Instead of recovery in the afternoon session on Friday the price stayed at the lows. The week finished with bearish daily and weekly candles and sell signal was triggered. Confirmation is needed with one more lower low for impulse followed by corrective retracement.Did you noticed how the market behavior has changed? While the trolls were cheering the new ATH every rip was sold the whole week - the smart money is exiting the market.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - obviously the small down up shown last week played and the price broke two trend lines, the third one connects the October and December lows and should be first support. For a reversal to be confirmed we need one more lower low to complete impulse followed by corrective retracement. Short entry is when you see such confirmation with a stop above the last high.

Another option is to count truncated fifth wave and we have impulse lower... I am not a big fan of this truncation.

If there is no reversal the index should open higher next week and rally to new highs(green). Given how the charts look this scenario has lower probability... but with FOMC and the big tech companies reporting next week I am sure the big boys will organize one last rally to lure the sheeple, which are now well trained like Pavlov's dog.

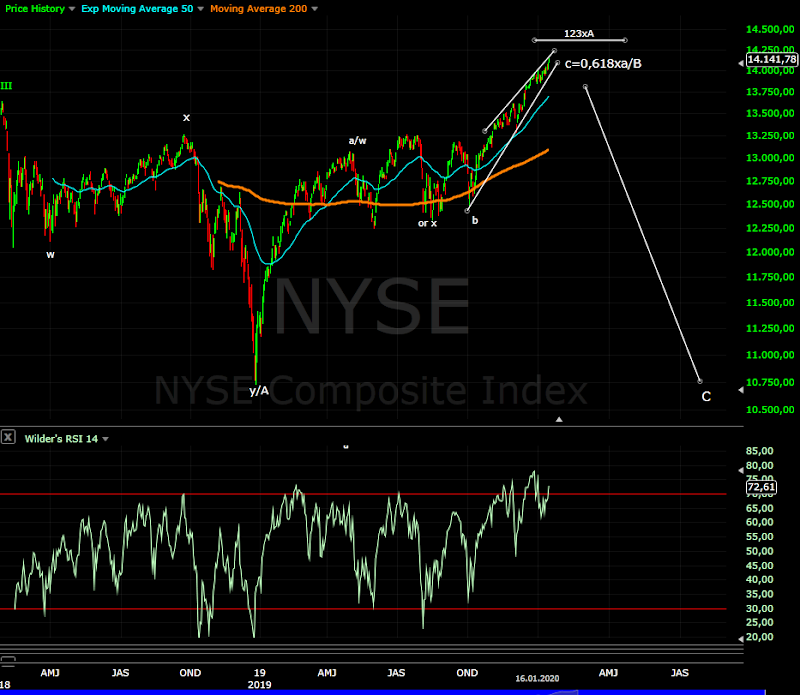

Intermediate term - last week I have added w-x-y labels... it is not possible to say from the October low if we have a-b-c with c=a or impulse with extended fifth wave. The bulls are seeing impulse, the bears a-b-c. For me it does not matter - cycles are saying this is important high namely 4 year cycle high end of story.

Bearish daily and weekly candles and RSI below the trend line after divergence.... with this signals it is difficult to see another higher high. Single shares with reversal candles across the board too...

Long term - at the top of wave B, expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenarios - three waves lower for C triangle or impulse C for running flat.

MARKET BREADTH INDICATORS

Market Breadth Indicators - turned lower with sell signals.

McClellan Oscillator - below zero after divergences.

McClellan Summation Index - just turned lower with sell signal.

Weekly Stochastic of the Summation Index - just turned lower with sell signal.

Bullish Percentage - just turned lower with sell signal.

Percent of Stocks above MA50 - sell signal, it looks like double top.

Fear Indicator VIX - higher lows and divergences, the trend line connecting the highs was hit. Final pullback and a spike higher should follow.

Advance-Decline Issues - turned lower again after another lower high and divergences.

HURST CYCLES

Daily(trading) cycle - close below MA10 and the trend line, RSI broke below MA18 and the trend line. Sell signal has been triggered. Entry point is discussed on the first chart.

Hurst cycles - DJ 40 day cycle highs sine wave, 4x40d cycles make one 20w cycle.... it looks like the market is turning lower right on time.

Week 16 for the 20 week cycle, week 38 for the 40 week high-to-high cycle - 4 year cycle high is imminent.

Jan 25, 2020

Jan 18, 2020

Weekly preview

As expected at least a week was needed for w5 to be completed. Now time and pattern look mature and waiting for reversal signs. Interesting if we will see another few days before reversal for perfect cycle high the middle of next week.

The top of this w5 should be the top of wave c/B and the charts below show why I still stick to this count....

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - it will be great to see one more down up with RSI divergence, but it is not a guarantee. Looking at AAPL we have the minimum for v/5 - ED making higher high so I will not be surprised to see the indexes lower on Monday. If we see the channel broken(red) with high probability the move from 6th of January is over.

Intermediate term - as explained impulse with extended first wave 3=0,618x1 5=0,382x1, on intermediate term scale c=0,618xa and long term B=1,618xA.... three different degree of Fibo measurements converge to the same target - I would not ignore this message.

The first wave lasted 40 trading days, the third wave 20 trading days and the fifth wave is now 10 trading days long so time and price measurements are satisfied.

Long term - at the top of wave B, after that expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

Many said where is my alternate scenario so here it is - according Neely wave B with such size are not fully retraced so three waves decline for C triangle or impulse C for running flat... the decline will be only 25% not 30%:))))

MARKET BREADTH INDICATORS

Market Breadth Indicators - mixed signals some are strong some with divergences.

McClellan Oscillator - turned lower with divergences.

McClellan Summation Index - buy signal with long term divergence.

Weekly Stochastic of the Summation Index - buy signal, in the overbought area for a while.

Bullish Percentage - strong, buy signal.

Percent of Stocks above MA50 - buy signal, it looks like double top.

Fear Indicator VIX - higher low and divergences.

Advance-Decline Issues - another lower high and divergences.

HURST CYCLES

Daily(trading) cycle - the price is above MA10 the signal is still on buy, RSI with divergence oscillating around MA18 - the trading cycle should turn lower soon, triggering a sell signal will take a while most likely breaking below MA10 and testing it.

Week 15 for the 20 week cycle, week 37 for the 40 week high-to-high cycle - 4 year cycle high is imminent.

The charts below are showing what I am explaining for two years and I do not see a reason to change my mind because the pattern has not changed - a bunch of corrective waves, there is no third waves.

If you think this is wrong just buy because according to the bulls we are in the middle of the third wave. The self proclaimed EW god Avi Gilburt sees 100 point lower and another 600+ points higher.

My opinion is SP500/NDX will follow the rest of the world and not the opposite the rest of the world following AAPL(a few tech stocks distorting this two indexes).... by the way look at AAPL just test of the break out now support zone around 220 is already 30% correction. What do you think will happen with the indexes if AAPL is down 30%? So good luck.

EUROPE

JAPAN

EMERGING MARKETS

NYSE

DJT

RUSSELL2000

XLF

CYCLES

Short term - it will be great to see one more down up with RSI divergence, but it is not a guarantee. Looking at AAPL we have the minimum for v/5 - ED making higher high so I will not be surprised to see the indexes lower on Monday. If we see the channel broken(red) with high probability the move from 6th of January is over.

Intermediate term - as explained impulse with extended first wave 3=0,618x1 5=0,382x1, on intermediate term scale c=0,618xa and long term B=1,618xA.... three different degree of Fibo measurements converge to the same target - I would not ignore this message.

The first wave lasted 40 trading days, the third wave 20 trading days and the fifth wave is now 10 trading days long so time and price measurements are satisfied.

Long term - at the top of wave B, after that expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

Many said where is my alternate scenario so here it is - according Neely wave B with such size are not fully retraced so three waves decline for C triangle or impulse C for running flat... the decline will be only 25% not 30%:))))

MARKET BREADTH INDICATORS

Market Breadth Indicators - mixed signals some are strong some with divergences.

McClellan Oscillator - turned lower with divergences.

McClellan Summation Index - buy signal with long term divergence.

Weekly Stochastic of the Summation Index - buy signal, in the overbought area for a while.

Bullish Percentage - strong, buy signal.

Percent of Stocks above MA50 - buy signal, it looks like double top.

Fear Indicator VIX - higher low and divergences.

Advance-Decline Issues - another lower high and divergences.

HURST CYCLES

Daily(trading) cycle - the price is above MA10 the signal is still on buy, RSI with divergence oscillating around MA18 - the trading cycle should turn lower soon, triggering a sell signal will take a while most likely breaking below MA10 and testing it.

Week 15 for the 20 week cycle, week 37 for the 40 week high-to-high cycle - 4 year cycle high is imminent.

The charts below are showing what I am explaining for two years and I do not see a reason to change my mind because the pattern has not changed - a bunch of corrective waves, there is no third waves.

If you think this is wrong just buy because according to the bulls we are in the middle of the third wave. The self proclaimed EW god Avi Gilburt sees 100 point lower and another 600+ points higher.

My opinion is SP500/NDX will follow the rest of the world and not the opposite the rest of the world following AAPL(a few tech stocks distorting this two indexes).... by the way look at AAPL just test of the break out now support zone around 220 is already 30% correction. What do you think will happen with the indexes if AAPL is down 30%? So good luck.

EUROPE

JAPAN

EMERGING MARKETS

NYSE

DJT

RUSSELL2000

XLF

CYCLES

Jan 11, 2020

Weekly preview

Waves 4 and 5 playing out as expected, interesting is the futures has much bigger wave 4 and the pattern looks now like impulse with a wedge shape, but not ED. The charts are adjusted accordingly to be in sync with futures.

The cycles suggest short term we should see another 1-1,5 weeks higher and long term this should be important top - 4y cycle high. The minimum is a few weeks decline for 20 week cycle low late February/first week of March.

Crude oil with reversal at week 38(high-to-high) the previous time in April 2019 it made a high a week before the indices... which are now at week 36. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - w4 was finished on Monday, but of higher degree and now in w5. RSI shows very weak move and divergence which fits with wave 5 price action. At least one more high is needed for impulse(white), but I think it will stretch in time probably as ED(yellow).

Of course impulsive break below support will mean the move from October is finished.

Intermediate term - I have changed the count with triangle for b/B because the futures are showing much bigger decline for this w4 and with this count they are in sync. A triangle pattern will explain 40w low in October despite the higher low.

From October we have an impulse with wedge shape, but no overlapping. The first wave was roughly 40 trading days, the third wave 20 trading days and if the fifth wave is 10 trading days it will fit perfect with another 1-1,5 weeks higher for 20 week cycle high(see below).

Usually the wedges/ED retrace to the point where they have started, and this is exactly what should happen if my EW and cycle count is right.

Now we have RSI divergence which is much better for an expected intermediate term high.

Long term - close to the top of wave B, after that expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same... only the bullish percentage is ok the others do not follow the price higher.

McClellan Oscillator - oscillating around zero, with multiple divergences.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal, in the overbought area and waiting for turn lower.

Bullish Percentage - buy signal.

Percent of Stocks above MA50 - turned lower and short term divergence.

Fear Indicator VIX - higher lows and double divergence...

Advance-Decline Issues - pointing lower with divergences, needs to break below the trend line to confirm reversal.

HURST CYCLES

Daily(trading) cycle - the price is above MA10 the signal is still on buy, RSI with double divergence oscillating around MA18 - the cycle is getting weak and should turn lower soon.

Hurst cycles - SP500 highs the last 20w(blue arrows) cycle with 20d sine wave. It looks like another 20d cycle high, for perfect 20w cycle one more 20d cycle is needed...

SP500 lows the last 20w(black arrows) cycle with 20d sine wave. It looks like we had another 20d cycle low early this week. Counting eight such cycles point to the first week of March.

DJ lows 40d cycle. I find it interesting that if you synchronize the sine wave with the lows and slightly longer cycle 32 trading days instead of 28(for SP500 above with a low in October are slightly shorter), four cycle for 20w cycle point to the same time frame - the first week of March.

Week 14 for the 20 week cycle, week 36 for the 40 week high-to-high cycle.

The cycles suggest short term we should see another 1-1,5 weeks higher and long term this should be important top - 4y cycle high. The minimum is a few weeks decline for 20 week cycle low late February/first week of March.

Crude oil with reversal at week 38(high-to-high) the previous time in April 2019 it made a high a week before the indices... which are now at week 36. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - w4 was finished on Monday, but of higher degree and now in w5. RSI shows very weak move and divergence which fits with wave 5 price action. At least one more high is needed for impulse(white), but I think it will stretch in time probably as ED(yellow).

Of course impulsive break below support will mean the move from October is finished.

Intermediate term - I have changed the count with triangle for b/B because the futures are showing much bigger decline for this w4 and with this count they are in sync. A triangle pattern will explain 40w low in October despite the higher low.

From October we have an impulse with wedge shape, but no overlapping. The first wave was roughly 40 trading days, the third wave 20 trading days and if the fifth wave is 10 trading days it will fit perfect with another 1-1,5 weeks higher for 20 week cycle high(see below).

Usually the wedges/ED retrace to the point where they have started, and this is exactly what should happen if my EW and cycle count is right.

Now we have RSI divergence which is much better for an expected intermediate term high.

Long term - close to the top of wave B, after that expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same... only the bullish percentage is ok the others do not follow the price higher.

McClellan Oscillator - oscillating around zero, with multiple divergences.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal, in the overbought area and waiting for turn lower.

Bullish Percentage - buy signal.

Percent of Stocks above MA50 - turned lower and short term divergence.

Fear Indicator VIX - higher lows and double divergence...

Advance-Decline Issues - pointing lower with divergences, needs to break below the trend line to confirm reversal.

HURST CYCLES

Daily(trading) cycle - the price is above MA10 the signal is still on buy, RSI with double divergence oscillating around MA18 - the cycle is getting weak and should turn lower soon.

Hurst cycles - SP500 highs the last 20w(blue arrows) cycle with 20d sine wave. It looks like another 20d cycle high, for perfect 20w cycle one more 20d cycle is needed...

SP500 lows the last 20w(black arrows) cycle with 20d sine wave. It looks like we had another 20d cycle low early this week. Counting eight such cycles point to the first week of March.

DJ lows 40d cycle. I find it interesting that if you synchronize the sine wave with the lows and slightly longer cycle 32 trading days instead of 28(for SP500 above with a low in October are slightly shorter), four cycle for 20w cycle point to the same time frame - the first week of March.

Week 14 for the 20 week cycle, week 36 for the 40 week high-to-high cycle.

Jan 4, 2020

Weekly preview

I was expecting wave iv and v of 5/c/B and it looks like this is playing out. Topping has begun - if the top is in we should see small waves iii-iv-v lower next week, but my feeling tells me another week before the pattern is finished.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - to confirm a top we need to see the decline continue next week breaking the trend line and support. The problem is we do not have a bearish candle on the daily chart and usually reversal does not start this way.... may be we are still in w4 or w5 is an ED, we will know next week.

Intermediate term - the indices are close at least to intermediate term high and if I am right we will see much deeper decline than most expect.

Long term - close to the top of wave B, after that expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - Fear&Greed hit 97 on very weak market breadth on Thursday - a lot of complacency. Now starting to see the short term divergences, intermediate term high is around the corner.

McClellan Oscillator - lower highs, very weak on Thursday only 4 points higher.

SP500 McClellan Summation Index - buy signal with double divergences.

Weekly Stochastic of the Summation Index - buy signal, reached the overbought level.

Bullish Percentage - flat, still buy signal.

Percent of Stocks above MA50 - turned lower despite the strength from Thursday.

Fear Indicator VIX - more higher lows, preparing to spike higher.

Advance-Decline Issues - pointing lower with multiple divergences.

HURST CYCLES

Daily(trading) cycle - the days of this cycle are numbered, RSI with a sell signal already, but price is still above MA10 so sell signal is not triggered. Next week we should see either a bounce from MA10 and completion of the pattern or break below MA10 and sell signal activated. For now is wait patiently.

Hurst cycles - I am still experimenting with cycles... cycles vary 20 week cycle could be 18w or 20w or 22w - my theory as the cycle develops you can see if the smaller cycles are shorter or longer then adjust them for the current 20 week cycle. This is sine wave 20day cycle highs(or 14 trading days). I think this 20w cycle, which begun in September, should be shorter and the 14d cycles are 12-13 days long. I want to see at least 7 such cycles finished(next week) before the 20 week cycle makes a high and turns lower.

Week 13 reached 2/3 of the cycle, we should see a turn lower soon. The coming high is minimum 40week cycle high and after that we will see a decline until we hit 40 week cycle low and this is 6 months later mid 2020.

Short term - to confirm a top we need to see the decline continue next week breaking the trend line and support. The problem is we do not have a bearish candle on the daily chart and usually reversal does not start this way.... may be we are still in w4 or w5 is an ED, we will know next week.

Intermediate term - the indices are close at least to intermediate term high and if I am right we will see much deeper decline than most expect.

Long term - close to the top of wave B, after that expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - Fear&Greed hit 97 on very weak market breadth on Thursday - a lot of complacency. Now starting to see the short term divergences, intermediate term high is around the corner.

McClellan Oscillator - lower highs, very weak on Thursday only 4 points higher.

SP500 McClellan Summation Index - buy signal with double divergences.

Weekly Stochastic of the Summation Index - buy signal, reached the overbought level.

Bullish Percentage - flat, still buy signal.

Percent of Stocks above MA50 - turned lower despite the strength from Thursday.

Fear Indicator VIX - more higher lows, preparing to spike higher.

Advance-Decline Issues - pointing lower with multiple divergences.

HURST CYCLES

Daily(trading) cycle - the days of this cycle are numbered, RSI with a sell signal already, but price is still above MA10 so sell signal is not triggered. Next week we should see either a bounce from MA10 and completion of the pattern or break below MA10 and sell signal activated. For now is wait patiently.

Hurst cycles - I am still experimenting with cycles... cycles vary 20 week cycle could be 18w or 20w or 22w - my theory as the cycle develops you can see if the smaller cycles are shorter or longer then adjust them for the current 20 week cycle. This is sine wave 20day cycle highs(or 14 trading days). I think this 20w cycle, which begun in September, should be shorter and the 14d cycles are 12-13 days long. I want to see at least 7 such cycles finished(next week) before the 20 week cycle makes a high and turns lower.

Week 13 reached 2/3 of the cycle, we should see a turn lower soon. The coming high is minimum 40week cycle high and after that we will see a decline until we hit 40 week cycle low and this is 6 months later mid 2020.

Jan 1, 2020

Long term - update

Happy New Year!!!!

I wish you successful year and good luck trading in 2020.

The current view for the next 6 months:

- Stocks - final wave lower to finish correction lasting more than two years and 4 year cycle low.

- Bonds - to finish a correction and one more high for 4 year cycle high.

- USD - one more leg higher to finish the move which began early 2018.

- Precious metals/miners - final sell off for the 4 year cycle low.

- Crude Oil - final leg lower to finish B wave and 4 year cycle low.

2020 should be an important year - all asset classes are aligned for final rally/sell off and 4 year cycle lows/highs.

- STOCKS

The bigger pattern which I am watching from 2018 is a flat correction for wave IV from 2009. We saw a-b-c/B in 2019 with C to follow in the first half of 2020. Completing expanded flat mid 2020(4y cycle low) will satisfy perfectly the 38% proportions between wave 3 and 4 both time and price. SP500 is stronger than other indexes and now everybody is convinced this is third wave... well it is not. Quick look at other indexes and it is pretty clear what is going on.

For this who want to see impulse you need 1-2 i-ii count - not very likely the first leg is corrective and the supposed w2 is shallow sideway move which is usually b wave. Or you can count w1 of a huge ED for V.

- BONDS

We saw a few months higher and correction in the last 4 months as expected.... but 4 year cycle high at month 37 is too short. More likely we will see the correction finished in 2-3 months and one more high to finish the 4 year cycle. Probably risk off trade the money moving from stocks to bonds - safety when the indices decline in third wave in Q2 2020.

10 year yield - final plunge and correcting higher is running as expected. Next we should see 2-3 months higher for the correction to be finished and turn lower again.

- FOREX

Six months later I can only repeat the same - the pattern is very challenging:) Many see the USD plunging lower and PM to the moon, but I sill think there is one final rally for the USD in 2020.

The USD bears see a-b-c with c diagonal and sharp plunge, I think this is A-B running and we should see C next year. The count is difficult it could be something different, but the idea is one more rally in the next 6 months.

JPY - very messy pattern with zig-zags higher and 4 year low expected next year so I will stay with the call that we have more to the downside.

USD/JPY - mirror image...

- GOLD/SILVER/MINERS

We saw the PM sector higher in July/August and turn lower as expected. The move higher was stronger than expected and the decline is corrective... how looks the long term picture now? The consensus is we have a break out and third wave for gold - I do not think so, the PM sector is in secular bear market. Do not get me wrong, gold will most likely test 1900, but this will be c/B and not wave 3.

For now lets focus on the next 6 months and I think the direction is lower for 4 year cycle low next year.

Gold - it is obvious why everybody see impulse 1-2-3=1,618x1,4 and now 5 running(green). I think we have a-b-c higher and now a-b-c lower is running. If I am wrong we will see higher high and again multi month correction. This will have implications for the bigger pattern, but I still think this is not the beginning of a third wave.

Silver - a look at the bigger picture suggests we should see final sell off to complete third 18 month cycle for 4 year cycle low in Q2.2020.

Gold miners - the same idea like stocks and PM - decline for 4 year cycle low. Cycles look pretty good - two 18 month cycles, 40w cycle low in October and now 20w cycle running. Move below the October low will mean the last 40w cycle turned lower and GDXJ will decline into 4 year cycle low.

- CRUDE OIL/NATGAS

I was not sure what is going on, in the middle of something corrective and six months later crude oil did not disappoint:) - very ugly corrective pattern. We should see one more leg lower to finish B wave and important cycle low.

The pattern is not easy... I am wondering if it is a triangle for b/B(better visible on brent oil)... anyway one more sell off is needed for finished pattern plus cycles point to important low next year.

Natgas - similar to crude oil it seems that Benner cycle sequence 11-10-7 works better than Hurst cycles. History is too short, but it seems to work good - HIGHS - 90(7)97(11)2008(10)2018(7)2025 / LOWS - 92(10)2002(7)2009(11)2020(10)2030.

Next important low is in 2020 which fits with the EW pattern.

I was expecting to see b/B wave higher... we have a zig-zag higher. Now we should see c/B lower.

Subscribe to:

Comments (Atom)