Reading comments the bulls are everywhere again, very smart again.... buy every dip, free money, 3000 at least. The same shit like January all over again, the sheeple has very short memory. The market does not work this way.

After the summer pause I am talking all the time about zig-zags , "yellow scenario" wave b etc. Below you can see the daily charts for NYSE/DJI/SP500 - all I can see is corrective waves. We can argue about w1 or w3 of ED or wave B, but I can not see an impulse. Unless we see a strong rally for iii of 3 breaking above the trend channels to prove me wrong this is just corrective crap period.

EW pattern looking close to be finished. Hitting the channel one more time with multiple divergences on the daily chart. Market breadth weak with divergences. RUT finished triangle and thrust higher for the final wave with RSI divergences daily and weekly.

The odds are higher that we are close to intermediate term top.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - expecting the trend line to be hit one more time and reversal to support and the lower trend line. MACD multiple divergences the bulls need strong move up above the upper trend line to clear the divergences.

Intermediate term - at first glance the three indexes look different SP500 strong managed to squeeze higher high and NYSE very week. If you count the waves and measure the Fibo levels you will see something different - the same pattern for all three indexes. I will dare too say they have the same pattern it is corrective and no NYSE/DJ will not catch up with SP500 as the bulls count already 3000. The opposite will happen.

Most likely the trend channel will be hit one more time with multiple RSI divergences and we will see at least a move to the lower trend line. I see corrective waves and possible patterns are wave 1 or 3 of ED and wave B which takes too long and I doubt it is part of wave 4 from the Feb.2016 low.

ED works for SP500/DJI but not for NYSE... curious what will happen in September and October.

NYSE - overlapping waves, weak angle of ascend, it looks like bearish flag. I see two zig-zags with the same size higher. Unless we see parabolic move up for iii of 3 the bulls will hold the bag again.

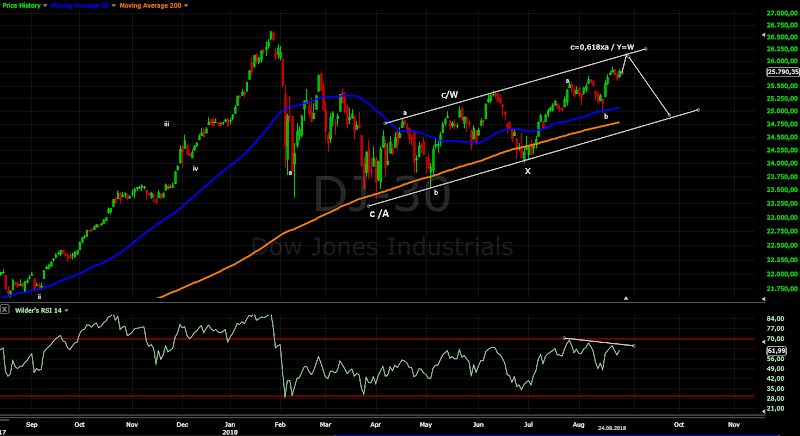

DJI - the same story, but stronger testing the March highs.

SP500 - the same story, the strongest testing the January high.

Long term - intermediate term high expected. It could be 4 year cycle high, but I do not think this is major top.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same weak with divergences, but holding for the moment.

McClellan Oscillator - showed strength up to the 40 level, now expecting lower highs.

McClellan Summation Index - buy signal, but lower high and divergence.

Weekly Stochastic of the Summation Index - turned higher.

Bullish Percentage - turned up, lower high so far and could not move into overbought territory.

Percent of Stocks above MA50 - several lower highs below 75. This is a sign of weakness unable to move into overbought territory.

Fear Indicator VIX - higher lows and divergences expected.

Advance-Decline Issues - lower highs, but still holding above the trend line.

HURST CYCLES

Day 7... this daily cycle looks weak so far, no strong rally and this is the way it should look like when the longer cycles are turning lower.

Week 8 of the 20 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Countdown and combo finished on the daily chart, waiting for some bearish sign like price flip on the weekly chart.

Aug 25, 2018

Aug 18, 2018

Weekly preview

Last week I have explained why this reversal feels wrong and so far it failed. I see a zig-zag lower and impulse higher the price is doing the opposite if you expect a reversal.

Reversal and bearish trend should produce bearish weekly candle, that is why I wrote last week watch closely how the week develops. Usually you will see a pause for day or two (ii of 1 of C in current case) and lower for the rest of the week with bearish weekly candle. What we have is lower for three days with intraday reversal for bullish weekly candle.

The price and the indicators behave like pullback for daily cycle low. If I am right it will last another 2-3 weeks before the move up is over.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - nothing to suggest reversal zig-zag lower and impulse higher. Now we should see pullback to test the gap and MA200.

Intermediate term - MA50 was tested. The odds are higher that we will see one more higher high before a bigger decline. I see two options for this decline either 2 of ED or alternate C.

Long term - no change the indexes are nearing an intermediate term top and decline until October should follow for 18 month cycle low. I do not think we have major top... and the bottom for wave 4 is still not 100% clear. Now I prefer that the low was in April for wave 4.

MARKET BREADTH INDICATORS

Market Breadth Indicators - nothing new weak with divergences, but the McClellan Oscillator for example is spending a lot of time below zero without the price following which is usually a sign for a bottom.

McClellan Oscillator - more than a month below zero correcting and now up in positive territory.

McClellan Summation Index - accordingly weak and heading lower.

Weekly Stochastic of the Summation Index - turned lower.

Bullish Percentage - turned lower.

Percent of Stocks above MA50 - between 50 and 75.

Fear Indicator VIX - jumped sharply, I do not think that we will see 9 and staying there, rather series of higher lows.

Advance-Decline Issues - in the middle of the range holding the trend line with higher lows.

HURST CYCLES

Day 2 of the next 40 day cycle. It feels so far like daily cycle low. Sometimes the move lower is very shallow and you do not know where to put the cycle low this is even worse with the 20 week cycle. Look at closely this chart it shows you the low for the daily cycle low even if the price amplitude is missing. It says loud and clear we have daily cycle low and turn up.

Week 7 for the 20 week cycle.

Short term - nothing to suggest reversal zig-zag lower and impulse higher. Now we should see pullback to test the gap and MA200.

Intermediate term - MA50 was tested. The odds are higher that we will see one more higher high before a bigger decline. I see two options for this decline either 2 of ED or alternate C.

Long term - no change the indexes are nearing an intermediate term top and decline until October should follow for 18 month cycle low. I do not think we have major top... and the bottom for wave 4 is still not 100% clear. Now I prefer that the low was in April for wave 4.

MARKET BREADTH INDICATORS

Market Breadth Indicators - nothing new weak with divergences, but the McClellan Oscillator for example is spending a lot of time below zero without the price following which is usually a sign for a bottom.

McClellan Oscillator - more than a month below zero correcting and now up in positive territory.

McClellan Summation Index - accordingly weak and heading lower.

Weekly Stochastic of the Summation Index - turned lower.

Bullish Percentage - turned lower.

Percent of Stocks above MA50 - between 50 and 75.

Fear Indicator VIX - jumped sharply, I do not think that we will see 9 and staying there, rather series of higher lows.

Advance-Decline Issues - in the middle of the range holding the trend line with higher lows.

HURST CYCLES

Day 2 of the next 40 day cycle. It feels so far like daily cycle low. Sometimes the move lower is very shallow and you do not know where to put the cycle low this is even worse with the 20 week cycle. Look at closely this chart it shows you the low for the daily cycle low even if the price amplitude is missing. It says loud and clear we have daily cycle low and turn up.

Week 7 for the 20 week cycle.

Aug 11, 2018

Weekly preview

SP500 touched the upper trend line one more time and pulled back..... at first glance it looks like finished wave c/B and reversal. What bothers me DJ does not look like reversal more like b of B(the yellow scenario). RUT looks like triangle and XBI like a flat so positioning for a short term bottom and not reversal 10%. The indexes are not always in sync, but at important top/bottom they are. The daily cycle looks strong right translated and usually after that higher high follows.

What I want to say is the yellow scenario is alive so if you are short watch closely what happens next week. If we have a reversal it should be strong red week closing around the low for the week. If this does not happen it is more likely that we have b/B... or alternate 1 for ED.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - the upper trend line was hit one more time and price turned lower. If wave B is finished price should drop lower whole week and close around the lows for 1/C.

DJ a little bit more clear picture - the pattern looks way too much like impulse and a-b-c. The same pattern shows RSI - it says the top for wave 5 was in July not in August(broken trend line and test of the break)followed by two legs lower.

Intermediate term - the indicators with divergences so something lower is coming... watch the price behavior next week.

Alternate scenario if the bears disappoint - one more high for the yellow scenario and more likely something else 1 of ED than B... it will take too long for B.

Long term - the indexes are nearing an intermediate term top and decline until October should follow for 18 month cycle low. I do not think we have major top... and the bottom for wave 4 is still not 100% clear.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same.... weakness and divergences. After 6 weeks 170 points rally most indicators can not move into overbought territory and some of them with divergences.

McClellan Oscillator - below zero.

McClellan Summation Index - lower high and divergence.

Weekly Stochastic of the Summation Index - in overbought territory,but no reversal.

Bullish Percentage - made a new high, but below 70.

Percent of Stocks above MA50 - lower highs below 75.

Fear Indicator VIX - a lot of complacency and sharp reversal.

Advance-Decline Issues - lower high, but still holding around the middle of the range.

HURST CYCLES

Day 30 for the 40 day cycle.... the cycle is strong right translated the odds favor another higher high.

Week 6 for the 20 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Day 12 for a countdown, one more high is needed for the countdown to be finished.

Short term - the upper trend line was hit one more time and price turned lower. If wave B is finished price should drop lower whole week and close around the lows for 1/C.

DJ a little bit more clear picture - the pattern looks way too much like impulse and a-b-c. The same pattern shows RSI - it says the top for wave 5 was in July not in August(broken trend line and test of the break)followed by two legs lower.

Intermediate term - the indicators with divergences so something lower is coming... watch the price behavior next week.

Alternate scenario if the bears disappoint - one more high for the yellow scenario and more likely something else 1 of ED than B... it will take too long for B.

Long term - the indexes are nearing an intermediate term top and decline until October should follow for 18 month cycle low. I do not think we have major top... and the bottom for wave 4 is still not 100% clear.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same.... weakness and divergences. After 6 weeks 170 points rally most indicators can not move into overbought territory and some of them with divergences.

McClellan Oscillator - below zero.

McClellan Summation Index - lower high and divergence.

Weekly Stochastic of the Summation Index - in overbought territory,but no reversal.

Bullish Percentage - made a new high, but below 70.

Percent of Stocks above MA50 - lower highs below 75.

Fear Indicator VIX - a lot of complacency and sharp reversal.

Advance-Decline Issues - lower high, but still holding around the middle of the range.

HURST CYCLES

Day 30 for the 40 day cycle.... the cycle is strong right translated the odds favor another higher high.

Week 6 for the 20 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Day 12 for a countdown, one more high is needed for the countdown to be finished.

Aug 4, 2018

Weekly preview

We have a pullback as expected.... there is a lot of discussions if it is finished or not. I am showing two variations of the B wave and now we are watching closely which one plays out.

Focus on the big picture - no matter which one plays out the next big move is lower namely 8%-10%.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - SP500 with impulse lower DJ with zig-zag.... is it wave 4 red or zig-zag b yellow? I can not give an answer with high probability. I can only say one more leg lower for the pullback will feel better.

Intermediate term - two zig-zags for wave B yellow from the weekend and wave B red with two impulses from the update.

Long term - this up leg should be nearing its end. After that we should see a sell off testing the trend line. There is a high probability that this will be the low for wave 4 from the Feb.2016 low and 18 month cycle low.

MARKET BREADTH INDICATORS

Market Breadth Indicators - no change bearish despite the 150 points rally double tops and divergences.

McClellan Oscillator - below zero.

McClellan Summation Index - pointing lower with divergence.

SP500 Weekly Stochastic of the Summation Index - heading higher for another top.

Bullish Percentage - double top.

Percent of Stocks above MA50 - two tops below 75, can not move in overbought territory - sign of weakness.

Fear Indicator VIX - complacency again I do not expect to see it at 10.

Advance-Decline Issues - in the middle of the range.

HURST CYCLES

Day 24 of the 40 day cycle.

Week 5 of the 20 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Count down running at 9.

Short term - SP500 with impulse lower DJ with zig-zag.... is it wave 4 red or zig-zag b yellow? I can not give an answer with high probability. I can only say one more leg lower for the pullback will feel better.

Intermediate term - two zig-zags for wave B yellow from the weekend and wave B red with two impulses from the update.

Long term - this up leg should be nearing its end. After that we should see a sell off testing the trend line. There is a high probability that this will be the low for wave 4 from the Feb.2016 low and 18 month cycle low.

MARKET BREADTH INDICATORS

Market Breadth Indicators - no change bearish despite the 150 points rally double tops and divergences.

McClellan Oscillator - below zero.

McClellan Summation Index - pointing lower with divergence.

SP500 Weekly Stochastic of the Summation Index - heading higher for another top.

Bullish Percentage - double top.

Percent of Stocks above MA50 - two tops below 75, can not move in overbought territory - sign of weakness.

Fear Indicator VIX - complacency again I do not expect to see it at 10.

Advance-Decline Issues - in the middle of the range.

HURST CYCLES

Day 24 of the 40 day cycle.

Week 5 of the 20 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Count down running at 9.

Aug 1, 2018

Update

I have overlooked one possible pattern. If we see a deeper pullback bellow the support zone 2770-2790 to around MA200 than B is over and C is running. I have small short position just in case:)

Subscribe to:

Posts (Atom)