From time perspective a few more days higher were needed for the daily cycle - we have it. The pattern is more complicated story.

The big picture is getting more clear - it is not an impulse one wave too much, this wave too much can not be justified as b/B expanded flat anymore - b is too big, a-b-c does not work for many indexes and there is no impulse for c, what is left - w-x-y.

Short term is a messy story - first from the low 14.May the move looks corrective, and on top of this from the minor low 22.May it is corrective too. The best I can come up with is shown below on the short term charts.

Overall look at the markets - even the weakest index XLF rallied like a magic 10% for two days to synchronize the pattern with all the other indexes, the USD spiking lower to complete a-b-c, crude oil spiking higher to complete most likely impulse, silver spiking higher to complete impulse c for a-b-c, TLT(bonds) is ready for another run higher.

All markets and indexes are aligned now, I do not think June will be a good month.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - w-x-y fits best and currently in the middle of c/Y. NYSE/DJ/NDX with more clear patterns shown below.

NYSE/DJ have similar pattern. I think we have a-b-c with c as ED for c=a. Predicting ED often fails, when you have not seen waves 3 and 4, but all this corrective waves this is the best I can see. The other options are to count triangle or bigger ED 1/C.

NDX - similar pattern, short term you have zig-zag lower and now clear corrective move up so either ED or triangle. I would bet it is rather ED to complete the pattern, test the upper trend line of the wedge and the high from February.

Around the low I was explaining that the wave in 2019-2020 is X wave what follows is another corrective pattern which are - flat, zig-zag or triangle. I said repeating March two more times for a flat looks crazy, but there you have it for the NDX.

I wanted to explain this in the long term update - crazy is the new normal and we have to adjust. If you accept this you will see how all tools TA,EW,cycle continue to work so beautiful:) or you can continue to live in the old and dead "world of normal trading" thinking because a move is strong it is an impulse and no way it will move in the opposite direction - neither 2019/2020 rally nor the March sell off nor the current move are impulses all corrective moves. The new normal will continue for a decade it is just warming up. Open your mind and your eyes if you do not want to be left behind... by the way buy and hold is dead, died in January 2018, learn to trade.

Intermediate term - the next gap closed and the next resistance hit, MA200 tested. Now waiting to see completed pattern and reversal signature.

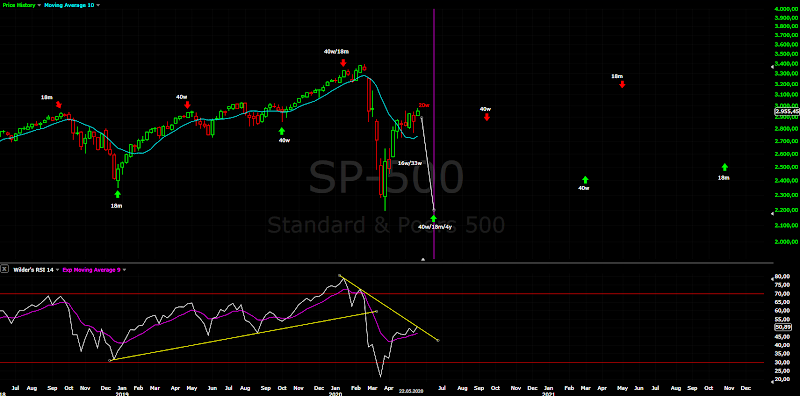

Long term - now this leg up should be close to completing and I expect the final sell off to complete the correction from 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - finally some are showing strength like A/D line(not cumulative) - it broke above the previous high which means the next low is a buy and there is no third wave lower, there is no bear market... good to see confirmation. Overall pointing up no sell signal some with divergence.

McClellan Oscillator - another lower high - time for correction.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - overbought level for a few weeks next it should turn lower for several weeks.

Bullish Percentage - double divergence.

Percent of Stocks above MA50 - strong above 90.

Fear Indicator VIX - not impressed with the rally at all, still higher low. We should see another spike higher with lower high to mark the end of the correction.

Advance-Decline Issues - finally higher high breaking the trend. This means the next low is the low for the correction and strong buy.

HURST CYCLES

Daily(trading) cycle - the signal is buy, and we have 10 day low either on Friday last week or Wednesday this week. At the moment close below 2970 will trigger sell signal. Again my expectation is this cycle to fail as left translated.

Hurst cycles day - adjusted the upper sine wave, now it fits much better with the highs. Next we should see a high in a few days, I suspect this will be the 20w high and decline into 20day low should follow.

Week 17 for the 20w cycle. Alternate March was 20w low with longer cycle 25 weeks and now we should see shorter one like 15 weeks. In fact this counts better, but the outcome is not any different just labeling 17+22 or 25+15 weeks.

High-to-high count week 19 so we should see 20w high soon.

May 30, 2020

May 23, 2020

Weekly preview

One day fireworks and four days nothing this is not trending move just part of a bigger pattern. The problem is the pattern is still a guess - different indexes look different, cash and futures are not in sync, it is a mess at the moment. Waiting to see completed pattern.

Overall we had daily cycle low and now the next daily cycle made a higher high as expected. At least cycles keep us on the right side:) Now it is higher until this daily cycle makes a top and reverses lower. If I am right it will be left translated and fail to rally turning lower into June for the 4y cycle low.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - you can count impulse and reversal(red), but for some indexes this does not work. I am skeptical about this, when you are trying to find a pattern it is just not there. When a pattern is completed you just see it.

With continuation higher there is two options - b/B for a flat or z wave... or even 3/C of a big ED. Guessing continues and waiting patiently for the moment. If I have to choose it is wave z to around 3050.

Intermediate term - the indicators look ripe for reversal RSI/MACD with divergence, MA200 almost tested, price trapped between MA50 and MA200. Waiting to see what happens next.

Long term - the same now the indicators have the right look for reversal - the histogram moved above zero and RSI touched the trend line what I wrote 2-3 weeks ago. Resistance/MA50/62% is being tested, now we should see a leg lower to complete the correction.

MARKET BREADTH INDICATORS

Market Breadth Indicators - first signs for a trouble, the indicators are not following higher and some with divergences.

McClellan Oscillator - multiple short term divergences.

McClellan Summation Index - possible double top.

Weekly Stochastic of the Summation Index - turning lower, possible sell signal.

Bullish Percentage - double divergence.

Percent of Stocks above MA50 - strength above 75.

Fear Indicator VIX - divergence higher low.

Advance-Decline Issues - another lower high and divergence, weak pointing lower.

HURST CYCLES

Daily(trading) cycle - the signal is still buy, but the price and RSI are not showing a lot of strength. This is the expectations from the beginning that this daily cycle will fail as left translated.

I want to pay attention to something, which is very helpful for trading - every 7-10 trading days their some kind of interaction between price and M10, which could be just 1-2 sideways days for MA10 to catch up or test of the MA10 or close below it(should not be for more than a day)

I think this corresponds to 10 day Hurst cycle lasting 7-9 trading days. In the begging or the middle of the longer cycles this are good entry points to add in the direction of the trend.

The current daily cycles illustrates this very good. I see 4 such cycles for the previous daily cycle and now we have the first one for the current daily cycle. Ideally we should see down on Tuesday to touch MA10 and turn higher for a few more days.

Hurst cycles - this sharp move higher is from cycle low I doubt it is 80d low too short for that, most likely it is 40d low and the next 40d cycle running.

Week 16 for the 20w cycle. It is starting to take too long, if we do not see the high next week considering alternate option - March 20w low this corresponds to A-B pattern(green first chart)... again March is not 40w low there is no 40w cycle with length 25 weeks.

Short term - you can count impulse and reversal(red), but for some indexes this does not work. I am skeptical about this, when you are trying to find a pattern it is just not there. When a pattern is completed you just see it.

With continuation higher there is two options - b/B for a flat or z wave... or even 3/C of a big ED. Guessing continues and waiting patiently for the moment. If I have to choose it is wave z to around 3050.

Intermediate term - the indicators look ripe for reversal RSI/MACD with divergence, MA200 almost tested, price trapped between MA50 and MA200. Waiting to see what happens next.

Long term - the same now the indicators have the right look for reversal - the histogram moved above zero and RSI touched the trend line what I wrote 2-3 weeks ago. Resistance/MA50/62% is being tested, now we should see a leg lower to complete the correction.

MARKET BREADTH INDICATORS

Market Breadth Indicators - first signs for a trouble, the indicators are not following higher and some with divergences.

McClellan Oscillator - multiple short term divergences.

McClellan Summation Index - possible double top.

Weekly Stochastic of the Summation Index - turning lower, possible sell signal.

Bullish Percentage - double divergence.

Percent of Stocks above MA50 - strength above 75.

Fear Indicator VIX - divergence higher low.

Advance-Decline Issues - another lower high and divergence, weak pointing lower.

HURST CYCLES

Daily(trading) cycle - the signal is still buy, but the price and RSI are not showing a lot of strength. This is the expectations from the beginning that this daily cycle will fail as left translated.

I want to pay attention to something, which is very helpful for trading - every 7-10 trading days their some kind of interaction between price and M10, which could be just 1-2 sideways days for MA10 to catch up or test of the MA10 or close below it(should not be for more than a day)

I think this corresponds to 10 day Hurst cycle lasting 7-9 trading days. In the begging or the middle of the longer cycles this are good entry points to add in the direction of the trend.

The current daily cycles illustrates this very good. I see 4 such cycles for the previous daily cycle and now we have the first one for the current daily cycle. Ideally we should see down on Tuesday to touch MA10 and turn higher for a few more days.

Hurst cycles - this sharp move higher is from cycle low I doubt it is 80d low too short for that, most likely it is 40d low and the next 40d cycle running.

Week 16 for the 20w cycle. It is starting to take too long, if we do not see the high next week considering alternate option - March 20w low this corresponds to A-B pattern(green first chart)... again March is not 40w low there is no 40w cycle with length 25 weeks.

May 16, 2020

Weekly preview

Finally we have a move lower, this trading cycle was missing at least one push lower into the time frame for a daily cycle low.

The pattern is again not 100% clear. At the moment I think we will see another 2-3 days lower for daily cycle low and final move up to complete the rally from late March. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - the move up looks corrective, the leader NDX is the weakest so I think we should see another low and final move up. Best guess w-x-y with y as a flat. Some see A-B-C or 1-2 I am not convinced the pattern is so bullish.

Intermediate term - RSI broke the trend line, which is the first sign that the move up is topping. If the market is topping next we should see test of the broken trend line ideally with lower high. The big picture - the price is close to MA200 and it looks tired. Even if I am wrong it needs to cool off before breaking above MA200. So we should see something lower even if it is only corrective.

Long term - Resistance/MA50/62% is being tested, after that we should see a leg lower to complete the correction.

MARKET BREADTH INDICATORS

Market Breadth Indicators - sell signals, but probably we will see one final weak push higher. Despite the strong move up from the March low, indicators like Bullish Percentage,Percent of Stocks above MA50,Advance-Decline Issues are behaving like this is corrective leg. This is not good news for the market - according this indicators we should see lower low.

McClellan Oscillator - weak, does not buying this two days rally.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - reached overbought level, trying to turn lower.

Bullish Percentage - very weak, obviously only a few stocks make the index look strong.

Percent of Stocks above MA50 - bearish behavior staying below 75, probably divergence when we see stocks higher.

Fear Indicator VIX - second leg higher expected with lower high.

Advance-Decline Issues - weak, continues with lower highs.

HURST CYCLES

Daily(trading) cycle - sell signal, price is testing MA10, RSI below MA18 - nothing to suggest reversal higher. Now it is in the time window for a low and it is right translated so we should see a low soon and a rally higher.

Hurst cycles - 40d cycle low probably early May. I am watching my trading cycle above and think about the cycle theory later.

Week 15 for the 20w cycle. If my count is right we should see 20w cycle high soon and sharp turn lower.

The pattern is again not 100% clear. At the moment I think we will see another 2-3 days lower for daily cycle low and final move up to complete the rally from late March. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - the move up looks corrective, the leader NDX is the weakest so I think we should see another low and final move up. Best guess w-x-y with y as a flat. Some see A-B-C or 1-2 I am not convinced the pattern is so bullish.

Intermediate term - RSI broke the trend line, which is the first sign that the move up is topping. If the market is topping next we should see test of the broken trend line ideally with lower high. The big picture - the price is close to MA200 and it looks tired. Even if I am wrong it needs to cool off before breaking above MA200. So we should see something lower even if it is only corrective.

Long term - Resistance/MA50/62% is being tested, after that we should see a leg lower to complete the correction.

MARKET BREADTH INDICATORS

Market Breadth Indicators - sell signals, but probably we will see one final weak push higher. Despite the strong move up from the March low, indicators like Bullish Percentage,Percent of Stocks above MA50,Advance-Decline Issues are behaving like this is corrective leg. This is not good news for the market - according this indicators we should see lower low.

McClellan Oscillator - weak, does not buying this two days rally.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - reached overbought level, trying to turn lower.

Bullish Percentage - very weak, obviously only a few stocks make the index look strong.

Percent of Stocks above MA50 - bearish behavior staying below 75, probably divergence when we see stocks higher.

Fear Indicator VIX - second leg higher expected with lower high.

Advance-Decline Issues - weak, continues with lower highs.

HURST CYCLES

Daily(trading) cycle - sell signal, price is testing MA10, RSI below MA18 - nothing to suggest reversal higher. Now it is in the time window for a low and it is right translated so we should see a low soon and a rally higher.

Hurst cycles - 40d cycle low probably early May. I am watching my trading cycle above and think about the cycle theory later.

Week 15 for the 20w cycle. If my count is right we should see 20w cycle high soon and sharp turn lower.

May 9, 2020

Weekly preview

No bearish price action as expected, but even more confusion after this week. The short term pattern is now more unclear - maybe triangle or flat. Cycles possible 40d low on Monday right on schedule on day 28. I can only wait and guess. I still think that we are seeing topping and there is one final sell off for important low.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - I have shown that the move lower is corrective, the move up looks like zig-zag too... different combinations are possible so I am just waiting with the labeling. Possibilities which make sense are triangle and flat b, or some ED - just guessing at the moment.

Intermediate term - the index should spend some time between EMA50 and MA200, but all this looks like topping to me before the next leg lower begins.

Long term - another 1-2 weeks for this move up will look good for RSI to reach the trend line and the histogram to reach zero or slightly above it. Resistance/MA50/62% is being tested, after that we should see a leg lower to complete the pattern.

MARKET BREADTH INDICATORS

Market Breadth Indicators - look tired and stretched higher, but there is no signs of reversal or sell signal.

McClellan Oscillator - short term double divergence.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - short term divergence and oscillating around 70.

Percent of Stocks above MA50 - again at 75.

Fear Indicator VIX - elevated levels, we should see one more decline for the indexes and VIX with divergence for important low.

Advance-Decline Issues - still lower highs, overbought levels have not been reached... there is no a broad based strength.

HURST CYCLES

Daily(trading) cycle - the weak point of this system is sideways patterns like triangle or flat. Price oscillating around MA10 and RSI about MA18 so I will not be surprised if some of this patterns is running. But we knew not to follow the sell signal, which is valuable information too.

Now the signal is buy, but I do not think it should be followed too late in the cycle for me. It is not clear if the same one is still running or a new one has begun. Currently day 33, usually the length is between 35-45 days. It will look better if next week we see some kind of a low.

Hurst cycles - there is probable 40d low on Monday exactly at day 28, if not we should see it next week. I can be sure only in hindsight.

Week 14 for the 20w cycle. Expecting a high, probably in 2 weeks, for the 20w cycle and final sell off.

Short term - I have shown that the move lower is corrective, the move up looks like zig-zag too... different combinations are possible so I am just waiting with the labeling. Possibilities which make sense are triangle and flat b, or some ED - just guessing at the moment.

Intermediate term - the index should spend some time between EMA50 and MA200, but all this looks like topping to me before the next leg lower begins.

Long term - another 1-2 weeks for this move up will look good for RSI to reach the trend line and the histogram to reach zero or slightly above it. Resistance/MA50/62% is being tested, after that we should see a leg lower to complete the pattern.

MARKET BREADTH INDICATORS

Market Breadth Indicators - look tired and stretched higher, but there is no signs of reversal or sell signal.

McClellan Oscillator - short term double divergence.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - short term divergence and oscillating around 70.

Percent of Stocks above MA50 - again at 75.

Fear Indicator VIX - elevated levels, we should see one more decline for the indexes and VIX with divergence for important low.

Advance-Decline Issues - still lower highs, overbought levels have not been reached... there is no a broad based strength.

HURST CYCLES

Daily(trading) cycle - the weak point of this system is sideways patterns like triangle or flat. Price oscillating around MA10 and RSI about MA18 so I will not be surprised if some of this patterns is running. But we knew not to follow the sell signal, which is valuable information too.

Now the signal is buy, but I do not think it should be followed too late in the cycle for me. It is not clear if the same one is still running or a new one has begun. Currently day 33, usually the length is between 35-45 days. It will look better if next week we see some kind of a low.

Hurst cycles - there is probable 40d low on Monday exactly at day 28, if not we should see it next week. I can be sure only in hindsight.

Week 14 for the 20w cycle. Expecting a high, probably in 2 weeks, for the 20w cycle and final sell off.

May 2, 2020

Weekly preview

Fake rally into FOMC and red close for the week, but enough to mess up the pattern. On Internet I see two camps either finished impulse up or corrective move wxyxz. Those with something else are minority.

We have right translated cycle so the next one should make higher high. Market breadth needs time - it it just starting to show weakness not to mention topping/divergences. That is why I am looking for a pattern with one more high. The problem it is a guess at the moment.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - a few guesses which are not very different just the labeling. As long as the price stays above 2805 there is a chance for an ED(a-b-c) the other options are wxy or wxyxz. Some are counting impulse wave 1 or A... it does not feel right for me. Below 2730 and I am wrong, maybe thi time the majority will be right:).

Intermediate term - 62% retracement and resistance(highs from 2018 and 2019) reached, now pullback is running. As long as it stays above the 50% retracement level a-b-c with ED looks good. As long as it stays above MA50 wxy(xz) is ok. Below this levels and something else is going on.

Long term - another 2-3 weeks higher will look good for RSI to reach the trend line and the histogram to reach zero or slightly above it. Nothing new - resistance/MA50/62% is tested after that we should see a leg lower to complete the pattern.

MARKET BREADTH INDICATORS

Market Breadth Indicators - some weakness, but no strong sell signal.

McClellan Oscillator - divergence and heading lower.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - divergence and turned lower.

Percent of Stocks above MA50 - reached the 75 level and turned lower.

Fear Indicator VIX - elevated levels, we should see one more decline for the indexes and VIX with divergence.

Advance-Decline Issues - broke the trend line, but still lower highs.

HURST CYCLES

Daily(trading) cycle - the signals are that this cycle is heading lower into cycle low - break below the trend line, the price below MA10, the RSI below MA18. At day 28 we have right translated cycle so the next one should make higher high.

The signal is sell, but with right translated cycle it is expected to last only a few days.

Hurst cycles - expecting 40day cycle low and final high for the 20w cycle.

Week 13 for the 20w cycle. Expecting a high for the 20w cycle and final sell off.

Short term - a few guesses which are not very different just the labeling. As long as the price stays above 2805 there is a chance for an ED(a-b-c) the other options are wxy or wxyxz. Some are counting impulse wave 1 or A... it does not feel right for me. Below 2730 and I am wrong, maybe thi time the majority will be right:).

Intermediate term - 62% retracement and resistance(highs from 2018 and 2019) reached, now pullback is running. As long as it stays above the 50% retracement level a-b-c with ED looks good. As long as it stays above MA50 wxy(xz) is ok. Below this levels and something else is going on.

Long term - another 2-3 weeks higher will look good for RSI to reach the trend line and the histogram to reach zero or slightly above it. Nothing new - resistance/MA50/62% is tested after that we should see a leg lower to complete the pattern.

MARKET BREADTH INDICATORS

Market Breadth Indicators - some weakness, but no strong sell signal.

McClellan Oscillator - divergence and heading lower.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - divergence and turned lower.

Percent of Stocks above MA50 - reached the 75 level and turned lower.

Fear Indicator VIX - elevated levels, we should see one more decline for the indexes and VIX with divergence.

Advance-Decline Issues - broke the trend line, but still lower highs.

HURST CYCLES

Daily(trading) cycle - the signals are that this cycle is heading lower into cycle low - break below the trend line, the price below MA10, the RSI below MA18. At day 28 we have right translated cycle so the next one should make higher high.

The signal is sell, but with right translated cycle it is expected to last only a few days.

Hurst cycles - expecting 40day cycle low and final high for the 20w cycle.

Week 13 for the 20w cycle. Expecting a high for the 20w cycle and final sell off.

Subscribe to:

Posts (Atom)