Short term view - correction should be over soon.

Intermediate term view - after new ATH another correction to finish the 20 week cycle.

As I wrote on Tuesday correction should start... now we wait to see when it will finish.

We have very choppy price action for almost two months.... it is difficult to follow the market. I will not be surprise for example to see a fake move bellow 1840 and another reversal higher....

My best guess is that there will be one more leg higher but I do not expect long lasting or huge rally. Another correction should follow to finish the 20 week cycle... or another month with choppy action.

I think we have finished a-b-c at the moment. So either the correction should finish or it could mutate in something more complicated... another wave x and than y. Again for the bullish case I would prefer this move lower to finish above 1850.

P.S. I am on a vacation the next two weeks so no weekly reviews next two weekends.

TECHNICAL PICTURE

Short term - now it looks like that we have 5 waves lower with divergence on the smaller time frames. That means we should expect something to the upside.

- Triple cross(EMA10 and EMA20 crossing EMA50) - short term trend neutral

Intermediate term - The price should stay above MA50 or move bellow it for no more than a day or two for the bullish scenario(green).

- Trend direction EMA50/MACD - still positive not convincing enough

- Momentum Histogram/RSI - ticked lower... too early to say anything

Long term - I do not think that any move higher will clear the MACD divergence and start another long lasting rally. I think the next big move will be lower, but it could last months until we reach this point.

- Trend direction EMA50/MACD - the long term trend is up - the price above MA50 and MACD above zero. The MACD divergence should make you worry, that the long term trend is topping.

- Momentum Histogram/RSI - momentum ticked up... but it's too early to say that intermediate term trend turned up.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - do not help us much.... some are trying to turn up... nothing convincing.

McClellan Oscillator - around the zero line.

McClellan Summation Index - buy signal

Weekly Stochastic of the Summation Index - buy signal

Bullish Percentage - no idea

Percent of Stocks above MA50 - in the middle of the range

Fear Indicator VIX - jumped higher and another higher low DANGER!!!!

Advance-Decline Issues - in the middle of the range

HURST CYCLES

It counts better as a longer 40 day cycle so I change it. The next one is already running at day 9 and should make ATH and than turn lower.

I think we will see a bottom for the 20 week cycle around the end of May.

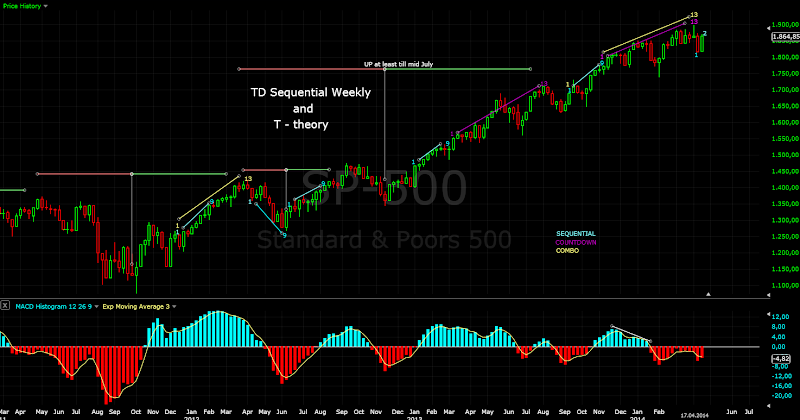

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

On the weekly chart the price is flipping up an down all the time. On the daily chart the current setup was aborted today which is a sign for a weakness.

Apr 25, 2014

Apr 22, 2014

Update

It looks like the bulls won the short term battle... now I expect pullback after 6 green days. The bulls should prove that they control the situation. Any move lower should be corrective and stay above 1850 (support / 50% retracement / MA50 daily chart). The pullback could be more shallow of course.

The red scenario has now low probability I will have it on my a radar for a while.

Another very important lesson this week - as I wrote "bullish until proven wrong". It does not matter what my preferred scenario is or looks better:) the market has the last word.

Apr 20, 2014

Weekly review

Short term view - Monday should be a red day.

Intermediate term view - One more leg lower to finish the correction.

The first part of the forecast played out - bottom and move higher to the 1860 area. Now I do not know who will win - the bulls or the bears. The index closed at 1864 leaving the door open for both scenarios. Momentum turned up, bullish weekly candle, the indicators favor the bullish scenario, but still have not confirmed 100% reversal... My preferred scenario is the bearish one, but I can not present you any evidence... except "it will look better":). With that said bullish until proven wrong and we will work on our trading plan:) First watch the price behavior for more clues: If the move is really bullish(green scenario) it should continue higher or we can see a pullback. A pullback should be weak not lasting long - day, day and a half ideally testing 38,2% Fibo and MA50 hourly around 1850. It is allowed of course 1840(Fibo 50%) to be tested, but the move lower should be weak and choppy. If the correction is about to resume(red scenario) we should see a strong impulsive move lower and on Monday we should see the price near to important support 1840. My trading plan with focus low risk: - If the price continue higher - hold the long position. Wait for a pullback to add longs/sell any shorts left. - If we see weak move lower - wait for reversal higher and add longs/sell any shorts left. - If we see strong push lower - wait for a bounce higher, probably from 1840, and when the price turns lower sell the long position and add shorts. There is different strategies for different traders. For example more aggressive if you are an active trader and not afraid of risk, on Monday if the price moves lower you can sell the long position to book the profit and go short with tight stop above the high for the week. Than you see what happens and adjust your positions according the red/green scenario. I hope the plan will work great like last week:) TECHNICAL PICTURE

Short term - I think we will see a move lower on Monday and when we see how it moves lower we will decide to be more bullish or bearish.

- Triple cross(EMA10 and EMA20 crossing EMA50) - short term trend turned up.

Intermediate term - the middle trend line was tested as expected now we wait a day or two and see who is in charge - bulls or bears.

- Trend direction EMA50/MACD - intermediate term trend rtying to reverse... MACD is trying to turn up and move above the zero line.

- Momentum Histogram/RSI - momentum has turned up.

Long term - checked the targets for the Elliot waves and I think they confirm that after the current correction we should see one more leg up and important top.

I do not think that any move higher will clear the MACD divergence and start another long lasting rally. I think the next big move will be lower, but it could last months until we reach this point. - Trend direction EMA50/MACD - the long term trend is up - the price above MA50 and MACD above zero. The MACD divergence should make you worry, that the long term trend is topping.

- Momentum Histogram/RSI - momentum ticked up... but it's too early to say that intermediate term trend turned up.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - trying to turn up and confirm move higher... but too early for now.

McClellan Oscillator - moved above zero...

McClellan Summation Index - trying to turn up but still sell signal.

Weekly Stochastic of the Summation Index - trying to turn up but still sell signal.

Bullish Percentage - trying to turn up but still sell signal.

Percent of Stocks above MA50 - in the middle of the range no valuable information. One last move lower to 25 area to finish the correction will look nice:)

Fear Indicator VIX - complacency again... but as you know VIX at 13 is a buy:)

Advance-Decline Issues - in the middle of the range slightly above zero nothing interesting for now.

HURST CYCLES

One more leg lower to finish the second 40 day cycle... or a little bit extended 40 day cycle with length 48 days....

Week 11 of the 20 week cycle. Another 2 weeks lower probably.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Setup negated at day 9 and price flip higher.

No price flip for now at the weekly chart.

Intermediate term view - One more leg lower to finish the correction.

The first part of the forecast played out - bottom and move higher to the 1860 area. Now I do not know who will win - the bulls or the bears. The index closed at 1864 leaving the door open for both scenarios. Momentum turned up, bullish weekly candle, the indicators favor the bullish scenario, but still have not confirmed 100% reversal... My preferred scenario is the bearish one, but I can not present you any evidence... except "it will look better":). With that said bullish until proven wrong and we will work on our trading plan:) First watch the price behavior for more clues: If the move is really bullish(green scenario) it should continue higher or we can see a pullback. A pullback should be weak not lasting long - day, day and a half ideally testing 38,2% Fibo and MA50 hourly around 1850. It is allowed of course 1840(Fibo 50%) to be tested, but the move lower should be weak and choppy. If the correction is about to resume(red scenario) we should see a strong impulsive move lower and on Monday we should see the price near to important support 1840. My trading plan with focus low risk: - If the price continue higher - hold the long position. Wait for a pullback to add longs/sell any shorts left. - If we see weak move lower - wait for reversal higher and add longs/sell any shorts left. - If we see strong push lower - wait for a bounce higher, probably from 1840, and when the price turns lower sell the long position and add shorts. There is different strategies for different traders. For example more aggressive if you are an active trader and not afraid of risk, on Monday if the price moves lower you can sell the long position to book the profit and go short with tight stop above the high for the week. Than you see what happens and adjust your positions according the red/green scenario. I hope the plan will work great like last week:) TECHNICAL PICTURE

Short term - I think we will see a move lower on Monday and when we see how it moves lower we will decide to be more bullish or bearish.

- Triple cross(EMA10 and EMA20 crossing EMA50) - short term trend turned up.

Intermediate term - the middle trend line was tested as expected now we wait a day or two and see who is in charge - bulls or bears.

- Trend direction EMA50/MACD - intermediate term trend rtying to reverse... MACD is trying to turn up and move above the zero line.

- Momentum Histogram/RSI - momentum has turned up.

Long term - checked the targets for the Elliot waves and I think they confirm that after the current correction we should see one more leg up and important top.

I do not think that any move higher will clear the MACD divergence and start another long lasting rally. I think the next big move will be lower, but it could last months until we reach this point. - Trend direction EMA50/MACD - the long term trend is up - the price above MA50 and MACD above zero. The MACD divergence should make you worry, that the long term trend is topping.

- Momentum Histogram/RSI - momentum ticked up... but it's too early to say that intermediate term trend turned up.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - trying to turn up and confirm move higher... but too early for now.

McClellan Oscillator - moved above zero...

McClellan Summation Index - trying to turn up but still sell signal.

Weekly Stochastic of the Summation Index - trying to turn up but still sell signal.

Bullish Percentage - trying to turn up but still sell signal.

Percent of Stocks above MA50 - in the middle of the range no valuable information. One last move lower to 25 area to finish the correction will look nice:)

Fear Indicator VIX - complacency again... but as you know VIX at 13 is a buy:)

Advance-Decline Issues - in the middle of the range slightly above zero nothing interesting for now.

HURST CYCLES

One more leg lower to finish the second 40 day cycle... or a little bit extended 40 day cycle with length 48 days....

Week 11 of the 20 week cycle. Another 2 weeks lower probably.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Setup negated at day 9 and price flip higher.

No price flip for now at the weekly chart.

Apr 16, 2014

Important lesson

I think we have witnessed something important which deserves a few words... and this was VERY IMPORTANT LESSON how to trade.

Do your homework (analysis), have a trading plan, trade your plan, self control do not lose your nerves. That makes the difference between a successful

trader and someone who will lose his money.

If you have done this, you would not have been caught to the downside yesterday. If you have traded this two days look back and recap what you have done right or wrong - Have you been prepared? Have you traded your plan or the emotions took control? If something went wrong - why?

It is not that we saw some important move, but it was a priceless lesson, which we have to learn if we want to be successful traders.

If you can navigate through uncertain moment like now (bottom or not,fake breakout) and squeeze a profit after such crazy volatile reversal

than the rest is piece of cake:)

The analysis worked great the trading plan too... but what about Russell2000 and NASDAQ making new lows?

When you have a break out up/down what should you see? - The index moving higher/lower, not a rocket science:)

Look for confirmation - look at smaller time frame (hourly chart for example) the indicators, the bars in both directions, how it develops in time.

The indicators usually reset first (for example MACD moving to the zero line) and than shoot up/plunge with the breakout.

The Bars in the direction of the break out are bigger than the one in the opposite direction and close near their highs/lows.

Retests of the break out are usually short living (I would say 1 to 2 hours) and do not move deep bellow/above the breakout.

If you look at NASDAQ - hourly chart MACD double divergence, huge bar closing above the two bars from the break out, retest very deep and lasting more than an hour.... I would say

all this are signs for a fake break out.

Trading - you follow the signal and open short trade at 3980(several points bellow the previous lows), What happens? The index just do not move lower instead it prints huge bar covering the two bars of the breakout.You wait for a while and it continue moving higher above 4000.... When it refuses to move lower it will move higher(we were expecting a short term bottom). Close the short position and open long around 4005.

Net result is zero for the day. What was the most import thing, so that you do not end with a loss? - not to panic:) and look at the charts.

Chart updated... what we have - choppy move higher, three days in a row gaps higher are met with selling. That is not what you want to see after an intermediate term bottom. Do you remember previous bottoms?

short covering and buy the dip crowd pushed the indexes straight up. Does this bottom look like this?-No

Fibo retracement 50% was reached and there is enough waves to say X is finished. Corrections are ugly bastards:) and now I can not tell when and how X will finish(if this is X at all).

What I can say at the moment - bellow 1835 and X is with high probability over, above 1865 and green becomes the favorite scenario.

Apr 15, 2014

Update

Chart updated. This was not a day for some one with weak nerves..... DAX puked like crazy, huge fake move bear trap on Russell2000 and NASDAQ making lower low, SP500 bouncing like crazy between support and resistance but did not make lower low...

So the plan has not changed. The choppy upward move says the move higher should be corrective or the red scenario X (which was the preferred one).

Congratulations to those who did not lose self control and did not fall into the trap:)

Apr 14, 2014

Update

Bullish candle, double bottom the yellow scenario with lowest probability was rejected(unless we see a move bellow 1815). Now we wait to see what happens

We had a chance to take some profits/open longs... I hope you have used it:)

Apr 13, 2014

Weekly review

Short term view - short term move to the upside

Intermediate term view - 50%-61,8% retracement and another leg lower

The indexes moved exactly as expected - move to the first support level 1840, bounce followed by a move lower to the next support... even surprised from the perfect textbook moves. The first target was reached very fast for only one week and that makes me think that we are not finished to the downside.

Now it is tricky... there is several different scenarios. I have my favorite, but the prudent approach for a trader is to review all of them to weight their probability and create a trading plan. That is what I will do instead of saying "I am very smart this will happen".

The facts which we have:

- Technicals - weekly charts DJ double MACD/RSI divergence SP500 MACD/RSI divergence, daily charts - exactly the same picture. Short term oversold readings.

- Elliot waves - corrective structures Russell2000/NASDAQ very choppy W-X-Y I think SP500,DJ,DAX 5-3-5 move and A-B-C ZigZag almost finished.

- Cycles - 20 week cycle topped earlier which is bearish. Average length is 13-16 weeks, which means we should expect another 3-6 weeks lower. Look at the chart 72 weeks without correction.... and one red week should do the job - I do not think so.

- Tom Demark - daily and weekly countdowns have been finished and the indexes turned lower. The previous occasion was followed by 4 weeks correction.

- Market breadth - no signs for extremes or capitulation.

Ok to sum up - Technicals/Cycles/TomDemark bearish, the indexes have just turned lower, no signs of a reversal at the moment, no extremes, short term oversold, Elliot waves says we are near to the completion of a corrective structure.

My interpretation is that we have a corrective move lower, we should see a bottom on Monday, but all this is a part of a bigger move lower which is not finished. You can see the scenarios on the hourly chart and I will start with the one which has highest probability... according me:)

- Red scenario - A-B-C structure finishing, expect bottom on Monday and move higher to retrace 50%-61,8% of the drop. But all this should be wave X of a bigger W-X-Y correction. Target for Y 1775(MA200)-1740 significant support level. My preferred scenario.

- Green scenario - A-B-C is finished and the indexes continue higher. Second highest probability. The move looks perfect, but somehow it does not fit for me in the bigger picture. The indexes made higher high with divergences on the daily and weekly charts and I do not think that one red week is all we will see.

- Yellow scenario - impulse lower if the corrective structure mutates in 1-2 1-2 and we witness an impulse lower with target 1740 support level. I think this scenario has the lowest probability because if you look at Russell2000/NASDAQ you will see that this is not an impulse. I could be wrong so this option is on our radar too.

How to trade this uncertain situation?

- If the indexes just continue lower obviously you do not need to do anything , hold the shorts.

- If the price gap higher or move lower on Monday and reverse in green territory above the opening price take half of the profits.(That is the expected bounce for all three scenarios) You can open a small long position, but this depends on the trader:) some like risk other not.

Reaction lower after an initial bounce higher which probably reached 1840 level (resistance now):

- If you see the indexes making lower low this is probably the yellow scenario, add to the short position.

- If the indexes make a higher low close the other half of the short position and open a long position.

I know a little bit confusing a lot of scenarios and IFs, but I prefer to be prepared... or you can play casino if you want:)

TECHNICAL PICTURE

Short term - I expect an initial bounce to 1840 resistance and 1850(MA50).

- Triple cross(EMA10 and EMA20 crossing EMA50) - short term trend is down.

Intermediate term - The price moved bellow the middle trend line and MA50 MACD bellow zero. This is bearish. I do not think that just one week is always we will see. I think the price will test the broken trend line and move lower to MA200/next support level.

- Trend direction EMA50/MACD - intermediate term trend is down.

- Momentum Histogram/RSI - momentum points lower

Long term - the price action start looking to me like a topping process in early stages... I do not think that any move higher will clear the MACD divergence and start another long lasting rally. I think the next big move will be lower, but it could last months until we reach this point.

- Trend direction EMA50/MACD - the long term trend is up - the price above MA50 and MACD above zero. The MACD divergence should make you worry, that the long term trend is reversing.

- Momentum Histogram/RSI - momentum turned lower, intermediate term trend is down.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - the indicators point lower saying the intermediate term trend is down. There is no signs of a reversal or extremes.

McClellan Oscillator - nearing oversold levels, but no extreme for now.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - sell signal.

Percent of Stocks above MA50 - there is still room to reach the oversold level.

Fear Indicator VIX - moving higher after another higher low.

Advance-Decline Issues - in the middle of the range at zero nothing interesting for now.

HURST CYCLES

It looks like the second 40 day cycle topped out earlier which is bearish. There is a scenario that this is the bottom of the first 40 day cycle at day 48 and we will see a strong rally. looking at the weekly chart bellow it will look a little bit strange but who knows....

Week 10 of a 20 week cycle. Expect a move for 3 to 6 weeks lower.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Setup at 6 now. There is high probability that it will be finished.

We have now price flip on the weekly chart and this confirms finished combo/countdown. The previous occasion was followed by a correction for 4 weeks. I expect now something similar too.

Intermediate term view - 50%-61,8% retracement and another leg lower

The indexes moved exactly as expected - move to the first support level 1840, bounce followed by a move lower to the next support... even surprised from the perfect textbook moves. The first target was reached very fast for only one week and that makes me think that we are not finished to the downside.

Now it is tricky... there is several different scenarios. I have my favorite, but the prudent approach for a trader is to review all of them to weight their probability and create a trading plan. That is what I will do instead of saying "I am very smart this will happen".

The facts which we have:

- Technicals - weekly charts DJ double MACD/RSI divergence SP500 MACD/RSI divergence, daily charts - exactly the same picture. Short term oversold readings.

- Elliot waves - corrective structures Russell2000/NASDAQ very choppy W-X-Y I think SP500,DJ,DAX 5-3-5 move and A-B-C ZigZag almost finished.

- Cycles - 20 week cycle topped earlier which is bearish. Average length is 13-16 weeks, which means we should expect another 3-6 weeks lower. Look at the chart 72 weeks without correction.... and one red week should do the job - I do not think so.

- Tom Demark - daily and weekly countdowns have been finished and the indexes turned lower. The previous occasion was followed by 4 weeks correction.

- Market breadth - no signs for extremes or capitulation.

Ok to sum up - Technicals/Cycles/TomDemark bearish, the indexes have just turned lower, no signs of a reversal at the moment, no extremes, short term oversold, Elliot waves says we are near to the completion of a corrective structure.

My interpretation is that we have a corrective move lower, we should see a bottom on Monday, but all this is a part of a bigger move lower which is not finished. You can see the scenarios on the hourly chart and I will start with the one which has highest probability... according me:)

- Red scenario - A-B-C structure finishing, expect bottom on Monday and move higher to retrace 50%-61,8% of the drop. But all this should be wave X of a bigger W-X-Y correction. Target for Y 1775(MA200)-1740 significant support level. My preferred scenario.

- Green scenario - A-B-C is finished and the indexes continue higher. Second highest probability. The move looks perfect, but somehow it does not fit for me in the bigger picture. The indexes made higher high with divergences on the daily and weekly charts and I do not think that one red week is all we will see.

- Yellow scenario - impulse lower if the corrective structure mutates in 1-2 1-2 and we witness an impulse lower with target 1740 support level. I think this scenario has the lowest probability because if you look at Russell2000/NASDAQ you will see that this is not an impulse. I could be wrong so this option is on our radar too.

How to trade this uncertain situation?

- If the indexes just continue lower obviously you do not need to do anything , hold the shorts.

- If the price gap higher or move lower on Monday and reverse in green territory above the opening price take half of the profits.(That is the expected bounce for all three scenarios) You can open a small long position, but this depends on the trader:) some like risk other not.

Reaction lower after an initial bounce higher which probably reached 1840 level (resistance now):

- If you see the indexes making lower low this is probably the yellow scenario, add to the short position.

- If the indexes make a higher low close the other half of the short position and open a long position.

I know a little bit confusing a lot of scenarios and IFs, but I prefer to be prepared... or you can play casino if you want:)

TECHNICAL PICTURE

Short term - I expect an initial bounce to 1840 resistance and 1850(MA50).

- Triple cross(EMA10 and EMA20 crossing EMA50) - short term trend is down.

Intermediate term - The price moved bellow the middle trend line and MA50 MACD bellow zero. This is bearish. I do not think that just one week is always we will see. I think the price will test the broken trend line and move lower to MA200/next support level.

- Trend direction EMA50/MACD - intermediate term trend is down.

- Momentum Histogram/RSI - momentum points lower

Long term - the price action start looking to me like a topping process in early stages... I do not think that any move higher will clear the MACD divergence and start another long lasting rally. I think the next big move will be lower, but it could last months until we reach this point.

- Trend direction EMA50/MACD - the long term trend is up - the price above MA50 and MACD above zero. The MACD divergence should make you worry, that the long term trend is reversing.

- Momentum Histogram/RSI - momentum turned lower, intermediate term trend is down.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - the indicators point lower saying the intermediate term trend is down. There is no signs of a reversal or extremes.

McClellan Oscillator - nearing oversold levels, but no extreme for now.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - sell signal.

Percent of Stocks above MA50 - there is still room to reach the oversold level.

Fear Indicator VIX - moving higher after another higher low.

Advance-Decline Issues - in the middle of the range at zero nothing interesting for now.

HURST CYCLES

It looks like the second 40 day cycle topped out earlier which is bearish. There is a scenario that this is the bottom of the first 40 day cycle at day 48 and we will see a strong rally. looking at the weekly chart bellow it will look a little bit strange but who knows....

Week 10 of a 20 week cycle. Expect a move for 3 to 6 weeks lower.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Setup at 6 now. There is high probability that it will be finished.

We have now price flip on the weekly chart and this confirms finished combo/countdown. The previous occasion was followed by a correction for 4 weeks. I expect now something similar too.

Apr 9, 2014

Update

FED saves the market again:))) Ok two green days and target reached so if this is all part of the correction tomorrow should be a red day or a candle with small body followed by a red candle. If the markets open higher the correction is over.

Apr 8, 2014

Update

Support and MA50 on the daily chart reached.... now it is time for the bounce for a day or two which I wrote about.

MA50 and 50% Fibo retracement to around 1865 +-several points looks like the logical target.

Apr 6, 2014

Weekly review

Short term view - probably bounce higher for a day or two and lower again.

Intermediate term view - I think we will see a move lower for several weeks.

Ok I am back online:) Nothing interesting this 4-5 weeks choppy moves up and down in a tight range.

Now we have ugly candle on daily chart wiping out four days advance and producing bearish weekly candle. We have MACD divergence daily and weekly, on the DJ it looks even worse. The price could not reach the upper trend line(see the daily chart) the new highs were met with selling. Tom Demark daily and weekly counts reached 13 at the same time, cycle ripe enough to support a move lower for several weeks.... My conclusion - the market looks tired and needs a correction for several weeks. The logical target I think is the lower trend line and support around 1800.

TECHNICAL PICTURE

Short term - it is difficult to say if we will see a bounce on Monday or later during the week(watch the opening on Monday), but I think any bounce is a sell. We have a free space lower with first support level around 1840.

- Triple cross(EMA10 and EMA20 crossing EMA50) - short term is still up, but I think it will turn lower.

Intermediate term - new highs which were met with strong selling, MACD divergence, the price could not reach the upper trend line.... weak price action. So I think the price will visit the lower trend line and support around 1800.

- Trend direction EMA50/MACD - intermediate term trend is up, but with MACD divergence and it will probably reverse.

- Momentum Histogram/RSI - momentum has turned lower.

Long term - the price action start looking to me like a topping process in early stages... I do not think that any move higher will clear the MACD divergence and start another long lasting rally. I think the next big move will be lower, but it could last months until we reach this point.

- Trend direction EMA50/MACD - the long term trend is up - the price above MA50 and MACD above zero. The MACD divergence should make you worry, that the long term trend is reversing.

- Momentum Histogram/RSI - momentum is still up.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - a lot of divergences on the trend following indicator.... we should see something to the downside for at least several weeks.

McClellan Oscillator - moved bellow zero after another divergence.

McClellan Summation Index - just turned lower after making a lower high.

Weekly Stochastic of the Summation Index - sell signal for several weeks, the indexes are not finished to the downside.

Bullish Percentage - another lower high and double divergence.

Percent of Stocks above MA50 - slightly lower high compared with previous peaks.

Fear Indicator VIX - another higher low...

Advance-Decline Issues - weak could not reach the overbought level... I think this is because this leg up was part of a bigger corrective structure.

Put/Call ratio - another lower high.

HURST CYCLES

We are in the second 40 day cycle. I think the 80 day cycle has topped out and a move bellow the last minor low should confirm it.

Week 9 of a 20 week cycle. If a correction has begun expect a move for 3 to 5 weeks lower.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

The new high could be counted as 13 and finished countdown. The technical picture and the indicators support it we have price flip so i think correction has begun.

The same story - the new high could be counted as 13 and finished countdown. The ugly candle, finished countdown and daily technical picture say to expect several weeks lower.

Intermediate term view - I think we will see a move lower for several weeks.

Ok I am back online:) Nothing interesting this 4-5 weeks choppy moves up and down in a tight range.

Now we have ugly candle on daily chart wiping out four days advance and producing bearish weekly candle. We have MACD divergence daily and weekly, on the DJ it looks even worse. The price could not reach the upper trend line(see the daily chart) the new highs were met with selling. Tom Demark daily and weekly counts reached 13 at the same time, cycle ripe enough to support a move lower for several weeks.... My conclusion - the market looks tired and needs a correction for several weeks. The logical target I think is the lower trend line and support around 1800.

TECHNICAL PICTURE

Short term - it is difficult to say if we will see a bounce on Monday or later during the week(watch the opening on Monday), but I think any bounce is a sell. We have a free space lower with first support level around 1840.

- Triple cross(EMA10 and EMA20 crossing EMA50) - short term is still up, but I think it will turn lower.

Intermediate term - new highs which were met with strong selling, MACD divergence, the price could not reach the upper trend line.... weak price action. So I think the price will visit the lower trend line and support around 1800.

- Trend direction EMA50/MACD - intermediate term trend is up, but with MACD divergence and it will probably reverse.

- Momentum Histogram/RSI - momentum has turned lower.

Long term - the price action start looking to me like a topping process in early stages... I do not think that any move higher will clear the MACD divergence and start another long lasting rally. I think the next big move will be lower, but it could last months until we reach this point.

- Trend direction EMA50/MACD - the long term trend is up - the price above MA50 and MACD above zero. The MACD divergence should make you worry, that the long term trend is reversing.

- Momentum Histogram/RSI - momentum is still up.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - a lot of divergences on the trend following indicator.... we should see something to the downside for at least several weeks.

McClellan Oscillator - moved bellow zero after another divergence.

McClellan Summation Index - just turned lower after making a lower high.

Weekly Stochastic of the Summation Index - sell signal for several weeks, the indexes are not finished to the downside.

Bullish Percentage - another lower high and double divergence.

Percent of Stocks above MA50 - slightly lower high compared with previous peaks.

Fear Indicator VIX - another higher low...

Advance-Decline Issues - weak could not reach the overbought level... I think this is because this leg up was part of a bigger corrective structure.

Put/Call ratio - another lower high.

HURST CYCLES

We are in the second 40 day cycle. I think the 80 day cycle has topped out and a move bellow the last minor low should confirm it.

Week 9 of a 20 week cycle. If a correction has begun expect a move for 3 to 5 weeks lower.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

The new high could be counted as 13 and finished countdown. The technical picture and the indicators support it we have price flip so i think correction has begun.

The same story - the new high could be counted as 13 and finished countdown. The ugly candle, finished countdown and daily technical picture say to expect several weeks lower.

Subscribe to:

Posts (Atom)