Short term view - lower for a day or two than higher.

Intermediate term view - waiting 1-2 weeks to see what the market wants to do.

Boring week as expected... SP500 moved a little bit higher and now trying to start a pullback.

Nothing new - waiting to see if a topping will start or the move higher will extend. The pullback so far is not strong, no impulse, Sp500 touched 2119 a few points short of it's target 2130 that makes me think that the move lower should make a 20 day cycle low. After that if my plan is right we will see a marginal new high with divergence or lower high and strong move lower should begin. It should happen in the next 1-2 weeks or it will become too late and the move will continue crawling higher for another 4-6 weeks to 2200. Patience the market will show us the way:)

P.S. Article from Steen Jakobsen Chief Economist & CIO / Saxo Bank - Macro Digest: Up close and nasty – US slowdown looms. Interesting is that he is watching fundamentals, macro data and makes exactly the same conclusions like me from the last week about USD,Stocks,Gold,Bonds. The only difference is the he sees one more lower low for the yields. That is my preferred scenario too, but I just do not like the charts at the moment... which could change of course, the yields rally could be a fake.

TECHNICAL PICTURE

Short term - difficult to trade... I think the pullback is not over, but another move higher should follow.

Intermediate term - no change

Long term - no change. Divergences which support the idea of a correction.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - sending the same message like last week. They look a little bit worse, but is still too early, waiting for reversal signs.

McClellan Oscillator - three lower highs... bad signs unless the index start moving higher rapidly.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - reached overbought level, the swing higher should be soon over.

Bullish Percentage - buy signal, but long term several lower highs.

Percent of Stocks above MA50 - moved below 75 about the same story triple divergence.

Fear Indicator VIX - moved lower, but we have triple divergence.

Advance-Decline Issues - very weak, with series of lower highs.

NYSE New Highs-New Lows - series of lower highs.

HURST CYCLES

I expect 20 day cycle low followed by the high of the bigger 40 day cycle.

Week 4 of the current 20 week cycle.

Following closely the current 20 week cycle... when it tops the indexes should move lower to 18 month cycle low and the low for the year.

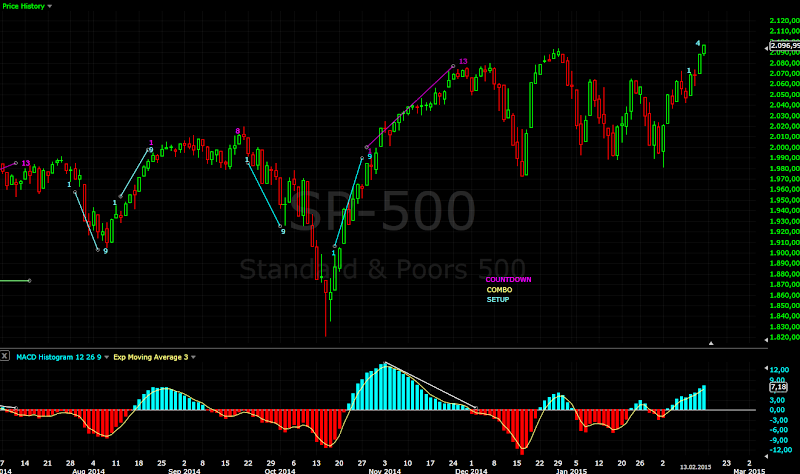

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Setup finished as expected and price flip has followed. Now I am waiting to see which scenario will play out. The bullish one will start a countdown, the bearish one 9-13-9 and move lower.

Feb 28, 2015

Feb 25, 2015

Update

I little bit higher as expected to finish the structure, but now it does not look bullish any more - 5 waves, divergences, wedging....

A few points could be squeezed but the next move should be something to the downside.

Feb 22, 2015

What about the other markets?

The first great opportunity for this year will be buying stocks after a correction. I have already written about that.

The second one which should be even more profitable is precious metals and gold miners. I know I know they are very hated, the direction is only down:) I have spent a lot of time watching the charts and I will wrote more about this market.

Than I have decided to look at the charts of the other asset classes and the astonishing is that I see everywhere major trend changes.

I have not the time for a comprehensive analysis of all the markets, probably my cycle count/EW is not perfect, but I see the same literally everywhere !!!????!!!! it could not be a coincidence.

I think it is important if you are trading. I will share the charts and some thoughts and you can make your conclusion.

My personal opinion - 2015 will be an important year and we will see a lot of trend changes... the year has started crazy, volatile, CBs are nervous definitely something is going on.

To summarize - for the indexes I expect 18 month cycle low and the low for the year in the next several months, USD major top,

Bonds long term top or even the top of the bond bull, commodities long term or major bottom.

Overall it looks like the trend changes will happen between May and October.... but the bonds are in a hurry, I think we saw the top already:))

If the dollar start moving lower for years the logical conclusion is the commodities(depressed for years) should surge and if the money starts moving out of bonds

the stocks should rise. I am not a fundamental guy just thoughts... it looks like an inflationary environment is coming. As I have already wrote the CBs will continue to do what they do until they lose control and everything implodes, but before that we will see crazy stuff to the upside.

- GOLD and MINERS

I think we will see a long term bottom in precious metals. Even if it is only a corrective move I expect 50% retracement or something like gold at 1500 USD.

There is many ways to play the move:

- the classical is ETF GLD - many do not like it saying paper gold they do not have the physical metal. For trading is ok, for investing in gold I do not think so.

I have found an interesting alternative buying shares CEF (Central Fund of Canada). There are since 1961 on the market and store physical gold and silver in vaults in Canada. They DO NOT sell their gold ans silver. It is an alternative of paper gold or storing physical gold on your own... it is something in middle if you want to invest in gold. Make your research I do not want to give you wrong information.

- the more profitable and more risky approach is buying gold miners shares - usually they move 3x-4x times the move in gold. If we see 50% move in gold it is easily 200% in gold miners. I will not be surprised to see many of them to tripling.

To the charts - gold has very consistent cycle 22-24 weeks and an yearly cycle 45-48 weeks. The only exception was the steep decline in 2013. This is normal when the move is very sharp the cycle is usually shorter. The move is compressed in time, it is exhausting itself faster.

If my cycle count is right we should see a 4 and 8 year cycle low in September. The current cycle is at week 16 and the top for the current cycle should be behind us than we have one more 22-24 cycle before a major bottom.

EW - there is room for an interpretation, but the move lower looks like an impulse. The best fit with cycles is that we are in wave iii of 5 to finish the current cycle and iv and v of 5 will be the last cycle before 4 year and 8 year bottom.

There is support around 1000 and MACD on weekly chart is expected to make a long term divergence. In several months we will check the charts to see if they confirm the plan.

I have looked at the charts of many gold miners and they confirm my view to expect long term bottom in precious metals

Of course not all shares have the same pattern, but I think can I summarize them in the two charts below. I saw two main patterns - huge correction since 2008 which is in its final stages 5 of C or huge choppy corrective move which needs one more push lower.(A few shares look like have already hit a bottom and have 5 wave up).

Barrick gold - it looks like an expanded flat

Silver wheaton - it looks like a W-X-Y mess the last move up was a-b-c so one final impulse lower to finish the zigzag will look great.

- BONDS

TLT - everything was pointing to a correction and one more move higher,the move higher was looking like an impulse, no divergences, above MA50... pullback was expected but the move lower has surprised me it is something more. I was expecting to see a major top later in sync with the other assets, but I think that we saw the top at least for this year... or a bold call the bond bull is over:)

The move lower is impulse(TLT), huge monthly bar, it moved below many support levels, add to this the cycles below.... and I do not think that we will see another higher high in bonds for this year.

Here is chart of TLT - I think the move since January 2014 is A-B-C. I do not know what happened whit 4 and 5 of C. The only bullish pattern left with the overlapping waves is expanding ending diagonal(green) but I do not think it appears as wave C... correct me if I am wrong.

The upper trend line connects the three peeks visible on the weekly chart - perfect hit and reversal. Short term cycles and the internal structure point to a corrective rally(red). The technical damages and long term cycles support rather the red scenario.

Below is a chart of 30-years treasure yield - I think we have important cycle low and I expect at least move higher for a year or even it is the low for the whole move since 1981.

HERE is a post about bonds from a guy which is trading professionally using Husrt cycles. You can read more if you want.

- FOREX

I know USD is very strong, parity with EUR bla bla... When I look at the two major crosses I think the next major move is lower for the USD.... at least for two years. This is in sync with what I see for the commodities strong move higher for a 1-2 years and I do not see this happening if the USD continue strengthening further.

From the top around 1,60 I see only overlapping corrective waves probably zigzags, major 15 year cycles and internal 5 year cycles which are scheduled to bottom this year. Different measurements point to a bottom around 1,05 this will be also perfect hit of the trend line. Even if I am wrong I think we will see 15 year cycle low and a move in the opposite direction for a 1 to 2 years.

Currently we are near to a an eight year top and close to finishing 5 waves. So I expect an important top, but the next move lower should be corrective and make higher low.

- ENERGY

When I look at the charts below I think the next major bottom is coming this year. You do not need ATH or something crazy, just mean reversion - crude oil something like 80 and natgas at 5 and that means already the prise doubling or 100% rise.

Crude oil makes every 2 to 3 years an important bottom. The cycles are not consistent, but the EW pattern looks very clear.

The opposite with natgas - very consistent cycle every three years and if you shift it one year to the right you have again bottoms every year. EW is not so clear I think it is A-B-C lower. I am not sure if it has already bottomed out or this will happen later.

Even coal show huge corrective pattern which should bottom this year.

I hope you have enjoyed the post. There is a lot of food for thoughts and enough time to prepare if you think the charts are telling us something. The main conclusion for me - we should see trend changes in many markets which will have huge implications if you are trading.

Feb 21, 2015

Weekly review

Short term view - probably a little bit more to the upside left... but we should see topping action up and down.

Intermediate term view - too early to be bearish but now watching closely.

The short term played out exactly as expected. Now for the next week it is difficult to predict the path. Five waves up or a little bit higher left on Monday so it is time to be cautious. If I am right the indexes should start topping , which does not exclude higher prices, it means up and down moves. Still bullish action and too early to get bearish. Now I am just watching to see how it develops. Without a sign you do not flip bullish/bearish, wait for confirmation.

March is one of the Months when reversals usually occur... so watching and waiting to see if I am right.

P.S. On Sunday I will post something which I think is important and interesting about the other and the long term.

TECHNICAL PICTURE

Short term - bullish above the last support level around 2070 and watching for further signs.

Intermediate term - no change

Long term - no change. Divergences which support the idea of a correction.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - have reached the minimum levels where a swing could top out and we have triple divergence on most of the indicators. Now watching for reversal signs.

McClellan Oscillator - three lower highs... bad signs unless the index start moving higher rapidly.

McClellan Summation Index - buy signal, but lower highs.

Weekly Stochastic of the Summation Index - reached overbought level.

Bullish Percentage - buy signal, but several lower highs.

Percent of Stocks above MA50 - moved above 75 about the same story triple divergence.

Fear Indicator VIX - moved lower as expected but we have a divergence.

Advance-Decline Issues - very weak, with series of lower highs.

HURST CYCLES

Day 14 of the current 40 day cycle.

Week 3 of the current 20 week cycle.

Following closely the current 20 week cycle... when it tops the indexes should move lower to 18 month cycle low and the low for the year.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Day 8 of a setup... I think it will be finished and than we see what happens.

Intermediate term view - too early to be bearish but now watching closely.

The short term played out exactly as expected. Now for the next week it is difficult to predict the path. Five waves up or a little bit higher left on Monday so it is time to be cautious. If I am right the indexes should start topping , which does not exclude higher prices, it means up and down moves. Still bullish action and too early to get bearish. Now I am just watching to see how it develops. Without a sign you do not flip bullish/bearish, wait for confirmation.

March is one of the Months when reversals usually occur... so watching and waiting to see if I am right.

P.S. On Sunday I will post something which I think is important and interesting about the other and the long term.

TECHNICAL PICTURE

Short term - bullish above the last support level around 2070 and watching for further signs.

Intermediate term - no change

Long term - no change. Divergences which support the idea of a correction.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - have reached the minimum levels where a swing could top out and we have triple divergence on most of the indicators. Now watching for reversal signs.

McClellan Oscillator - three lower highs... bad signs unless the index start moving higher rapidly.

McClellan Summation Index - buy signal, but lower highs.

Weekly Stochastic of the Summation Index - reached overbought level.

Bullish Percentage - buy signal, but several lower highs.

Percent of Stocks above MA50 - moved above 75 about the same story triple divergence.

Fear Indicator VIX - moved lower as expected but we have a divergence.

Advance-Decline Issues - very weak, with series of lower highs.

HURST CYCLES

Day 14 of the current 40 day cycle.

Week 3 of the current 20 week cycle.

Following closely the current 20 week cycle... when it tops the indexes should move lower to 18 month cycle low and the low for the year.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Day 8 of a setup... I think it will be finished and than we see what happens.

Feb 14, 2015

Weekly review

Short term view - choppy start of the week than higher.

Intermediate term view - still up... probably another week or two, but watching closely now for reversal signs.

As expected the move up continued after a pause for a day. The charts and indicators are still pointing higher so the expected minimum of 2-3 weeks higher will be achieved:) After that I will be careful.

Short term the move up does not look finished and I think we will see more to the upside but nothing huge...

Intermediate term - the indexes are moving higher that is not a surprise... everybody is bullish counting new ATHs, break outs.... no so fast.

I think the move is weaker compared to previous moves from cycle lows, TomDemark setup had price flip in the middle another sign for a weaker move... market breadth is pointing higher but I think will see triple long term divergences on most of the indicators. I think this confirms my intermediate term view that a correction should start soon.

Below you can see the updated charts Russel2000 and DJTA. I wrote two months ago about expanded flat and wave 4 and since than nothing has changed and I do not see a reason to change the forecast at the moment.

Look at Russell2000 - the moves are with corrective nature, I do not see impulses and I think this is an expanded flat.

What if I am wrong - the move higher will accelerate and we will see higher prices SP500 around 2240... would you complain about some extra money?:)

TECHNICAL PICTURE

Short term - choppy start of the week before continuing higher. Any move lower should stay above the support level 2065-2070. Move below it will be bearish.

Intermediate term - the targets with Fibo extensions....(the first target is 2135-2140 of course:)

Long term - no change. Momentum is still up but I expect to see another divergence - MACD, RSI, histogram

MARKET BREADTH INDICATORS

The Market Breadth Indicators - still pointing up, yes the move up is not over, but I think the indicators are weaker and we will see triple long term divergence on many of them.

McClellan Oscillator - lower high at the moment.. strength is missing.

McClellan Summation Index - buy signal, I expect another lower high.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal. I expect to see a triple divergence.

Percent of Stocks above MA50 - moving higher. I expect another lower high.

Fear Indicator VIX - expect to see another higher low when the move is over an triple divergence.

Advance-Decline Issues - the same story moving higher, but I expect lower high and triple divergence.

HURST CYCLES

At day 10 of the current 40day cycle.

At week 2 of the current 20 week cycle. Following closely the current 20 week cycle... when it tops the indexes should move lower to 18 month cycle low and the low for the year.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

There was a price flip on Monday and we have again 4 of a setup. As I have mentioned I expect to see a weaker move compared to previous bottoms.

DJ Transportation Average - I still think it is in wave 4.

Russell2000 - I think it is an expanded Flat.

Intermediate term view - still up... probably another week or two, but watching closely now for reversal signs.

As expected the move up continued after a pause for a day. The charts and indicators are still pointing higher so the expected minimum of 2-3 weeks higher will be achieved:) After that I will be careful.

Short term the move up does not look finished and I think we will see more to the upside but nothing huge...

Intermediate term - the indexes are moving higher that is not a surprise... everybody is bullish counting new ATHs, break outs.... no so fast.

I think the move is weaker compared to previous moves from cycle lows, TomDemark setup had price flip in the middle another sign for a weaker move... market breadth is pointing higher but I think will see triple long term divergences on most of the indicators. I think this confirms my intermediate term view that a correction should start soon.

Below you can see the updated charts Russel2000 and DJTA. I wrote two months ago about expanded flat and wave 4 and since than nothing has changed and I do not see a reason to change the forecast at the moment.

Look at Russell2000 - the moves are with corrective nature, I do not see impulses and I think this is an expanded flat.

What if I am wrong - the move higher will accelerate and we will see higher prices SP500 around 2240... would you complain about some extra money?:)

TECHNICAL PICTURE

Short term - choppy start of the week before continuing higher. Any move lower should stay above the support level 2065-2070. Move below it will be bearish.

Intermediate term - the targets with Fibo extensions....(the first target is 2135-2140 of course:)

Long term - no change. Momentum is still up but I expect to see another divergence - MACD, RSI, histogram

MARKET BREADTH INDICATORS

The Market Breadth Indicators - still pointing up, yes the move up is not over, but I think the indicators are weaker and we will see triple long term divergence on many of them.

McClellan Oscillator - lower high at the moment.. strength is missing.

McClellan Summation Index - buy signal, I expect another lower high.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal. I expect to see a triple divergence.

Percent of Stocks above MA50 - moving higher. I expect another lower high.

Fear Indicator VIX - expect to see another higher low when the move is over an triple divergence.

Advance-Decline Issues - the same story moving higher, but I expect lower high and triple divergence.

HURST CYCLES

At day 10 of the current 40day cycle.

At week 2 of the current 20 week cycle. Following closely the current 20 week cycle... when it tops the indexes should move lower to 18 month cycle low and the low for the year.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

There was a price flip on Monday and we have again 4 of a setup. As I have mentioned I expect to see a weaker move compared to previous bottoms.

DJ Transportation Average - I still think it is in wave 4.

Russell2000 - I think it is an expanded Flat.

Feb 8, 2015

Weekly review

Short term view - lower prices for a day or two

Intermediate term view - next week we will know if the correction is running or we have another 2-3 weeks higher.

Based on cycles I was expecting short term bottom and move higher... it came a little bit earlier, but overall not a surprise. You should not nave been caught on the wrong side shorting the fake break out lower.

The price moved higher to resistance and it is still in the range. As long as there is no convincing break out we have to keep an eye on both bullish and bearish scenario.

Indicators look positive, market breadth - I would say new swing higher has begun, EW - impulse higher, cycles - 40 day and 20 week cycle low. I would keep it simple and say we should see at least another impulse higher after a pullback. BUT the move should show strength and any pullback should stay above 2020-2025.

Now what if I am wrong:

- the prices move much higher than I expect - we are on the right side, I was wrong and I will adjust the forecast/charts. Not really a problem.

- the impulse was wave C of a corrective move(the whole sideway mess), which has finished on Friday, and the next wave lower has begun - it is possible. I will watch carefully how the pullback look like and the 2020-2025 area - the gap , 50% Fibo retracement and support. If this is the case the move lower should be impulsive and move fast below this level.

TECHNICAL PICTURE

Short term - the bullish scenario(green) and the bearish scenario(red). I am leaning more to the bullish scenario but watching carefully the bearish one. Next week we will have the answer.

Intermediate term - the same on the daily chart. MACD is still around zero and bellow the trend line, so we do not have confirmation for a bullish outcome.

Long term - no change. Momentum turned up - another 2-3 weeks higher?.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - I would say new swing higher has begun, but we do not have confirmation or something convincing at the moment.

McClellan Oscillator - above zero... nothing interesting.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal.

Percent of Stocks above MA50 - nothing interesting near the middle of the range.

Fear Indicator VIX - series of lower highs and higher lows....

Advance-Decline Issues - series of lower highs and higher lows....

HURST CYCLES

At day 5 after 40 day and 20 week cycle low.

Low at week 16... perfect right on time. Following closely the current 20 week cycle... when it tops the indexes should move lower to 18 month cycle low and the low for the year.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Nothing interesting but to take a look at strength from another angle - previous cycle lows were followed by finished countdown, setup at 7, and the current one is at 4. If the indexes want to move higher they should print choppy pullback - on Monday bar 5 of the setup should close above 2050(bar 1). If we see another price flip on Monday at day 4(close below 2050) that would mean weakness and I would not expect this rally to last very long.

Intermediate term view - next week we will know if the correction is running or we have another 2-3 weeks higher.

Based on cycles I was expecting short term bottom and move higher... it came a little bit earlier, but overall not a surprise. You should not nave been caught on the wrong side shorting the fake break out lower.

The price moved higher to resistance and it is still in the range. As long as there is no convincing break out we have to keep an eye on both bullish and bearish scenario.

Indicators look positive, market breadth - I would say new swing higher has begun, EW - impulse higher, cycles - 40 day and 20 week cycle low. I would keep it simple and say we should see at least another impulse higher after a pullback. BUT the move should show strength and any pullback should stay above 2020-2025.

Now what if I am wrong:

- the prices move much higher than I expect - we are on the right side, I was wrong and I will adjust the forecast/charts. Not really a problem.

- the impulse was wave C of a corrective move(the whole sideway mess), which has finished on Friday, and the next wave lower has begun - it is possible. I will watch carefully how the pullback look like and the 2020-2025 area - the gap , 50% Fibo retracement and support. If this is the case the move lower should be impulsive and move fast below this level.

TECHNICAL PICTURE

Short term - the bullish scenario(green) and the bearish scenario(red). I am leaning more to the bullish scenario but watching carefully the bearish one. Next week we will have the answer.

Intermediate term - the same on the daily chart. MACD is still around zero and bellow the trend line, so we do not have confirmation for a bullish outcome.

Long term - no change. Momentum turned up - another 2-3 weeks higher?.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - I would say new swing higher has begun, but we do not have confirmation or something convincing at the moment.

McClellan Oscillator - above zero... nothing interesting.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal.

Percent of Stocks above MA50 - nothing interesting near the middle of the range.

Fear Indicator VIX - series of lower highs and higher lows....

Advance-Decline Issues - series of lower highs and higher lows....

HURST CYCLES

At day 5 after 40 day and 20 week cycle low.

Low at week 16... perfect right on time. Following closely the current 20 week cycle... when it tops the indexes should move lower to 18 month cycle low and the low for the year.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Nothing interesting but to take a look at strength from another angle - previous cycle lows were followed by finished countdown, setup at 7, and the current one is at 4. If the indexes want to move higher they should print choppy pullback - on Monday bar 5 of the setup should close above 2050(bar 1). If we see another price flip on Monday at day 4(close below 2050) that would mean weakness and I would not expect this rally to last very long.

Feb 5, 2015

Update

It looks like an impulse now pullback should follow. After an impulse this should be another short term buying opportunity. Minimum target another impulse with the same size around 2095-2100.

Feb 3, 2015

Update

It looks like a reversal near the MA200 and new swing higher has begun. It is neither the triangle nor the 1-2 day move lower... it has lasted only half a day lower to 1980, but this does not change the idea - short term bottom and 20 week cycle low.

Move higher from 20 week low should last at least 2-3 weeks. Now it is time for short term long trades and we watch how the move will look like and how high it will move. With the early reversal from higher level it is even higher high possible.

Feb 1, 2015

Weekly review

Short term view - lower for a few days and than higher.

Intermediate term view - next move up should make lower high and "decent" correction lower to begin.

I was watching the triangle... it still looks like triangle, it is not busted the pattern, but it takes too long to reverse higher. That should have happened around FOMC and now I think the prices will break lower.

Short term - I think the price will break lower from the range(the hourly chart the red lines). Usually when you see corrective move crawling lower but not reverse higher for too long one final flush lower is necessary before a bottom.... two months are long enough time where are the buyers?

The move lower is corrective, we are near to 40 day and 20 week cycle low, market breadth is not clear but rather near to a bottom than a top.

Near term next several weeks - 1-2-3 days sell off next week and than we should see a move higher 1-2-3 weeks from 20 week cycle low. I suspect the indexes will make lower high because the the technical indicators on the monthly and weekly chart are pointing lower and we are nearing the end of a bigger cycle 18 month which is pulling the prices lower.

This should be the lower high (or higher high with divergence) I wrote about two weeks ago, which can be shorted with low risk and the move should be straight lower not like this choppy mess for two months.

Long term - I am talking for months that a bigger correction is coming and I see more and more signs... and I think the moment has come.

- Positive news like 1,1 trillion QE and.... no reaction, buyers are missing and the market looks tired.

- No progress higher for the last three months and the last two are red bars. In fact I wrote short before Thanksgiving take the profits and watch from the side line. Since than the indexes can not find direction.

- the current daily cycle is the first one for years which is left translated(top on day 8 early in the cycle) and we have only one 20 week cycle before 18 month cycle low.

- See the monthly chart(the last one below) - we have two consecutive red months. For the whole bull market this happened 3 times and corrections have followed respectively - 17% / 21% / 11%.

- the histogram moved below the zero line, RSI broke below it's trend line and retested it... now pointing lower, the price is on the verge breaking lower from the wedge.

To summarize - after the next high I expect the prices to drop 10%-15% lower, unless the indexes start rallying on Monday(the triangle).

TECHNICAL PICTURE

Short term - measuring the size of the previous waves potential short term low should be in the 1950-1965 area.

Alternate scenario is the triangle if I am wrong, but we should see a strong rally on Monday.

Intermediate term - no signs for reversal so far. The price is near the MA200, I expect fake break lower and reversal higher before a significant correction.

Long term - no change. Momentum points lower with divergence.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - are not very helpful, but I would say we are near to a short term bottom than to a top and long lasting sell off. One last flush lower and they will look nice for a short term bottom.

McClellan Oscillator - looks like a triangle too, with higher lows and lower highs.

McClellan Summation Index - nothing.

Weekly Stochastic of the Summation Index - can not take a decision lower or higher:)

Bullish Percentage - sell signal.

Percent of Stocks above MA50 - one final sell off and value like 25% or lower will look great for a short term bottom.

Fear Indicator VIX - divergences, makes lower highs.

Advance-Decline Issues - nothing interesting.

HURST CYCLES

Waiting for the bottom of the current 40 day and 20 week cycle.....

A move from the 20 week cycle low should last 1-2-3 weeks, but the 18 month cycle will drag the prices lower.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

The monthly chart does not look very bullish... I have pointed above the bearish signs one more is the finished combo and countdown.

Intermediate term view - next move up should make lower high and "decent" correction lower to begin.

I was watching the triangle... it still looks like triangle, it is not busted the pattern, but it takes too long to reverse higher. That should have happened around FOMC and now I think the prices will break lower.

Short term - I think the price will break lower from the range(the hourly chart the red lines). Usually when you see corrective move crawling lower but not reverse higher for too long one final flush lower is necessary before a bottom.... two months are long enough time where are the buyers?

The move lower is corrective, we are near to 40 day and 20 week cycle low, market breadth is not clear but rather near to a bottom than a top.

Near term next several weeks - 1-2-3 days sell off next week and than we should see a move higher 1-2-3 weeks from 20 week cycle low. I suspect the indexes will make lower high because the the technical indicators on the monthly and weekly chart are pointing lower and we are nearing the end of a bigger cycle 18 month which is pulling the prices lower.

This should be the lower high (or higher high with divergence) I wrote about two weeks ago, which can be shorted with low risk and the move should be straight lower not like this choppy mess for two months.

Long term - I am talking for months that a bigger correction is coming and I see more and more signs... and I think the moment has come.

- Positive news like 1,1 trillion QE and.... no reaction, buyers are missing and the market looks tired.

- No progress higher for the last three months and the last two are red bars. In fact I wrote short before Thanksgiving take the profits and watch from the side line. Since than the indexes can not find direction.

- the current daily cycle is the first one for years which is left translated(top on day 8 early in the cycle) and we have only one 20 week cycle before 18 month cycle low.

- See the monthly chart(the last one below) - we have two consecutive red months. For the whole bull market this happened 3 times and corrections have followed respectively - 17% / 21% / 11%.

- the histogram moved below the zero line, RSI broke below it's trend line and retested it... now pointing lower, the price is on the verge breaking lower from the wedge.

To summarize - after the next high I expect the prices to drop 10%-15% lower, unless the indexes start rallying on Monday(the triangle).

TECHNICAL PICTURE

Short term - measuring the size of the previous waves potential short term low should be in the 1950-1965 area.

Alternate scenario is the triangle if I am wrong, but we should see a strong rally on Monday.

Intermediate term - no signs for reversal so far. The price is near the MA200, I expect fake break lower and reversal higher before a significant correction.

Long term - no change. Momentum points lower with divergence.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - are not very helpful, but I would say we are near to a short term bottom than to a top and long lasting sell off. One last flush lower and they will look nice for a short term bottom.

McClellan Oscillator - looks like a triangle too, with higher lows and lower highs.

McClellan Summation Index - nothing.

Weekly Stochastic of the Summation Index - can not take a decision lower or higher:)

Bullish Percentage - sell signal.

Percent of Stocks above MA50 - one final sell off and value like 25% or lower will look great for a short term bottom.

Fear Indicator VIX - divergences, makes lower highs.

Advance-Decline Issues - nothing interesting.

HURST CYCLES

Waiting for the bottom of the current 40 day and 20 week cycle.....

A move from the 20 week cycle low should last 1-2-3 weeks, but the 18 month cycle will drag the prices lower.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

The monthly chart does not look very bullish... I have pointed above the bearish signs one more is the finished combo and countdown.

Subscribe to:

Posts (Atom)