Maybe you do not remember, when we saw this two days decline early December I wrote it is strange it does not really fit like w4 from the October low.... but I just follow the herd. Now we have the next wave which is way too big to be w5 from the October low.... and if you accept that they are from different degree everything makes sense.

I think we have impulse for c/B which begun late August and not in October - changed the counts accordingly below.

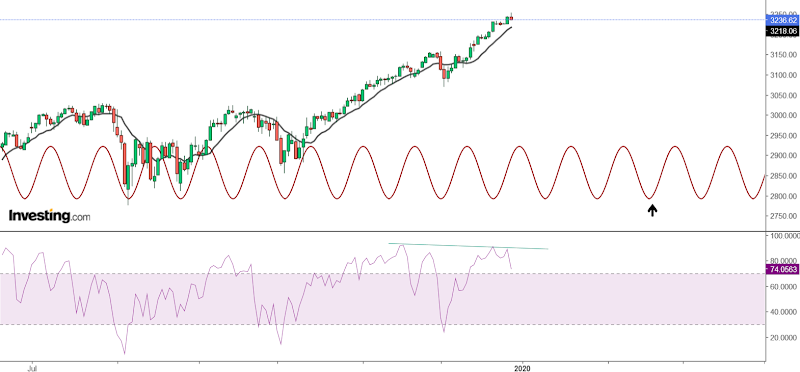

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - from October you have extended w3 2,618 so we should not have another extended wave. It is taking too long time and price so I think we have a wave from early December currently iii/5/c/B.

Of course any move lower should be corrective and stay in the channel and above support or the the wave from December is finished.

Intermediate term - small down and up will finish this fifth wave and give time for topping and short term divergences for the indicators and market breadth. Even MACD and RSI count like five waves from the August low:)

Long term - the top of wave B in 1-2 weeks, then expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - market breadth has not been reset so that the trend can re-energize for another long lasting rally, market breadth is still showing long term divergence. Fear&greed with extreme again 93-94.

McClellan Oscillator - above zero, short term lower high.

McClellan Summation Index - buy signal, with divergence.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal and divergence.

Percent of Stocks above MA50 - buy signal and divergences.

Fear Indicator VIX - higher low and divergence.

Advance-Decline Issues - lower high and divergence.

HURST CYCLES

Daily/trading cycle - it is up, the price is above MA10 and RSI above MA18 and above the respective trend lines.

Hurst cycles - three days sideways move for 14 day low(20 day Hurst cycle) and the next one is running, watching mid-February or early March for important low.

Week 12 for the 20 week cycle.... it takes too long for a 20w cycle from August.

Dec 28, 2019

Dec 21, 2019

Weekly preview

Two weeks higher as expected. We have full set of waves and I think this is 5/c/B completed... now waiting for reversal signs. I am short SP500 and crude oil, do not do like me wait for confirmation.

The current top is different compared to the previous two - the market sucked in everybody, the whole spectrum from the usual trolls, amateurs with their third wave, "smart" long term investors, maybe experienced traders with their models, "experts" with their paid subscription. Judging by the comments everybody joined the herd and the herd gone mad:) Everybody shouting in my face idiot you are wrong:). I have not seen such level of mass stupidity, at least not on my blog. Good luck to all of you, you will gone need it and we will see at 2200 next year.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - strange this last wave 5 looks like impulse with zig-zags... wave 3 is extended 2,618 usually in this case you have 5=1, but the market wants to extend to the max obviously and the trend line was hit one more time with 5=1,618x1. For the rest of the year support and the trend line should be tested and a bounce into year end.

The only wave to extend even more is to count this ii and now iii/5.... not my preferred count.

Intermediate term - exhaustion gap, I want be surprised to see open lower next week. MACD/RSI 5 waves higher too and divergence. For me this is the top of c/B.

Long term - the top of wave B, expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - somewhat improved, but nothing more than making room to absorb the coming decline. Market breadth has not been reset so that the trend can re-energize for another long lasting rally, market breadth is still showing long term divergence.

McClellan Oscillator - above zero, interesting it was negative on Friday.

McClellan Summation Index - buy signal with lower highs.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal.

Percent of Stocks above MA50 - buy signal.

Fear Indicator VIX - higher low and divergence.

Advance-Decline Issues - lower high and divergence.

HURST CYCLES

Daily/trading cycle - it is up, the price is above MA10 and RSI above MA18 and above the respective trend lines.

Week 11 or 17 for the 20 week cycle.

I have changed the chart - this one is more trading oriented with MA10 and RSI like the one above and gives better perspective for timing - tops and bottoms. My biggest mistake this year was timing not EW and I am looking how to improve it.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

At the same time on both charts daily and weekly we have finished sell setup and on both charts 9-13-9 sequence. Usually when such thing appears on both charts you have a strong signal.... confirming the EW pattern a high, fascinating:)

Short term - strange this last wave 5 looks like impulse with zig-zags... wave 3 is extended 2,618 usually in this case you have 5=1, but the market wants to extend to the max obviously and the trend line was hit one more time with 5=1,618x1. For the rest of the year support and the trend line should be tested and a bounce into year end.

The only wave to extend even more is to count this ii and now iii/5.... not my preferred count.

Intermediate term - exhaustion gap, I want be surprised to see open lower next week. MACD/RSI 5 waves higher too and divergence. For me this is the top of c/B.

Long term - the top of wave B, expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - somewhat improved, but nothing more than making room to absorb the coming decline. Market breadth has not been reset so that the trend can re-energize for another long lasting rally, market breadth is still showing long term divergence.

McClellan Oscillator - above zero, interesting it was negative on Friday.

McClellan Summation Index - buy signal with lower highs.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal.

Percent of Stocks above MA50 - buy signal.

Fear Indicator VIX - higher low and divergence.

Advance-Decline Issues - lower high and divergence.

HURST CYCLES

Daily/trading cycle - it is up, the price is above MA10 and RSI above MA18 and above the respective trend lines.

Week 11 or 17 for the 20 week cycle.

I have changed the chart - this one is more trading oriented with MA10 and RSI like the one above and gives better perspective for timing - tops and bottoms. My biggest mistake this year was timing not EW and I am looking how to improve it.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

At the same time on both charts daily and weekly we have finished sell setup and on both charts 9-13-9 sequence. Usually when such thing appears on both charts you have a strong signal.... confirming the EW pattern a high, fascinating:)

Dec 14, 2019

Weekly preview

We saw corrective moves this week as expected so I still think that ED is running and most likely we saw wave iii/5. Looking at Europe,Japan,EEM I see the same everywhere - iii/5/c/B. The markets are close to the top for this move up from the Dec.2018 low.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - wave iii for the ED. Confirmation for reversal is a move below 3130 - support and the trend line. MACD and RSI with divergences - this is a top.

Intermediate term - the trend line touched one more time. MACD and RSI with divergences. According to my EW count the index is completing impulse from the October low and most likely this is c/B... or c/y/B it does not matter much.

Long term - close to the top of wave B. When it is finished expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - short term turned up, but nothing bullish the same old multiple divergences. The indicators has not been reset to suggest important low.

McClellan Oscillator - above zero with divergences.

McClellan Summation Index - turned up with divergences.

Weekly Stochastic of the Summation Index - in the oversold area.

Bullish Percentage - turned up, multiple divergences.

Percent of Stocks above MA50 - turned up, multiple divergences.

Fear Indicator VIX - higher lows and building divergences.

Advance-Decline Issues - in the middle of the range with divergences.

HURST CYCLES

Daily cycle trading - we have a cycle moving higher the price is above MA10 and RSI above MA18. For a short trade I want to see failed left translated cycle and RSI divergence.

Hurst cycles - the sine wave is 14 trading days long which corresponds to 20 day Hurst cycle. For the last several months it is running with pretty high accuracy. From the late August low you have 5 such cycles, from the October low 3 cycles. Neither bottoms is perfect for 80day/10w cycle low which needs 4x14 cycles. For now I will stick to my cycle count and I expect 20w cycle low the end of January(the arrow) with 8x14 cycles which corresponds to 2x80 daily cycles or one 20 week cycle.

Week 16, if we see a reversal next week I will stick to my cycle phasing, if we see continuation for another 1-2 or more weeks I have to change it to a 40w cycle low in October.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Week 8 for the sell setup. If the next week closes above 3110 we will have finished sell setup and 9-13-9 sequence from the Dec.2018 low.

Short term - wave iii for the ED. Confirmation for reversal is a move below 3130 - support and the trend line. MACD and RSI with divergences - this is a top.

Intermediate term - the trend line touched one more time. MACD and RSI with divergences. According to my EW count the index is completing impulse from the October low and most likely this is c/B... or c/y/B it does not matter much.

Long term - close to the top of wave B. When it is finished expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - short term turned up, but nothing bullish the same old multiple divergences. The indicators has not been reset to suggest important low.

McClellan Oscillator - above zero with divergences.

McClellan Summation Index - turned up with divergences.

Weekly Stochastic of the Summation Index - in the oversold area.

Bullish Percentage - turned up, multiple divergences.

Percent of Stocks above MA50 - turned up, multiple divergences.

Fear Indicator VIX - higher lows and building divergences.

Advance-Decline Issues - in the middle of the range with divergences.

HURST CYCLES

Daily cycle trading - we have a cycle moving higher the price is above MA10 and RSI above MA18. For a short trade I want to see failed left translated cycle and RSI divergence.

Hurst cycles - the sine wave is 14 trading days long which corresponds to 20 day Hurst cycle. For the last several months it is running with pretty high accuracy. From the late August low you have 5 such cycles, from the October low 3 cycles. Neither bottoms is perfect for 80day/10w cycle low which needs 4x14 cycles. For now I will stick to my cycle count and I expect 20w cycle low the end of January(the arrow) with 8x14 cycles which corresponds to 2x80 daily cycles or one 20 week cycle.

Week 16, if we see a reversal next week I will stick to my cycle phasing, if we see continuation for another 1-2 or more weeks I have to change it to a 40w cycle low in October.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Week 8 for the sell setup. If the next week closes above 3110 we will have finished sell setup and 9-13-9 sequence from the Dec.2018 low.

Dec 7, 2019

Weekly preview

Volatile moves with a zig-zag lower, zig-zag higher and flat for the week. The pattern which makes most sense to me is to count another w4 and ED to complete the move from October and the whole B wave from Dec.2018. In this case expect another two weeks and 30 points higher for the ED to be completed - the Christmas rally. This will be great Christmas present if we see a high with ED - probably the most reliable pattern.

P.S. When I write the analysis my assumption is that the reader/trader has some trading system and rules for entry/exit point.

Obviously this is not the case for many and there is confusion about analysis,trading,trading plan,entry points. When I draw some line lower/higher this is not a trade. That is why on the daily cycle chart I will focus on trading with simple trading system, which should help beginners and clear the confusion analysis<->trading.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - with some creativity ignoring upper trend line and candle shadow you can draw another trend line and count w4. The move up is another zig-zag so most likely ED.

Alternate scenarios are flat or triangle, but then the creativity will not help... the correction will be too big to be part of this rally.

Intermediate term - expect two more touches of the the trend line in the next two weeks before the ED is completed. The indicators - just more divergences, one day and a half is too short to reset the indicators and erase the divergences. This is not an important low so that the indexes can re-energize and continue higher, this is topping.

I find it interesting if you count w-x-y as shown on the chart you have a cluster of three different Fibo measurements in the same area. Such a cluster shows with very high probability the target area for a move and on top of this the count and measurements work for SP500/DJI/NYSE/NDX... fascinating, isn't it:)

Long term - close to the top of wave B. When it is finished expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - very weak for a long time and going nowhere with multiple divergences.

McClellan Oscillator - above zero with multiple divergences.

McClellan Summation Index - sell signal with multiple divergences.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - at the overbought level with multiple divergences.

Percent of Stocks above MA50 - at the overbought level with multiple divergences.

Fear Indicator VIX - spike higher as expected and now the low is tested, right on time for divergence and important high.

Advance-Decline Issues - in the middle of the range, preparing for another divergence.

HURST CYCLES

From now on I will focus on the cycle which I call daily cycle and stop mixing with Hurst cycles. This daily cycle is not Hurst cycle. Sometimes it corresponds to 80 day Hurst cycle sometimes not. It's focus is trading, it does not care about theory for example Hurst cycles if we have 40w low in August or October or EW what pattern we have etc. It is simple, objective and effective - above MA10 is up, below MA10 is down. The idea is for traders without experience to stay on the right side of the trade:) and to make difference between analysis and trading. I explain over and over that drawing some line up or down is not a trade and I hear all the time - missed the move, wrong all the time, lost money because of you etc.

Daily cycle trading - the price broke below the trend line and MA10, RSI broke below the trend line and MA18. We have strong right translated cycle and we should expect one more higher high and "failed"(left translated) cycle. Usually a strong move is followed by higher high and a cycle which makes a top early and reverses(left translated).

The price/RSI moved above the the trend line and MAs and it seems the next daily cycle begun. My positioning now is - waiting.

Monthly chart - the 4 year cycle consists according to the nominal Hurst model of 54 months and November was month 54. The indices are at 4 year cycle high - this is for those who think that the indices are going to accelerate north.... good luck with that.

Monthly chart TA look - bearish rising wedge, RSI broken trend line and testing it for the second time with double divergence again all this on monthly chart - the writing is on the wall.... for those who can read it.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Weekly chart sell setup at 7, add two weeks for the ED and you have 9.... fascinating, isn't it:)

Short term - with some creativity ignoring upper trend line and candle shadow you can draw another trend line and count w4. The move up is another zig-zag so most likely ED.

Alternate scenarios are flat or triangle, but then the creativity will not help... the correction will be too big to be part of this rally.

Intermediate term - expect two more touches of the the trend line in the next two weeks before the ED is completed. The indicators - just more divergences, one day and a half is too short to reset the indicators and erase the divergences. This is not an important low so that the indexes can re-energize and continue higher, this is topping.

I find it interesting if you count w-x-y as shown on the chart you have a cluster of three different Fibo measurements in the same area. Such a cluster shows with very high probability the target area for a move and on top of this the count and measurements work for SP500/DJI/NYSE/NDX... fascinating, isn't it:)

Long term - close to the top of wave B. When it is finished expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - very weak for a long time and going nowhere with multiple divergences.

McClellan Oscillator - above zero with multiple divergences.

McClellan Summation Index - sell signal with multiple divergences.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - at the overbought level with multiple divergences.

Percent of Stocks above MA50 - at the overbought level with multiple divergences.

Fear Indicator VIX - spike higher as expected and now the low is tested, right on time for divergence and important high.

Advance-Decline Issues - in the middle of the range, preparing for another divergence.

HURST CYCLES

From now on I will focus on the cycle which I call daily cycle and stop mixing with Hurst cycles. This daily cycle is not Hurst cycle. Sometimes it corresponds to 80 day Hurst cycle sometimes not. It's focus is trading, it does not care about theory for example Hurst cycles if we have 40w low in August or October or EW what pattern we have etc. It is simple, objective and effective - above MA10 is up, below MA10 is down. The idea is for traders without experience to stay on the right side of the trade:) and to make difference between analysis and trading. I explain over and over that drawing some line up or down is not a trade and I hear all the time - missed the move, wrong all the time, lost money because of you etc.

Daily cycle trading - the price broke below the trend line and MA10, RSI broke below the trend line and MA18. We have strong right translated cycle and we should expect one more higher high and "failed"(left translated) cycle. Usually a strong move is followed by higher high and a cycle which makes a top early and reverses(left translated).

The price/RSI moved above the the trend line and MAs and it seems the next daily cycle begun. My positioning now is - waiting.

Monthly chart - the 4 year cycle consists according to the nominal Hurst model of 54 months and November was month 54. The indices are at 4 year cycle high - this is for those who think that the indices are going to accelerate north.... good luck with that.

Monthly chart TA look - bearish rising wedge, RSI broken trend line and testing it for the second time with double divergence again all this on monthly chart - the writing is on the wall.... for those who can read it.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Weekly chart sell setup at 7, add two weeks for the ED and you have 9.... fascinating, isn't it:)

Subscribe to:

Posts (Atom)