more likely. The difference is the decline for the 20w low will be of a lower degree b not B. For the neowave pattern this is f from the November low and not F from the March low.

As long as the price stays above 3650 watching the white labels. If we see bigger drop to the lower trend line than the red labels.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle.

MARKET BREADTH INDICATORS

Market Breadth Indicators - very weak, pointing lower with divergences.

McClellan Oscillator - below zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - short term divergence, but still above 70.

Percent of Stocks above MA50 - heading lower and sligthly below 75.

Fear Indicator VIX - higher lows, building divergences.

Advance-Decline Issues - turned lower after lower highs and divergence.

HURST CYCLES

Short term cycles - low-to-low count looks ok, next we should see decline into 20d low, which will mean the 20w cycle turning lower.

High-to-high two options - 20w cycle with 21+ weeks length or three 10w cycles with length 7 weeks. They are even shorter than low-to-low cycles so the second option makes more sense and fit with the pattern. Anyway the point is 10w or 20w high and turn lower into 10w/20w low.

Week 12 for the 20 week cycle.

Jan 16, 2021

Weekly preview

Lower this week, which is not a big surprise - just enough for reversal, but not enough to confirm it. I think we saw the top for the move which started in November, but at the moment it is not confirmed.

TRADING

Trading cycle - sell signal, another close below MA10 confirmation is second close below it. RSI is below the MA too, but for confirmation I want to see it breaking below the trend line.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - NYSE made higher high, DJI only intraday, SP500 slightly lower high - similar to Jan-Feb last year non-confirmations. The move from the November low should be completed, but we need confirmation like brake below the channel and the last minor low.

Intermediate term - the indicators with long and short term divergences warning for a high.

Looking at RSI I think this labeling is better - three moves higher with roughly the same length 11-9-10 weeks.

Neowave pattern diametric completing at 18m high looks good. Classical EW pattern should be W-X-Y(red) with the catch that there is no impulses.

Alternate this is THE top Z/G(white) I do not believe it much, but if we see the last move retraced very quickly like 4-5 weeks we have reversal.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the oscillators are turning lower with divergences. I think they are pointing to intermediate term high.

McClellan Oscillator - turned lower and below zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - short term divergence and turned lower.

Percent of Stocks above MA50 - short term divergence and turned lower, sligthly below 75.

Fear Indicator VIX - higher lows, we should see spike higher.

Advance-Decline Issues - turned lower after lower highs and divergence.

HURST CYCLES

Short term cycles - this choppy price action makes it difficult to analyze the short term cycles... this is the fourth week from the previous high so most likely the indices made 5w high and turned lower into 5w low.

Based on the length the 20d low should have been on 12th at day 14. In the alternate scenario you have 17 days for 20d cycle low and turn higher into 5w high.... it has low probability, but can not be 100% excluded at the moment.

I am searching for ways to confirm this short term cycle lows. One possible way I have found is using the McClellan Oscillator. It has this capability to show weakness, which is not visible on the price chart making it suitable for this goal. Those interested in cycles study the chart. It is not perfect, but it seems to work pretty good. It says the 10w low is where I have it and the 20d low is mid this week.

Week 11 for the 20w cycle. The indices are at 20w cycle high and turn into 20w low probably occurred this week.

Trading cycle - sell signal, another close below MA10 confirmation is second close below it. RSI is below the MA too, but for confirmation I want to see it breaking below the trend line.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - NYSE made higher high, DJI only intraday, SP500 slightly lower high - similar to Jan-Feb last year non-confirmations. The move from the November low should be completed, but we need confirmation like brake below the channel and the last minor low.

Intermediate term - the indicators with long and short term divergences warning for a high.

Looking at RSI I think this labeling is better - three moves higher with roughly the same length 11-9-10 weeks.

Neowave pattern diametric completing at 18m high looks good. Classical EW pattern should be W-X-Y(red) with the catch that there is no impulses.

Alternate this is THE top Z/G(white) I do not believe it much, but if we see the last move retraced very quickly like 4-5 weeks we have reversal.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the oscillators are turning lower with divergences. I think they are pointing to intermediate term high.

McClellan Oscillator - turned lower and below zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - short term divergence and turned lower.

Percent of Stocks above MA50 - short term divergence and turned lower, sligthly below 75.

Fear Indicator VIX - higher lows, we should see spike higher.

Advance-Decline Issues - turned lower after lower highs and divergence.

HURST CYCLES

Short term cycles - this choppy price action makes it difficult to analyze the short term cycles... this is the fourth week from the previous high so most likely the indices made 5w high and turned lower into 5w low.

Based on the length the 20d low should have been on 12th at day 14. In the alternate scenario you have 17 days for 20d cycle low and turn higher into 5w high.... it has low probability, but can not be 100% excluded at the moment.

I am searching for ways to confirm this short term cycle lows. One possible way I have found is using the McClellan Oscillator. It has this capability to show weakness, which is not visible on the price chart making it suitable for this goal. Those interested in cycles study the chart. It is not perfect, but it seems to work pretty good. It says the 10w low is where I have it and the 20d low is mid this week.

Week 11 for the 20w cycle. The indices are at 20w cycle high and turn into 20w low probably occurred this week.

Jan 9, 2021

Weekly preview

We knew that cycle and pattern are not completed and the market decided to go for blow off, which is not unusual. It has to fool as much traders as possible - judging by the comments it was successful. Three days will not change the last two months - another corrective move, which is topping... it is history it is done.

Nothing changed - the move from the November low is completing and the 20w cycle will turn lower for several weeks.

TRADING

Trading cycle - buy signal, more closes below and above MA10/RSI crosses. The same - expecting setup like Jan-Feb and turn lower.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - you can count a-b-c with c=0,618xa, another option is the whole move from the November low is diametric not just the c-wave. It works for indexes like DAX,SP500 and others, but it is best visible on the NDX chart. SP500 closer look - from 9-th of Dec real mess and final blow off. This double zig-zags/diametrics are every where. Another one looks close to completion ideally 10 points higher.

Intermediate term - nothing new, the indicators with long and short term divergences warning for a high. Neowave pattern symmetrical completing at 18m high looks good. Classical EW pattern should be W-X-Y with the catch that there is no impulses.

Alternate this is THE top... still the pattern high should be later, but if we see the last move retraced very quickly like 4-5 weeks we have reversal.

Long term - DJI weekly chart another touch of the trend line with double RSI divergence does not make me feel bullish.

MARKET BREADTH INDICATORS

Market Breadth Indicators - oscillators turned up, but weak with lower highs so far. This three days up do not show some big strength.

McClellan Oscillator - slightly above zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - bounced from 70 lower high so far.

Percent of Stocks above MA50 - bounced from 75, lower high so far.

Fear Indicator VIX - higher low, short term double divergence.

Advance-Decline Issues - turned up from zero, lower high so far.

HURST CYCLES

Short term cycles - this time the DAX, because it shows more clear what is going on. I still think we have 20d high and next is decline into 20d low.

Week 10 for the 20w cycle. The indices are at 20w cycle high and turn into 20w low is expected.

Trading cycle - buy signal, more closes below and above MA10/RSI crosses. The same - expecting setup like Jan-Feb and turn lower.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - you can count a-b-c with c=0,618xa, another option is the whole move from the November low is diametric not just the c-wave. It works for indexes like DAX,SP500 and others, but it is best visible on the NDX chart. SP500 closer look - from 9-th of Dec real mess and final blow off. This double zig-zags/diametrics are every where. Another one looks close to completion ideally 10 points higher.

Intermediate term - nothing new, the indicators with long and short term divergences warning for a high. Neowave pattern symmetrical completing at 18m high looks good. Classical EW pattern should be W-X-Y with the catch that there is no impulses.

Alternate this is THE top... still the pattern high should be later, but if we see the last move retraced very quickly like 4-5 weeks we have reversal.

Long term - DJI weekly chart another touch of the trend line with double RSI divergence does not make me feel bullish.

MARKET BREADTH INDICATORS

Market Breadth Indicators - oscillators turned up, but weak with lower highs so far. This three days up do not show some big strength.

McClellan Oscillator - slightly above zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - bounced from 70 lower high so far.

Percent of Stocks above MA50 - bounced from 75, lower high so far.

Fear Indicator VIX - higher low, short term double divergence.

Advance-Decline Issues - turned up from zero, lower high so far.

HURST CYCLES

Short term cycles - this time the DAX, because it shows more clear what is going on. I still think we have 20d high and next is decline into 20d low.

Week 10 for the 20w cycle. The indices are at 20w cycle high and turn into 20w low is expected.

Jan 3, 2021

Weekly preview

Nothing new to add - higher as expected, ideally we should see another 1-3 days for 20d cycle high and completion of the pattern.

P.S. long term update is posted below and there is a link in the first menu on the right side.

TRADING

Trading cycle - buy signal. I think it is dangerous to be long, because I expect the same cycle setup as Jan-Feb this year - double top and turn lower.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - I think we have diametric for the c-wave and the last wave itself is a diametric, which needs the final two waves to be completed Below 3690 means with high probability we saw the high for this c wave, confirmation is below 3640.

Intermediate term - nothing new, the indicators with long and short term divergences warning for a high. Neowave pattern symmetrical completing at 18m high looks good. Classical EW pattern should be W-X-Y with the catch that there is no impulses.

Alternate this is THE top. I do not believe it much, but if we see the last move retraced in less time like 3-4-5 weeks we have reversal.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle. Alternate pattern, which makes some sense and works with cycles, is mega expanded flat

MARKET BREADTH INDICATORS

Market Breadth Indicators - looking toppy with divergences, but still not serious turn lower.

McClellan Oscillator - around zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - short term weakness with divergence, but still above 70.

Percent of Stocks above MA50 - something like double top?

Fear Indicator VIX - short term divergence.

Advance-Decline Issues - weak sligthly above zero.

HURST CYCLES

Short term cycles - expecting to see 20d high and turn lower, ideally something between 1-3 days.

It seems we have nice rounding top and it seems we have to dominant 20w cycle with bell shape. This is the reason why the shorter cycles 5w/10w are not well visible.

Week 9 for the 20w cycle. The indices are at 20w cycle high and turn into 20w low is around the corner.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

We have completed sell setup on the weekly chart. The previous two occasions marked intermediate term top for 20w and 40w cycle high.

Trading cycle - buy signal. I think it is dangerous to be long, because I expect the same cycle setup as Jan-Feb this year - double top and turn lower.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - I think we have diametric for the c-wave and the last wave itself is a diametric, which needs the final two waves to be completed Below 3690 means with high probability we saw the high for this c wave, confirmation is below 3640.

Intermediate term - nothing new, the indicators with long and short term divergences warning for a high. Neowave pattern symmetrical completing at 18m high looks good. Classical EW pattern should be W-X-Y with the catch that there is no impulses.

Alternate this is THE top. I do not believe it much, but if we see the last move retraced in less time like 3-4-5 weeks we have reversal.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle. Alternate pattern, which makes some sense and works with cycles, is mega expanded flat

MARKET BREADTH INDICATORS

Market Breadth Indicators - looking toppy with divergences, but still not serious turn lower.

McClellan Oscillator - around zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - short term weakness with divergence, but still above 70.

Percent of Stocks above MA50 - something like double top?

Fear Indicator VIX - short term divergence.

Advance-Decline Issues - weak sligthly above zero.

HURST CYCLES

Short term cycles - expecting to see 20d high and turn lower, ideally something between 1-3 days.

It seems we have nice rounding top and it seems we have to dominant 20w cycle with bell shape. This is the reason why the shorter cycles 5w/10w are not well visible.

Week 9 for the 20w cycle. The indices are at 20w cycle high and turn into 20w low is around the corner.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

We have completed sell setup on the weekly chart. The previous two occasions marked intermediate term top for 20w and 40w cycle high.

Jan 1, 2021

Long term - update

Happy New Year!!!!

I wish you successful year and good luck trading in 2021.

Really crazy year... the lost decade I was talking about, it is playing out in the real life and the assets are just mirroring this craziness. The current system(social order, financial system, the life as we know it etc.) started to fall apart in 2000 and since 2018 we are watching the begging of the end. The normal has died, stupidity and dictatorship is on the rise. We are in transition phase and this is the new normal. It will get worse before it gets better - this is how usually it plays out.

This is exactly what my pattern and cycle analysis is showing - mirroring the emotions from the real life. I do not see how it is possible, in the beginning of the biggest mess in real life, to see some third wave or what ever fantasy most have...

George Carlin 10 years ago real prophet:) The first 30 seconds is all you need to know about this "scary virus".

The current view for the next 6 months, all assets should continue to move in sync:

- Stocks - the next six months should be very volatile - low in February -> important high late March/April -> important low in the summer.

- Bonds - should make a high in the next months and decline into 18m cycle low.

- USD - higher in the next 6 months.

- Precious metals/miners - probably hit already 9y cycle high, even so I expect test of the high and then bigger decline in sync with the indices.

- Crude Oil - the same like the indices 18m high expected in a few months followed by decline into 18m low.

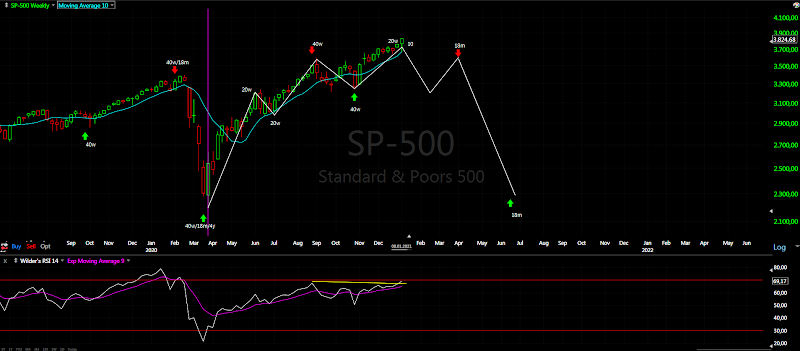

- STOCKS

Another corrective wave from the low in March 2020 is running. The pattern should be completed at the 18m cycle high in April. After that we should see decline into 18m low. There is an option that this is the price high, but I still think the pattern high should be in April.

For now expectibg lower low c wave of expanding triangle, alternate pattern, which makes some sense and works with cycles, is mega expanded flat

Long term I expect 4y cycle high in 2022 so the bigger decline is expected in 2023 and later. Neely`s triangle is the best looking pattern so far.

- BONDS

Decline into 40w cycle in November was expected - we saw it. Now we should move up into 18m high followed by a decline for 18m cycle low.

- FOREX

I was not sure what exactly is going on in the FOREX world, I think some big sideways pattern is running probably triangle, which will take a few more years and complete with 18y cycle low in 2023 for the USD .

Below how I see the big picture - 18y cycle highs and lows, which are running roughly 16 years long.

USD hit 18y cycle high in Dec.2016 and now it is heading into 18y cycle low sometimes in 2023.

The pattern is clear corrective sideways move, there is no reversal.

For the next 6 months the USD should move higher probably d-wave of a triangle.

USD/JPY really ugly pattern... I would say 4y cycle low and the pattern best guess triangle in a triangle.

- GOLD/SILVER/MINERS

The precious metals sector is heading into important 9y cycle high. The question is do we saw the high or it will occur in a few months in sync with the indices. The second option looks better, but this down phase is lasting very long.... maybe double top.

Gold - either hit 9y cycle high, alternate we will see the high in a few months. Anyway I expect test of the high or marginal higher high in a few months followed by turn lower into 9y cycle low.

Silver - the same but showing the lows, 4y low in March and now heading or hit 9y cycle high. Intermediate term we have 40w low early December and after a high in a few months decline into 18m low should begin.

Miners - the same like precious metals 4y low and now hit or heading into 4y/9y high. Intermediate term - 40w low, in the next months we should see test of the high and decline into 18m low.

- CRUDE OIL

Nothing much to say - I see the same pattern and cycles like the indices. In a few months we should see 18m high followed by decline into 18m cycle low. The pattern is corrective zig-zag.

Subscribe to:

Posts (Atom)