And the market did something in the middle:) The pattern looks like a mix from two of the short term scenarios from last week - b-wave but taking one week longer and one more 5w high but one week shorter.

According to my analysis next week we should see a few more days higher and this should be the top and 18m high. Alternate the market makes some strange turns and prolongs the top for another week - the second April week... maybe this triangle b-wave it will look better for 10w low.

TRADING

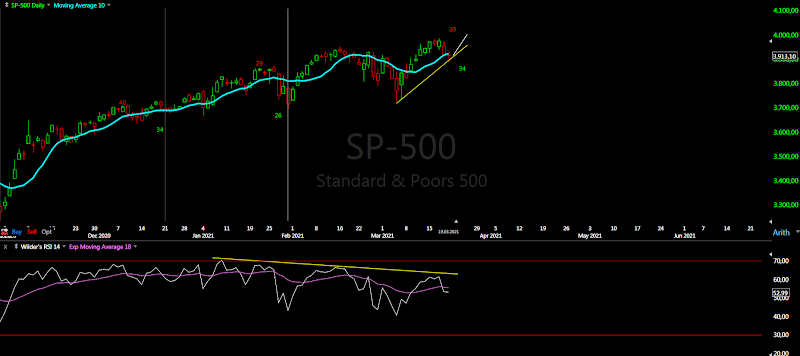

Trading cycle - buy signal. More MA10 crosses... trusting the analysis and ignoring all this crosses from the last three months was the right choice. The next turn lower should not be ignored.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - it looks like b-wave zig-zag and final rally running... alternate 4 of ED.

Intermediate term - I see one big zig-zag up. You can count it as W-X-Y(white) classic EW, but we do not have impulses. More likely series of zig-zags A-B-C(yellow) with the C-wave as a diametric.

Plenty of divergences, just waiting to see how the final move up will play out.

Long term - waiting for another 1-2 weeks to complete the move from March 2020. Then expect 8-10 weeks lower and we will watch how big the decline will be.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same like last week, most of them with long term multiple divergences.... turning up for the final high.

McClellan Oscillator - turned up around zero, expecting to see lower high.

McClellan Summation Index - very weak sell signal.

Weekly Stochastic of the Summation Index - neutral.

Bullish Percentage - around 70, final short term divergence?

Percent of Stocks above MA50 - above 75, one more divergence?

Fear Indicator VIX - testing the low and the gap again.

Advance-Decline Issues - weak, testing the previous lows, expecting another lower high.

HURST CYCLES

Short term cycles - heading into 20d high next week. Hihg-to-high count I think this alternate count with 10w highs is better, just they are shorter with three 20d cycles.

Week 8 for the 20w cycle. The white labels are Hurst cycles shown last week. I am showing the chart because of the yellow labels. From March 2020 we have a big zig-zag consisting of two zig-zags and the yellow labels are showing the length of the single waves. You can see the waves have comparable length 11-9-10 weeks. The current and last fourth surge higher is already 8 weeks long so another 1-2 weeks. In two weeks the two zig-zags will have the same length 23 weeks and the size relation is 0,618.

What I want to say is the indices are close to a high.

Mar 27, 2021

Mar 20, 2021

Weekly preview

FOMC was a high, it is too early to say for sure if this was the HIGH there is no significant technical damages. From pattern perspective there is possible completed pattern, but sharp reversal is missing so far. From cycle perspective I see right translated 20d cycle this means the next one should make higher high before reversing.

I am starting to like the idea with one more 5w cycle high, but I will wait too see what happens next week it should give as more clarity.

Many questions and suggestion what if something else is going on. So this is the subject this week:)

Short term - the pattern is very difficult you can not pin point it for sure, cycles the 18m high could be extended with one more 5w cycle something like mid-April, but that is all. Watch next week closely for an answer:

- if we saw the high this week, next week should open with gap lower and move fast 60-80-100 points day even two such days.

- if the high is next week Friday should be the b-wave and we should see the indices higher next week.

- if there is one more 5w cycle before the top next week should be lower, but moving slowly.

Long term - look at below the weekly chart this are my alternate scenarios. To summarize it - you should pray that Neely is right, because you will not like the "what if".

TRADING

Trading cycle - buy signal. Again right translated 20d cycle finding support around MA10. We should see one more high before reversal. High-to-high daily cycle a few more days and it will reach the average length and this should be intermediate term high at least.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - I see one diametric completed.... again if this is the top we should see sharp decline next week if not it is just wave a. Alternate with one more 5w high I have to shift the labels d-f to the right or count diagonal C-wave.

Intermediate term - I see one big zig-zag up. You can count it as W-X-Y(white) classic EW, but we do not have impulses. More likely series of zig-zags A-B-C(yellow) with the C-wave as a diametric. Besides market breadth and indicator divergences, almost every index shows similar pattern from the November low - complex structure with many zig-zags. That is why I can see extension for 2-3 weeks, but another 2-3 months is fantasy for me.

Long term - what if something else is going on? NYSE chart below for a clear pattern without tech stocks distortion. - First option the main stream got it right(I would not believe this even if I see it:) - we have impulse and this is the fifth wave. So with clear corrective leg this is w1 of ED. Than we need waves 2-3-4-5 and sometimes next year it is completed with 4y cycle high. This is the high for mega wave (III) from the low in 1929 and huge sideways wave (IV) begins. Usually it retraces to the low of the previous wave4 of lower degree (the 2009 low) and it will take decades. Personal opinion - it is more than clear from 2009 this is not an impulse. It is the same crappy corrective structure as the current move from the March.2020 low. Please do not try to explain me - no it is not an impulse. - Second option Neely is both right and wrong - right because the correction began in 2000 and it is a triangle, but wrong because it is not neutral triangle. In neutral triangle the C-wave should be the longest and the most complex wave and it is not. He tries to make it fit and counts the C-wave bottom in 2010. In this case the triangle is expanding triangle from 2000 with complex D-wave diametric. Depending on where you count the previous 4y cycle high(Jan.2018 or Sept.2018) this could be top of the D-wave or one more zig-zag up next year. Then comes the E-wave and the 70%-90% decline, which Peter Eliades is talking about. Neely's count is like a walk in the park compared to the alternative scenarios. Imagine what will happen in the real world if we have 20-30 years economical problems(first option) or 1929 style reset Great Depression v.2(second option). I pray that Neely is right, but my mood gets darker with every day watching what happens around me..... and I feel something very nasty will happen.

MARKET BREADTH INDICATORS

Market Breadth Indicators - many with long term multiple divergences. The indices should be close to a top of higher degree.

McClellan Oscillator - below zero, one more high for divergence?

McClellan Summation Index - weak, multiple divergences.

Weekly Stochastic of the Summation Index - neutral.

Bullish Percentage - reached 70, multiple divergences.

Percent of Stocks above MA50 - reached 75, multiple divergences.

Fear Indicator VIX - one more test of the low and almost closed the gap.

Advance-Decline Issues - lower high, multiple divergences.

HURST CYCLES

Short term cycles - this week should be 20d low next we should see 20d high. Changed the weekly labels for the alternate scenario with one more 5w high.

Week 7 for the 20w cycle. What if something else: - first I am trying to extend the 18m cycle - I would say one more 5w cycle is ok... even looking better. More extension makes zero sense.

- second I am trying to count the February low as 20w low and I can not. Between the September and February highs you have almost six months this means you have 20w+10w highs and this means somewhere between this two highs you MUST have 20w low and this is the January low not the February low.

This is the alternate model - the difference is one more 5w cycle for the 18m high.

Trading cycle - buy signal. Again right translated 20d cycle finding support around MA10. We should see one more high before reversal. High-to-high daily cycle a few more days and it will reach the average length and this should be intermediate term high at least.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - I see one diametric completed.... again if this is the top we should see sharp decline next week if not it is just wave a. Alternate with one more 5w high I have to shift the labels d-f to the right or count diagonal C-wave.

Intermediate term - I see one big zig-zag up. You can count it as W-X-Y(white) classic EW, but we do not have impulses. More likely series of zig-zags A-B-C(yellow) with the C-wave as a diametric. Besides market breadth and indicator divergences, almost every index shows similar pattern from the November low - complex structure with many zig-zags. That is why I can see extension for 2-3 weeks, but another 2-3 months is fantasy for me.

Long term - what if something else is going on? NYSE chart below for a clear pattern without tech stocks distortion. - First option the main stream got it right(I would not believe this even if I see it:) - we have impulse and this is the fifth wave. So with clear corrective leg this is w1 of ED. Than we need waves 2-3-4-5 and sometimes next year it is completed with 4y cycle high. This is the high for mega wave (III) from the low in 1929 and huge sideways wave (IV) begins. Usually it retraces to the low of the previous wave4 of lower degree (the 2009 low) and it will take decades. Personal opinion - it is more than clear from 2009 this is not an impulse. It is the same crappy corrective structure as the current move from the March.2020 low. Please do not try to explain me - no it is not an impulse. - Second option Neely is both right and wrong - right because the correction began in 2000 and it is a triangle, but wrong because it is not neutral triangle. In neutral triangle the C-wave should be the longest and the most complex wave and it is not. He tries to make it fit and counts the C-wave bottom in 2010. In this case the triangle is expanding triangle from 2000 with complex D-wave diametric. Depending on where you count the previous 4y cycle high(Jan.2018 or Sept.2018) this could be top of the D-wave or one more zig-zag up next year. Then comes the E-wave and the 70%-90% decline, which Peter Eliades is talking about. Neely's count is like a walk in the park compared to the alternative scenarios. Imagine what will happen in the real world if we have 20-30 years economical problems(first option) or 1929 style reset Great Depression v.2(second option). I pray that Neely is right, but my mood gets darker with every day watching what happens around me..... and I feel something very nasty will happen.

MARKET BREADTH INDICATORS

Market Breadth Indicators - many with long term multiple divergences. The indices should be close to a top of higher degree.

McClellan Oscillator - below zero, one more high for divergence?

McClellan Summation Index - weak, multiple divergences.

Weekly Stochastic of the Summation Index - neutral.

Bullish Percentage - reached 70, multiple divergences.

Percent of Stocks above MA50 - reached 75, multiple divergences.

Fear Indicator VIX - one more test of the low and almost closed the gap.

Advance-Decline Issues - lower high, multiple divergences.

HURST CYCLES

Short term cycles - this week should be 20d low next we should see 20d high. Changed the weekly labels for the alternate scenario with one more 5w high.

Week 7 for the 20w cycle. What if something else: - first I am trying to extend the 18m cycle - I would say one more 5w cycle is ok... even looking better. More extension makes zero sense.

- second I am trying to count the February low as 20w low and I can not. Between the September and February highs you have almost six months this means you have 20w+10w highs and this means somewhere between this two highs you MUST have 20w low and this is the January low not the February low.

This is the alternate model - the difference is one more 5w cycle for the 18m high.

Mar 13, 2021

Weekly preview

Corrective structure up as expected. This surge has the signs of a final push before a top - it comes after the price bounced twice from MA50 but not resetting rather topping, vertical move to look convincing, gaps up every day most likely exhaustion gaps, selling the highs every day.

According to my analysis cycles and pattern are very close to their final target - 18 month high and completed corrective structure from the March low. Next week we have FOMC, which is usually some kind of a low/high. If we see the week starting higher this is not good the indices are heading for the final top. If we see a few days lower than watch for the top in the fourth week of March.

TRADING

Trading cycle - buy signal after another MA10 cross. The analysis was right that the sell trigger should be ignored.

Again analysis and trigger should point in the same direction for a trade. High-to-high daily count entered the time window for a high and the next time we have a MA10 cross both analysis and trigger will point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - this move up is some complex corrective structure - I see two zig-zags so far.... is this a and now b? If we see the price lower for a few days around mid-week it is a b-wave and we have one more c-wave up. Alternate I am watching f lower and g higher.

Intermediate term - I see one big zig-zag up. You can count it as W-X-Y(white) classic EW, but we do not have impulses. More likely series of zig-zags A-B-C(yellow) with the C-wave as a diametric.

Multiple divergences MACD and RSI - this looks like a top and not a continuation to me.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern. At the moment I think the best looking pattern is Neely's triangle.

The best alternative I see, if it is not a triangle, is w1 of ED and 50%-62% decline for w2 of the diagonal.

MARKET BREADTH INDICATORS

Market Breadth Indicators - short term bottom and turned up as expected. At the moment we have plenty of long term divergences.... if price turns lower in the next 1-2 weeks we will have confirmation for intermediate term high.

McClellan Oscillator - above zero, series of lower highs so far.

McClellan Summation Index - turned up, very high probability for a divergence.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - turned up, series of lower highs so far.

Percent of Stocks above MA50 - turned up, series of lower highs so far.

Fear Indicator VIX - testing the low again with higher low so far.

Advance-Decline Issues - turned up, lower high so far.

HURST CYCLES

Short term cycles - 4 weeks from the previous high so it is time for 5w high. Waiting for the second 20d cycle high to be completed.

Week 6 for the 20 week cycle. The high-to-high count reached my target 4x7 weeks. Soon we will know if it is right or wrong.

Trading cycle - buy signal after another MA10 cross. The analysis was right that the sell trigger should be ignored.

Again analysis and trigger should point in the same direction for a trade. High-to-high daily count entered the time window for a high and the next time we have a MA10 cross both analysis and trigger will point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - this move up is some complex corrective structure - I see two zig-zags so far.... is this a and now b? If we see the price lower for a few days around mid-week it is a b-wave and we have one more c-wave up. Alternate I am watching f lower and g higher.

Intermediate term - I see one big zig-zag up. You can count it as W-X-Y(white) classic EW, but we do not have impulses. More likely series of zig-zags A-B-C(yellow) with the C-wave as a diametric.

Multiple divergences MACD and RSI - this looks like a top and not a continuation to me.

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern. At the moment I think the best looking pattern is Neely's triangle.

The best alternative I see, if it is not a triangle, is w1 of ED and 50%-62% decline for w2 of the diagonal.

MARKET BREADTH INDICATORS

Market Breadth Indicators - short term bottom and turned up as expected. At the moment we have plenty of long term divergences.... if price turns lower in the next 1-2 weeks we will have confirmation for intermediate term high.

McClellan Oscillator - above zero, series of lower highs so far.

McClellan Summation Index - turned up, very high probability for a divergence.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - turned up, series of lower highs so far.

Percent of Stocks above MA50 - turned up, series of lower highs so far.

Fear Indicator VIX - testing the low again with higher low so far.

Advance-Decline Issues - turned up, lower high so far.

HURST CYCLES

Short term cycles - 4 weeks from the previous high so it is time for 5w high. Waiting for the second 20d cycle high to be completed.

Week 6 for the 20 week cycle. The high-to-high count reached my target 4x7 weeks. Soon we will know if it is right or wrong.

Mar 6, 2021

Weekly preview

A lot of volatility this week - all this weakness for so long just confirms that the indices are close to a top.

Pattern - many trying to justify reversal.... three weeks overlapping mess could not retrace one week up. This is not a reversal for me.

Cycle - this is more complicated it is not so obvious. The majority is convinced this is 20w cycle low I am not. Why? The move of higher degree which divides the second zig-zag(running from November) in two parts is the one in January and not this one. This is well visible if you look at DJ,NYSE or the European indices. Another way to look at it - which decline is stronger and reaches the usual level for 20w low? This week is definitely not a 20w low you need another 2-3 weeks lower to count 20w low.

Short said I do not see a reason to change the analysis. The tech sector looks bad AAPL/TSLA with possible impulse lower and reversal. All this is dragging SP500 lower creating a distorted picture, but the rest like DJ/NYSE/Europe - nothing changed.

TRADING

Trading cycle - sell signal. There is two options - sideways pattern is running or it finds resistance at MA10 and the decline continues next week for a few more weeks. I think it is the first option and if it is the second you can buy 20w low.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - looks like complicated overlapping correction. If you look at DJ/NYSE you will see simple zig-zag with c=a. Still expecting final zig-zag higher.

Intermediate term - I see one big zig-zag up. You can count it as W-X-Y(white) classic EW, but we do not have impulses. More likely series of zig-zags A-B-C(yellow) with the C-wave as a diametric.

Too deep retracement for zig-zag C/Y(white)... maybe a triangle?

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle.

The best alternate pattern I see, if it is not a triangle, is w1 of ED and 50%-62% decline for w2 of the diagonal.

MARKET BREADTH INDICATORS

Market Breadth Indicators - lower after the weakness this week, but turning up hinting short term bottom.

McClellan Oscillator - turned up, but still below zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - trying to turn up.

Percent of Stocks above MA50 - turned up.

Fear Indicator VIX - one more test of the low?

Advance-Decline Issues - small divergence and turning up.

HURST CYCLES

Short term cycles - I think it is better to look other indices like DJ - I expect several days higher for 20d high.

Week 5 for the 20 week cycle. NYSE the price action and this weekly candle has nothing to do with 20w low. I have marked all the 10w lows - it is not even a 10w low. If we see another 2-3 weeks lower than it will be 20 low. For all the guys with "another three months higher" - if we do not see several more weeks lower you can forget your three months higher.

This is what I see - you have one big zig-zag up, which consists of two smaller zig-zags. Time relationship is similar and currently the middle section of the second leg of the smaller zig-zag was completed - the green arrow two weeks correction and up. What is left is 2-3 weeks final zig-zag (the circle) to complete the whole structure from the March low. Another 2-3 months makes zero sense - out of proportions big time.

Trading cycle - sell signal. There is two options - sideways pattern is running or it finds resistance at MA10 and the decline continues next week for a few more weeks. I think it is the first option and if it is the second you can buy 20w low.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - looks like complicated overlapping correction. If you look at DJ/NYSE you will see simple zig-zag with c=a. Still expecting final zig-zag higher.

Intermediate term - I see one big zig-zag up. You can count it as W-X-Y(white) classic EW, but we do not have impulses. More likely series of zig-zags A-B-C(yellow) with the C-wave as a diametric.

Too deep retracement for zig-zag C/Y(white)... maybe a triangle?

Long term - the bull market completed in 2018. Since then a bunch of corrective waves. Currently I think this rally should be a corrective wave of a bigger pattern most likely triangle. Look at NDX we have corrective wave which is 1,618 bigger than the previous one which could be only b of a triangle. I think the best looking pattern is Neely's triangle.

The best alternate pattern I see, if it is not a triangle, is w1 of ED and 50%-62% decline for w2 of the diagonal.

MARKET BREADTH INDICATORS

Market Breadth Indicators - lower after the weakness this week, but turning up hinting short term bottom.

McClellan Oscillator - turned up, but still below zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - trying to turn up.

Percent of Stocks above MA50 - turned up.

Fear Indicator VIX - one more test of the low?

Advance-Decline Issues - small divergence and turning up.

HURST CYCLES

Short term cycles - I think it is better to look other indices like DJ - I expect several days higher for 20d high.

Week 5 for the 20 week cycle. NYSE the price action and this weekly candle has nothing to do with 20w low. I have marked all the 10w lows - it is not even a 10w low. If we see another 2-3 weeks lower than it will be 20 low. For all the guys with "another three months higher" - if we do not see several more weeks lower you can forget your three months higher.

This is what I see - you have one big zig-zag up, which consists of two smaller zig-zags. Time relationship is similar and currently the middle section of the second leg of the smaller zig-zag was completed - the green arrow two weeks correction and up. What is left is 2-3 weeks final zig-zag (the circle) to complete the whole structure from the March low. Another 2-3 months makes zero sense - out of proportions big time.

Subscribe to:

Comments (Atom)