Hello traders!!!

the market makes everything possible to drive crazy both camps - bulls and bears and makes it very good.

What should we do in such conditions when the market is very volatile and moves up and down like crazy with no direction?

- Long term trading... forget it a while, step back and look at the big picture. Wait till the market finds its direction. Both camps have valid arguments, but you should be clever wait for the market to tell you the story and then join to the winning camp.

- Short term trading - the market has no clear direction, but this does not mean that we can not trade the swings and make money. So lets concentrate on the short term charts and make some profits:)

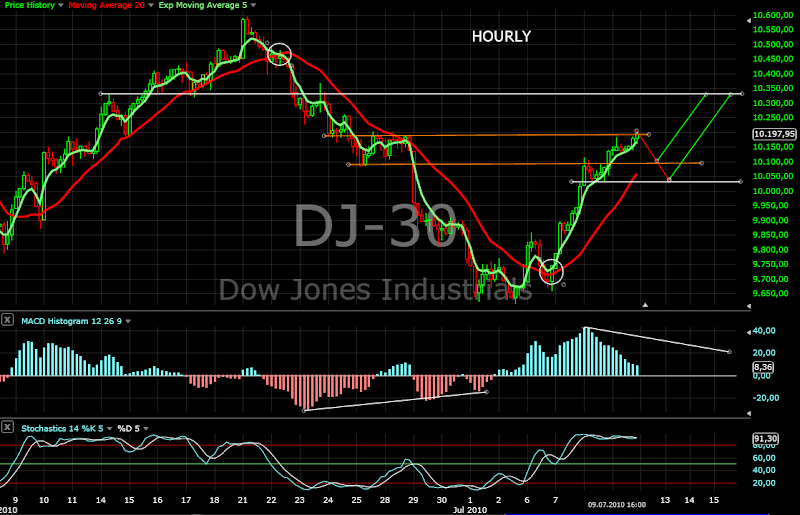

On the weekly chart we have a bullish engulfing candle and the histogram made a higher bar. On the daily chart we have a divergence on the MACD and the histogram is rising(now its over the zero line). This tells me that the indexes will move higher for a while 2-3 weeks. The market gives us bullish signals and we should listen what the market has to say and stay bullish at least for the short term.

The bullish scenario is we are in a trading range for the summer and the months of September/October and then we will see new highs at the year end. I am not convinced, but so what if it plays out this way. I have no problem with that.

The second chart show the bearish scenario. The blogs are full with bearish Elliot waves counts. According this counts this is 2 of 3. If the bears are right the indexes should reverse soon and that very hard. In worst case we should see a little bit higher prices hitting resistance around 10320(shown on the third chart) and the trend line and than reverse hard never looking back making new lows. That is the personality of a third wave. Sorry but when I look at the indicators I do not see the beginning of a third wave.

The third chart shows my personal view. I think we will see a rally. The bears will get killed again. The bulls will think we are heading for a new highs. Then the market will complete its right shoulder and the whole Head&Shoulders formation and we will see correction of the move from March 2009

Do not forget the market tries to fool everybody. In fact no one knows what will happen. I am presenting you different scenarios and the market will reveal itself with the time. The best what we can do now is short term trading trying to squeze some profit, until the picture is more clear.

That is way I will start posting short term charts - 1h and 15min, trying to catch the shorter swings and maybe daytrading.

Bearish scenario

I little bit more bullish