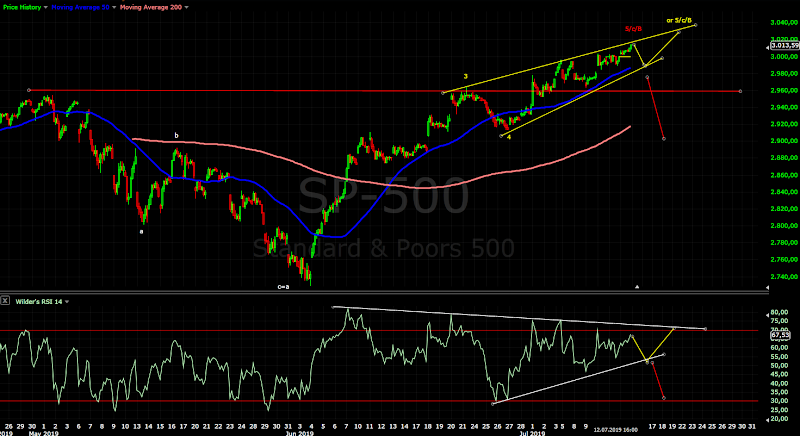

No follow trough to the downside obviously bigger than expected w4... I have shown updated version of the ED and since than the price action confirms the suggested pattern.

The big picture has not changed, just more divergencies - bearish indicators/market breadth/cycles and TomDemark finished countdown on the weekly chart. Now waiting the pattern to be finished and see confirmation for reversal.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - there is enough waves to call a top, go to shorter time frames and you will see finished impulse for possible c/5. BUT there is great sell the news event - FOMC and so far all a and c waves form 1/3/5 developed as zig-zags not impulses.

The perfect pattern - wave 1/3/5 are zig-zags and within the waves a and c are zig-zags it self too (this (a) (b) (c) labels). If the pattern and RSI from w1 and w3 repeat than we are at the point marked with the green arrows from the previous two occasions, and we will see small pullback Monday and last rally for (c)/c/5.

The perfect pattern is another zig-zag for c/5, a/5=c/5, (a)/c/5=(c)/c/5, 5=0,618x3(ED) aaaand all this Fibo measurements point to the same target 3044.

Now we can only wait and watch if the perfect pattern/Fibo will play out or the market will reverse prior FOMC. 10 points lower on Monday is ok, 20 and more will look bad. Below 3000 is the first sign for a problem and below 2975 will confirm a move to the downside is running.

Intermediate term - the trend line is tested one more time. RSI - after the broken trend line now we have divergence.

Nothing really changed, just timing - the next bigger move should be decline to at least MA50 and daily cycle low.... I think something like two weeks lower, two weeks higher and in September the decline really accelerates.

Long term - this should be the top of wave B or D and decline in three waves or impulse is expected.

MARKET BREADTH INDICATORS

Market Breadth Indicators - another short term divergences and turning lower again despite the strong day on Friday, the indexes are close to intermediate term high.

McClellan Oscillator - around zero, most likely will see another lower high.

McClellan Summation Index - turning lower after divergences.

Weekly Stochastic of the Summation Index - turned lower, sell signal.

Bullish Percentage - divergences short and long term, pointing lower.

Percent of Stocks above MA50 - divergences short and long term, pointing lower.

Fear Indicator VIX - bottoming and longer term divergences.

Advance-Decline Issues - another lower high and turned lower again.

HURST CYCLES

Day 38, I doubt we saw daily cycle low. I think it is topping and it will turn lower for 2 weeks.

Week 8 for the 20 week cycle. As explained last week the longer cycles 40 week(both high-to-high and trough-to-trough) are ripe for reversal.

Jul 27, 2019

Jul 20, 2019

Weekly preview

It looks like the daily cycle turned lower and we have a high which could be the top for all cycles of higher degree up to 4 year and see a decline lasting 6-9 months. For starter we need to see impulse lower to confirm intermediate term high in place.

I do not think the market will crash next week. The daily cycle is right translated - long and strong. In theory the next one should make higher high, but it will be the last 4th daily cycle for the 40 week cycle. Taking into account the other factors like pattern, market breadth etc. I expect it to make lower high.

I am thinking something like 2 weeks lower to MA50 around 2900 and daily cycle low, FED cutting rates trying to stop the decline, the next daily cycle begins 2-3 weeks higher with deep retracement at least 62% and from mid-August the plunge begins.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - the first support level 2990 was broken which activated the red count - finished ED. Now we need an impulse lower below 2960 for confirmation.

Many were skeptical about reversal because of the sharp jump higher on Thursday, but look at the reversal in May - 90% retracement and a lot of overlapping the first few days. Nothing different, do not expect perfection, it does not work this way.

Intermediate term - looking the indicators we have a high - the histogram is below zero after divergences, RSI broke the trend line. The next move should be decline to MA50 and daily cycle low around 2900 the end of July early August.

Long term - this should be the top of wave B or D and decline in three waves or impulse is expected.

The weekly candle is bearish reversal candle and the indicators look bad all of them with divergences and MACD/RSI with double divergence.

MARKET BREADTH INDICATORS

Market Breadth Indicators - short term topping in the last 2-3 weeks as expected and longer term divergences. All indicators are turning lower so the indexes should be making intermediate term high.

McClellan Oscillator - divergences and below zero now.

McClellan Summation Index - starting to turn lower.

Weekly Stochastic of the Summation Index - buy signal, but turning lower.

Bullish Percentage - short term topping, bigger divergences and turning lower.

Percent of Stocks above MA50 - short term topping, bigger divergences and turning lower.

Fear Indicator VIX - short term bottoming, longer term divergences, and turning higher.

Advance-Decline Issues - series of lower highs and turned lower again.

HURST CYCLES

Day 33, it looks like the daily cycle turned lower. Last week I wrote the daily cycle is easy way to trade with low risk. Just watch MA10 and RSI - early warning RSI broke the trend line and then on Wednesday the index closed below MA10 and RSI broke below the MA, which signaled daily cycle reversal and on Friday the signal was confirmed.

Week 7 for the 20 week cycle. Peak to peak we have week 42 or imminent 40 week cycle high. Trough to trough week 30 for the 40 week cycle so it should top out and move lower for two months.... there is high probability this happened this week.

Short term - the first support level 2990 was broken which activated the red count - finished ED. Now we need an impulse lower below 2960 for confirmation.

Many were skeptical about reversal because of the sharp jump higher on Thursday, but look at the reversal in May - 90% retracement and a lot of overlapping the first few days. Nothing different, do not expect perfection, it does not work this way.

Intermediate term - looking the indicators we have a high - the histogram is below zero after divergences, RSI broke the trend line. The next move should be decline to MA50 and daily cycle low around 2900 the end of July early August.

Long term - this should be the top of wave B or D and decline in three waves or impulse is expected.

The weekly candle is bearish reversal candle and the indicators look bad all of them with divergences and MACD/RSI with double divergence.

MARKET BREADTH INDICATORS

Market Breadth Indicators - short term topping in the last 2-3 weeks as expected and longer term divergences. All indicators are turning lower so the indexes should be making intermediate term high.

McClellan Oscillator - divergences and below zero now.

McClellan Summation Index - starting to turn lower.

Weekly Stochastic of the Summation Index - buy signal, but turning lower.

Bullish Percentage - short term topping, bigger divergences and turning lower.

Percent of Stocks above MA50 - short term topping, bigger divergences and turning lower.

Fear Indicator VIX - short term bottoming, longer term divergences, and turning higher.

Advance-Decline Issues - series of lower highs and turned lower again.

HURST CYCLES

Day 33, it looks like the daily cycle turned lower. Last week I wrote the daily cycle is easy way to trade with low risk. Just watch MA10 and RSI - early warning RSI broke the trend line and then on Wednesday the index closed below MA10 and RSI broke below the MA, which signaled daily cycle reversal and on Friday the signal was confirmed.

Week 7 for the 20 week cycle. Peak to peak we have week 42 or imminent 40 week cycle high. Trough to trough week 30 for the 40 week cycle so it should top out and move lower for two months.... there is high probability this happened this week.

Jul 13, 2019

Weekly preview

Small down and up moves as expected... time for topping and possible reversal next week. Overall the market is getting more dangerous every day - indicators with divergences on the daily and weekly chart, the daily cycle is nearing a high, market breadth with divergences and now working on short term divergences to signal a high, TomDemark finished countdown on the weekly chart, the pattern starts looking complete, DAX reversal bearish candle formation and divergences on the weekly chart... I do not know how to twist this as bullish.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - the line in the sand(red bearish) is now around 2950-60. The pattern is tricky I think the fifth wave from June low is running... it could be ED for w5(yellow) one more down/up and the index will hit the trend line on the daily chart around 3025.

Some see zig-zag for b/B expanded flat..... maybe, but I think it has lower probability. At the end for trading it does not matter down is down.

DJI shows better the idea...

Intermediate term - again RSI looks like topping similar to the previous two occasions. They have 4 runs to the 70 level, currently we have three.... one more high w4 and w5 for ED and kissing for good bye the trend line:)

Long term - the indexes are close to the top of wave B or D, when it is finished decline in three waves or impulse is expected.

MARKET BREADTH INDICATORS

Market Breadth Indicators - longer term divergences and some have started to build short term divergences as expected, but still no sell signal - patience.

McClellan Oscillator - another lower high.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal in overbought territory.

Bullish Percentage - turned lower.

Percent of Stocks above MA50 - toping begun?

Fear Indicator VIX - bottoming with long and short term divergences.

Advance-Decline Issues - series of lower highs.

HURST CYCLES

Day 28 for the 40 day cycle - nearing the top of this daily cycle.

Week 6 for the 20 week cycle and 29 for the 40 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

As expected finished countdown on the weekly chart and waiting for a price flip to trigger sell signal.

Short term - the line in the sand(red bearish) is now around 2950-60. The pattern is tricky I think the fifth wave from June low is running... it could be ED for w5(yellow) one more down/up and the index will hit the trend line on the daily chart around 3025.

Some see zig-zag for b/B expanded flat..... maybe, but I think it has lower probability. At the end for trading it does not matter down is down.

DJI shows better the idea...

Intermediate term - again RSI looks like topping similar to the previous two occasions. They have 4 runs to the 70 level, currently we have three.... one more high w4 and w5 for ED and kissing for good bye the trend line:)

Long term - the indexes are close to the top of wave B or D, when it is finished decline in three waves or impulse is expected.

MARKET BREADTH INDICATORS

Market Breadth Indicators - longer term divergences and some have started to build short term divergences as expected, but still no sell signal - patience.

McClellan Oscillator - another lower high.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal in overbought territory.

Bullish Percentage - turned lower.

Percent of Stocks above MA50 - toping begun?

Fear Indicator VIX - bottoming with long and short term divergences.

Advance-Decline Issues - series of lower highs.

HURST CYCLES

Day 28 for the 40 day cycle - nearing the top of this daily cycle.

Week 6 for the 20 week cycle and 29 for the 40 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

As expected finished countdown on the weekly chart and waiting for a price flip to trigger sell signal.

Jul 10, 2019

Long term - update

With some delay the next long term update.

No big surprises - the USD with ugly pattern, but still the expected a-b-c and precious metals/miners with a low in Q2, but it does not look like important low rather just intermediate term low.

The current view for the next 6 months:

- Stocks - final wave lower for wave 4 from 2009 to begin, possible surprise flat b/B and one more high later this year.

- Bonds - another month or two higher and bonds should turn lower again.

- USD - one more leg higher to finish the move which begun early 2018.

- Precious metals/miners - high in July/August and final sell off for the 4 year cycle to begin.

- Crude Oil - like the stock indexes - wave C lower with possible surprise one more high for B.

- STOCKS

We saw multi month rally as expected. The big picture - we should see one more sell off to finish w4 from 2009 with 4 year cycle low in 2020. Possible surprise is flat for b/B and one more rally to around 3050 before the reversal lower.

- BONDS

I was expecting multi month move higher and it is playing out. Next we should 4 year cycle high in the next few months and decline.

10 year yield - I expect one more low to finish a-b-c and RSI divergence, then higher at least to the resistance zone.

- FOREX

The pattern is challenging:) Many see the USD plunging lower and PM to the moon, but I think the USD move up is not over.

The USD bears see diagonal and sharp plunge, I think it is wave 2 or B and the low should be tested late 2019/early 2020.

The pattern is a mess looking at RSI I see one wave lower and zig-zag higher that is why I do not bet on ED for wave C and reversal rather wave 2 or B.

Long term I expect big A-B-C pattern and important 16 year cycle high(USD low) 2025-2026, but at the moment I can not say how complex it will be.

The first option with complex wave B

Or simple zig-zag like this

JPY - from the late 2016 low it is a mess, for me this is some complex corrective crap(only zig-zags to the upside) and we have not seen the 4 year cycle low. You have sequence 4y low(green) -> 4y high(red) -> 4y low(green) and so on. What I want to say - you can not have two 4y cycle highs without 4y cycle low between them, you can not expect to see a strong rally for 4/8 year cycle high before we see the next 4 year cycle low....

I can not see simple B wave like EUR/USD, only the complex pattern seems to fit....

USD/JPY - mirror image... the pattern is more complex and it takes longer than expected, but it has not changed.

- GOLD/SILVER/MINERS

We saw declines into May as expected, gold/GDX strong and silver/GDXJ close to the lows from 2017... but this is not 4 year cycle low. It looks like much bigger corrective pattern which begun August-September last year and I expect to see one more sell off for 4 year cycle low. Many including the most "experts" with paid subscription jumping on the break out train, but if the low is in it was in 2017 with 4 year cycle lasting 2.9 years... I do not think so. Only gold is stronger and could make higher low.

GOLD the strongest from the PM sector with shallow decline from February to May. The consensus is for a break out higher.... I can not see important low. The same thoughts about cycles like JPY above before a rally we need to see 4 year cycle low. The possible pattern is some kind of flat - running or expanded. When the pattern is finished we should see strong rally in 2020 for 8 year cycle high

Silver much weaker - one or two months to finish the current move up, then we should see one more sell off.... the third 18m cycle and the 4 year cycle do not look complete.

Miners - similar idea I want to see 4 year cycle before a strong rally to 4/8 year cycle high. The two EW patterns are the same like for the EUR\USD shown above - something complex or huge C. The rally next year should give us a clue what exactly is going on.

- CRUDE OIL/NATGAS

Multi month corrective wave higher as expected. The pattern is tricky hanging in the middle at the moment... there is more to the downside, but one final higher high for b is possible. The big picture the same question like EUR/USD and PM sector something more complex or straight up for C.... we can only wait and see how it develops in 2020.

Natgas - I was expecting more to the downside to complete the move lower and this is what happened. In the next months we should see bigger and longer retracement higher at least to MA200 daily/MA50 weekly around 3-3.10

Similar to crude oil for Natgas seems that Benner cycle sequence 11-10-7 works better than Hurst cycles. History is too short, but it seems to work good - HIGHS - 90(7)97(11)2008(10)2018(7)2025 / LOWS - 92(10)2002(7)2009(11)2020(10)2030.

Next important low is in 2020 and the next high is in 2025 which fits with the EW pattern and the rest of the commodity complex.

Jul 7, 2019

Weekly preview

Positive June as expected, but shallow pullbacks and a new high. First the bears wanted to sell the bottom now the bulls are buying the top:) Nothing new under the sun, the usual Fed bla bla, 3200-4000, trading emotions and not the charts.

We are seeing c wave which will finish the zig-zag from the December 2018 low. This last leg from the June low is weak building divergences only short term topping is missing which we should see in July.

The big picture - nothing has changed, decline in three waves or impulse for 4 year cycle low in 2020 is expected.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - one strong week, multiple divergences... I do not know how to count this as impulse, may be some kind of ED.

As long as the price stays above 2910(red) we should see one more high.

Intermediate term - close to the trend line, another week or two higher to touch the trend line with divergences will look perfect. RSI touched for the second time overbought level and it looks similar to the previous two occasions short before a move lower.... just the topping process is missing, I do not believe the index is in the middle of a third wave.

Long term - the indexes are close to the top of wave B or D, when it is finished decline in three waves or impulse is expected.

MARKET BREADTH INDICATORS

Market Breadth Indicators - reached overbought levels with divergences, now topping short term divergences and turn lower is expected.

McClellan Oscillator - divergences.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal, overbought level reached.

Bullish Percentage - buy signal and divergence.

Percent of Stocks above MA50 - buy signal and divergence.

Fear Indicator VIX - touched again the long term trend line from 2017 and divergences. Only short term divergence is missing.

Advance-Decline Issues - very weak, divergences, sequence of lower highs since the bottom in 2018.

HURST CYCLES

Day 23 for the 40 day cycle.... nearing the top for this daily cycle.

Week 5 for the current 20 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Weak price action, there is no finished setup - short living initial rally and too much overlapping.

One more week is missing to see finished countdown on the weekly chart.

We are seeing c wave which will finish the zig-zag from the December 2018 low. This last leg from the June low is weak building divergences only short term topping is missing which we should see in July.

The big picture - nothing has changed, decline in three waves or impulse for 4 year cycle low in 2020 is expected.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - one strong week, multiple divergences... I do not know how to count this as impulse, may be some kind of ED.

As long as the price stays above 2910(red) we should see one more high.

Intermediate term - close to the trend line, another week or two higher to touch the trend line with divergences will look perfect. RSI touched for the second time overbought level and it looks similar to the previous two occasions short before a move lower.... just the topping process is missing, I do not believe the index is in the middle of a third wave.

Long term - the indexes are close to the top of wave B or D, when it is finished decline in three waves or impulse is expected.

MARKET BREADTH INDICATORS

Market Breadth Indicators - reached overbought levels with divergences, now topping short term divergences and turn lower is expected.

McClellan Oscillator - divergences.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal, overbought level reached.

Bullish Percentage - buy signal and divergence.

Percent of Stocks above MA50 - buy signal and divergence.

Fear Indicator VIX - touched again the long term trend line from 2017 and divergences. Only short term divergence is missing.

Advance-Decline Issues - very weak, divergences, sequence of lower highs since the bottom in 2018.

HURST CYCLES

Day 23 for the 40 day cycle.... nearing the top for this daily cycle.

Week 5 for the current 20 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Weak price action, there is no finished setup - short living initial rally and too much overlapping.

One more week is missing to see finished countdown on the weekly chart.

Subscribe to:

Comments (Atom)