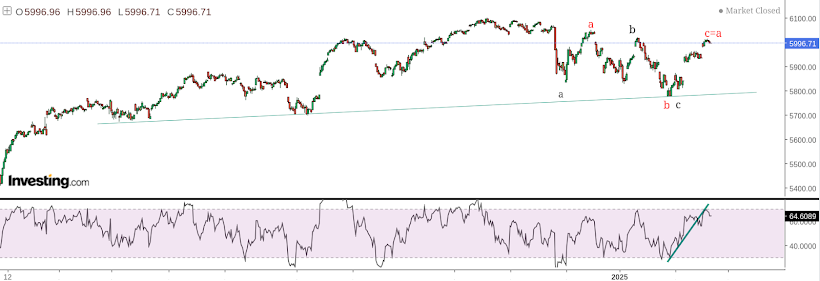

It seams like a-b-c correction lower completed and now the next leg higher, but if you look other indices like DJ,SPXEW it is more likely a-b-c correction higher and 10w high with reversal lower to follow.

TRADING

Trading trigger - buy signal.

Analysis - long term important top it could be 4y cycle high. Intermediate term turn lower into 40w cycle low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - it looks like a-b-c lower and now higher, but I think it is in fact a-b-c higher(red) and next is lower.

Intermediate term - the first target should be MA200 and support in the 5600-5700 area.

Long term - double zig-zag(from 2020) for y/B at 9y cycle high 2000-2007-2015-2024.

MARKET BREADTH INDICATORS

Market Breadth Indicators - turned higher.

McClellan Oscillator - cclose to overbought.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - in the middle of the range.

Percent of Stocks above MA50 - in the middle of the range.

Advance-Decline Issues - in the middle of the range.

Fear Indicator VIX - multiple divergences.

HURST CYCLES

Short term cycles - expect 20d high it could be 10w high too.

Next important low should be 40w low - earliest in March or it could stretch until May.

Subscribe to:

Post Comments (Atom)

Thanks, what do you think on vix, the 50 ema cross 200 ema, don't you think it's dead cross?

ReplyDeleteNo I do not think. VIX will go higher.

DeleteThanks a lot

ReplyDeleteLast week could have been 20w low, 23 weeks duration

ReplyDeleteI think it was in December right on schedule 4 months.

DeleteVix down and market up…no pullback?

ReplyDeleteKrasi, why updated chart on SPX direction? market is climbing higher non stop again.

ReplyDeleteKrasi, any comment or update on the SPX direction. it seems that the market is climbing higher again.

ReplyDelete