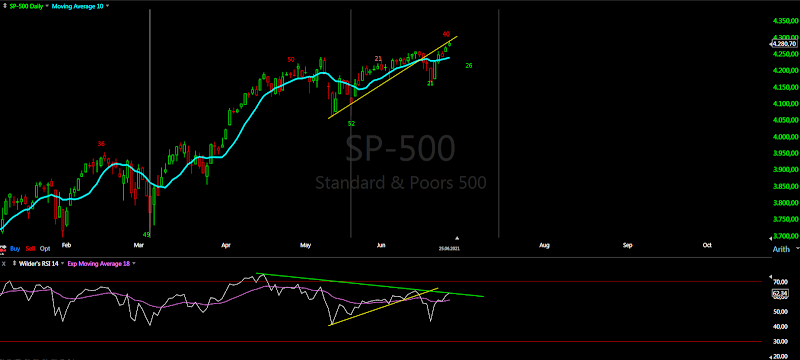

We saw 5w low as expected now the final up probably 10w high then expect the final down leg for the 18m low. Obviously the b-wave of he correction has not been completed and it is more more complex matching the a-wave complexity.

P.S. I am on a holiday for three weeks so no updates the next three weeks. I will use the time to prepare long term update.

TRADING

Trading trigger - buy. The analysis do not support it, probably price/RSI testing the broken trend line.

Analysis - sell. We have turn lower into 18 month low.

P.S. - for a trade both analysis and trigger should point in the same direction.

Jun 26, 2021

Weekly preview

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - most likely the B-wave is bigger zig-zag. Currently we have c=0,618xa so waiting to see if this is the top or it will extend to c=a.

Intermediate term - from the March low we have one big zig-zag consisting of two zig-zags, which itself consist of zig-zags. You can call it W-X-Y, but there is no impulses. Still in the b-wave and next is decline for the c-wave and 18m low.

Long term - we should see correction for 2-3 weeks between 10%-15% for 18m cycle low.

MARKET BREADTH INDICATORS

Market Breadth Indicators - do not show any reaction, still weak and sell signals.

McClellan Oscillator - reseting close to the zero line.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - turning lower.

Bullish Percentage - no reaction.

Percent of Stocks above MA50 - retracing towards the middle of the range.

Fear Indicator VIX - more bottoming.

Advance-Decline Issues - does not react much hanging around the middle of the range.

HURST CYCLES

Short term cycles - I am watching this count. It fits with the pattern and explains the sharp rise.

There is no consistent picture - different indices have different short term highs. DAX mid-April, NDX mid- or end of April, DJ/NYSE early May. SPX is mix of all this and influenced heavily by big tech stocks. The two options left are - this is the 10w high or if you take the early May high one more 10d cycle.

Week 34 for the 40w cycle. RSI testing the broken trend line and MA.

Jun 19, 2021

Weekly preview

Because EW and cycles do not work we saw completed zig-zag right on schedule and reversal. After 10 week high we should see a decline for several weeks and 18 month low.

Long term I have posted NDX/NYSE charts - I think the 4y high will be this year and it will play out like 2000/2007 with double top, now we are seeing the first high of it.

TRADING

Trading trigger - sell. Price/RSI broke below the MA and the trend line after day 40(red) right on schedule.

Analysis - sell. We have turn lower into 18 month low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - double zig-zag or according futures simple zig-zag with c-wave as ED was completed and now decline is running. So far is the typical zig-zag shape.

Intermediate term - from the March low we have one big zig-zag consisting of two zig-zags, which itself consist of zig-zags. You can call it W-X-Y, but there is no impulses.

Price is starting to brake below the trend line and MA50 and RSI on the verge of breaking the trend line from the March low.

Long term - we should see correction for 4-5 weeks between 10%-15% for 18m cycle low. Pattern adjusted according to the cycle analysis.

MARKET BREADTH INDICATORS

Market Breadth Indicators - weak, turned lower and sell signals.

McClellan Oscillator - below zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - sell signal, below 70.

Percent of Stocks above MA50 - very weak plunging lower.

Fear Indicator VIX - turned up after double bottom.

Advance-Decline Issues - heaing lower after another lower high.

HURST CYCLES

Short term cycles - it seems we have completed 10w high and next week we should see 5w low.

The longer term cycle the 18m cycle should take control and the highs should be lower highs - I expect pattern similar to the one shown on the chart.

Week 33 for the 40 week cycle. If you look at the RSI it is obviuos that the 20w cycle is turning lower.

In 2018 there were a lof of discussions if the high was in January or September. Now I think January.2018 is the more likely scenario. This means to expect the next 4y high this year. Given the right translated cycle and the next 18m low in a month expect a topping formation similar to 2000/2007. The so called M pattern - the next cycle making slightly higher high and failing.

Trading trigger - sell. Price/RSI broke below the MA and the trend line after day 40(red) right on schedule.

Analysis - sell. We have turn lower into 18 month low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - double zig-zag or according futures simple zig-zag with c-wave as ED was completed and now decline is running. So far is the typical zig-zag shape.

Intermediate term - from the March low we have one big zig-zag consisting of two zig-zags, which itself consist of zig-zags. You can call it W-X-Y, but there is no impulses.

Price is starting to brake below the trend line and MA50 and RSI on the verge of breaking the trend line from the March low.

Long term - we should see correction for 4-5 weeks between 10%-15% for 18m cycle low. Pattern adjusted according to the cycle analysis.

MARKET BREADTH INDICATORS

Market Breadth Indicators - weak, turned lower and sell signals.

McClellan Oscillator - below zero.

McClellan Summation Index - sell signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - sell signal, below 70.

Percent of Stocks above MA50 - very weak plunging lower.

Fear Indicator VIX - turned up after double bottom.

Advance-Decline Issues - heaing lower after another lower high.

HURST CYCLES

Short term cycles - it seems we have completed 10w high and next week we should see 5w low.

The longer term cycle the 18m cycle should take control and the highs should be lower highs - I expect pattern similar to the one shown on the chart.

Week 33 for the 40 week cycle. If you look at the RSI it is obviuos that the 20w cycle is turning lower.

In 2018 there were a lof of discussions if the high was in January or September. Now I think January.2018 is the more likely scenario. This means to expect the next 4y high this year. Given the right translated cycle and the next 18m low in a month expect a topping formation similar to 2000/2007. The so called M pattern - the next cycle making slightly higher high and failing.

Jun 12, 2021

Weekly preview

As expected more time and zig-zags were need to complete the pattern for 10w high - the same for 8-th week. Next is lower for c-wave and 5w low.

TRADING

Trading trigger - buy. Still above MA10, but I expect a turn lower soon.

Analysis - sell. We have transition from 18 month high into 18 month low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - as expected we are seeing another double zig-zag to complete c/B. Interesting is Fibo targets for three different degrees of waves converge together around 4260. Next week the B-wave should be completed followed by decline for the C-wave

Intermediate term - from the March low we have one big zig-zag consisting of two zig-zags, which itself consist of zig-zags. You can call it W-X-Y, but there is no impulses. Nothing new to add - double top and time for a decline.

Long term - the move from March 2020 is completed and we are seeing transition from up to down. Expect 4-6 weeks lower and we will watch how big the decline will be. This long sideways phase points to the a-b green scenario.

MARKET BREADTH INDICATORS

Market Breadth Indicators - no change weakness the oscillators are turning lower.

McClellan Oscillator - series of lower highs short term and intermediate turn.

McClellan Summation Index - buy ssignal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - turning lower.

Percent of Stocks above MA50 - heading lower.

Fear Indicator VIX - double bottom.

Advance-Decline Issues - turning lower.

HURST CYCLES

Short term cycles - as expected several days needed to complete the 20d and 10w cycle high. Next is decline into 5w low.

Week 14/32 for the 20w/40w cycle.

Trading trigger - buy. Still above MA10, but I expect a turn lower soon.

Analysis - sell. We have transition from 18 month high into 18 month low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - as expected we are seeing another double zig-zag to complete c/B. Interesting is Fibo targets for three different degrees of waves converge together around 4260. Next week the B-wave should be completed followed by decline for the C-wave

Intermediate term - from the March low we have one big zig-zag consisting of two zig-zags, which itself consist of zig-zags. You can call it W-X-Y, but there is no impulses. Nothing new to add - double top and time for a decline.

Long term - the move from March 2020 is completed and we are seeing transition from up to down. Expect 4-6 weeks lower and we will watch how big the decline will be. This long sideways phase points to the a-b green scenario.

MARKET BREADTH INDICATORS

Market Breadth Indicators - no change weakness the oscillators are turning lower.

McClellan Oscillator - series of lower highs short term and intermediate turn.

McClellan Summation Index - buy ssignal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - turning lower.

Percent of Stocks above MA50 - heading lower.

Fear Indicator VIX - double bottom.

Advance-Decline Issues - turning lower.

HURST CYCLES

Short term cycles - as expected several days needed to complete the 20d and 10w cycle high. Next is decline into 5w low.

Week 14/32 for the 20w/40w cycle.

Jun 5, 2021

Weekly preview

Another week of nothing. It is taking a lot of time and my interpretation is we are seeing 10w cycle high not 5w with a double top. According to cycle and pattern analysis another 2-3 days. In fact you do not need to make analysis just watch the comments - we are seeing the usual crap spiking again at a top.

TRADING

Trading trigger - buy. Still above MA10. RSI is playing around with MA and the trend line not showing much strength.

Analysis - sell, we have transition from 18 month high into 18 month low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - ugly b/B and now c/B running. There is already one zig-zag up with a=c, but it is too short - time and size compared to a/B so I guess it is a/c/B and we will see another double zig-zag to complete c/B. As long as it stays above 4190 this is the plan.

Intermediate term - from the March low we have one big zig-zag consisting of two zig-zags, which itself consist of zig-zags. You can call it W-X-Y, but there is no impulses. The same story the indicators are resetting higher before a move lower.

Long term - the move from March 2020 is completed and we are seeing transition from up to down. Expect 4-6 weeks lower and we will watch how big the decline will be.

MARKET BREADTH INDICATORS

Market Breadth Indicators - mixed, some turned up, but I do not think this is buy signal.

McClellan Oscillator - making lower highs short term and intermediate term.

McClellan Summation Index - turned up .

Weekly Stochastic of the Summation Index - turned up.

Bullish Percentage - doing nothing.

Percent of Stocks above MA50 - hanging around 75 and doing nothing.

Fear Indicator VIX - it looks like double bottom.

Advance-Decline Issues - another lower high.

HURST CYCLES

Short term cycles - this sideways move is taking very long so the indices are close to 10w high. So far we have the minimum 9 days for the last 20d cycle high, it could take another 2-3 days.

There is two options - high in May and now 5w high or high in April and now 10w high.

If you look at the weekly chart below you will see that this is week 31 or another 4-6 weeks for a 40w low with average length. This makes the option 18m high in April more likely - it will take less time. The other option will need much longer somewhere in the middle you need 1-2 weeks for 10w high and it will take more time.

This is another confirmation that the cycle high was mid-April right on schedule. I have explained last week about the cycle highs if someone wonders why this strange looking cycle high analysis.

Week 31 for the 40w cycle.

Trading trigger - buy. Still above MA10. RSI is playing around with MA and the trend line not showing much strength.

Analysis - sell, we have transition from 18 month high into 18 month low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - ugly b/B and now c/B running. There is already one zig-zag up with a=c, but it is too short - time and size compared to a/B so I guess it is a/c/B and we will see another double zig-zag to complete c/B. As long as it stays above 4190 this is the plan.

Intermediate term - from the March low we have one big zig-zag consisting of two zig-zags, which itself consist of zig-zags. You can call it W-X-Y, but there is no impulses. The same story the indicators are resetting higher before a move lower.

Long term - the move from March 2020 is completed and we are seeing transition from up to down. Expect 4-6 weeks lower and we will watch how big the decline will be.

MARKET BREADTH INDICATORS

Market Breadth Indicators - mixed, some turned up, but I do not think this is buy signal.

McClellan Oscillator - making lower highs short term and intermediate term.

McClellan Summation Index - turned up .

Weekly Stochastic of the Summation Index - turned up.

Bullish Percentage - doing nothing.

Percent of Stocks above MA50 - hanging around 75 and doing nothing.

Fear Indicator VIX - it looks like double bottom.

Advance-Decline Issues - another lower high.

HURST CYCLES

Short term cycles - this sideways move is taking very long so the indices are close to 10w high. So far we have the minimum 9 days for the last 20d cycle high, it could take another 2-3 days.

There is two options - high in May and now 5w high or high in April and now 10w high.

If you look at the weekly chart below you will see that this is week 31 or another 4-6 weeks for a 40w low with average length. This makes the option 18m high in April more likely - it will take less time. The other option will need much longer somewhere in the middle you need 1-2 weeks for 10w high and it will take more time.

This is another confirmation that the cycle high was mid-April right on schedule. I have explained last week about the cycle highs if someone wonders why this strange looking cycle high analysis.

Week 31 for the 40w cycle.

Subscribe to:

Posts (Atom)