Maybe you do not remember, when we saw this two days decline early December I wrote it is strange it does not really fit like w4 from the October low.... but I just follow the herd. Now we have the next wave which is way too big to be w5 from the October low.... and if you accept that they are from different degree everything makes sense.

I think we have impulse for c/B which begun late August and not in October - changed the counts accordingly below.

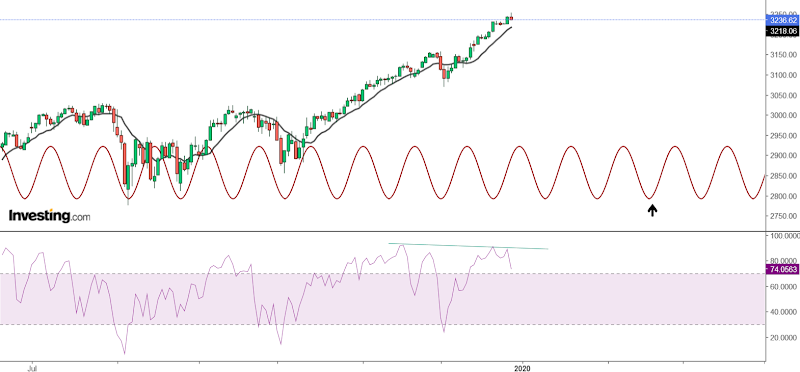

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - from October you have extended w3 2,618 so we should not have another extended wave. It is taking too long time and price so I think we have a wave from early December currently iii/5/c/B.

Of course any move lower should be corrective and stay in the channel and above support or the the wave from December is finished.

Intermediate term - small down and up will finish this fifth wave and give time for topping and short term divergences for the indicators and market breadth. Even MACD and RSI count like five waves from the August low:)

Long term - the top of wave B in 1-2 weeks, then expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - market breadth has not been reset so that the trend can re-energize for another long lasting rally, market breadth is still showing long term divergence. Fear&greed with extreme again 93-94.

McClellan Oscillator - above zero, short term lower high.

McClellan Summation Index - buy signal, with divergence.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal and divergence.

Percent of Stocks above MA50 - buy signal and divergences.

Fear Indicator VIX - higher low and divergence.

Advance-Decline Issues - lower high and divergence.

HURST CYCLES

Daily/trading cycle - it is up, the price is above MA10 and RSI above MA18 and above the respective trend lines.

Hurst cycles - three days sideways move for 14 day low(20 day Hurst cycle) and the next one is running, watching mid-February or early March for important low.

Week 12 for the 20 week cycle.... it takes too long for a 20w cycle from August.

Dec 28, 2019

Dec 21, 2019

Weekly preview

Two weeks higher as expected. We have full set of waves and I think this is 5/c/B completed... now waiting for reversal signs. I am short SP500 and crude oil, do not do like me wait for confirmation.

The current top is different compared to the previous two - the market sucked in everybody, the whole spectrum from the usual trolls, amateurs with their third wave, "smart" long term investors, maybe experienced traders with their models, "experts" with their paid subscription. Judging by the comments everybody joined the herd and the herd gone mad:) Everybody shouting in my face idiot you are wrong:). I have not seen such level of mass stupidity, at least not on my blog. Good luck to all of you, you will gone need it and we will see at 2200 next year.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - strange this last wave 5 looks like impulse with zig-zags... wave 3 is extended 2,618 usually in this case you have 5=1, but the market wants to extend to the max obviously and the trend line was hit one more time with 5=1,618x1. For the rest of the year support and the trend line should be tested and a bounce into year end.

The only wave to extend even more is to count this ii and now iii/5.... not my preferred count.

Intermediate term - exhaustion gap, I want be surprised to see open lower next week. MACD/RSI 5 waves higher too and divergence. For me this is the top of c/B.

Long term - the top of wave B, expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - somewhat improved, but nothing more than making room to absorb the coming decline. Market breadth has not been reset so that the trend can re-energize for another long lasting rally, market breadth is still showing long term divergence.

McClellan Oscillator - above zero, interesting it was negative on Friday.

McClellan Summation Index - buy signal with lower highs.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal.

Percent of Stocks above MA50 - buy signal.

Fear Indicator VIX - higher low and divergence.

Advance-Decline Issues - lower high and divergence.

HURST CYCLES

Daily/trading cycle - it is up, the price is above MA10 and RSI above MA18 and above the respective trend lines.

Week 11 or 17 for the 20 week cycle.

I have changed the chart - this one is more trading oriented with MA10 and RSI like the one above and gives better perspective for timing - tops and bottoms. My biggest mistake this year was timing not EW and I am looking how to improve it.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

At the same time on both charts daily and weekly we have finished sell setup and on both charts 9-13-9 sequence. Usually when such thing appears on both charts you have a strong signal.... confirming the EW pattern a high, fascinating:)

Short term - strange this last wave 5 looks like impulse with zig-zags... wave 3 is extended 2,618 usually in this case you have 5=1, but the market wants to extend to the max obviously and the trend line was hit one more time with 5=1,618x1. For the rest of the year support and the trend line should be tested and a bounce into year end.

The only wave to extend even more is to count this ii and now iii/5.... not my preferred count.

Intermediate term - exhaustion gap, I want be surprised to see open lower next week. MACD/RSI 5 waves higher too and divergence. For me this is the top of c/B.

Long term - the top of wave B, expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

MARKET BREADTH INDICATORS

Market Breadth Indicators - somewhat improved, but nothing more than making room to absorb the coming decline. Market breadth has not been reset so that the trend can re-energize for another long lasting rally, market breadth is still showing long term divergence.

McClellan Oscillator - above zero, interesting it was negative on Friday.

McClellan Summation Index - buy signal with lower highs.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal.

Percent of Stocks above MA50 - buy signal.

Fear Indicator VIX - higher low and divergence.

Advance-Decline Issues - lower high and divergence.

HURST CYCLES

Daily/trading cycle - it is up, the price is above MA10 and RSI above MA18 and above the respective trend lines.

Week 11 or 17 for the 20 week cycle.

I have changed the chart - this one is more trading oriented with MA10 and RSI like the one above and gives better perspective for timing - tops and bottoms. My biggest mistake this year was timing not EW and I am looking how to improve it.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

At the same time on both charts daily and weekly we have finished sell setup and on both charts 9-13-9 sequence. Usually when such thing appears on both charts you have a strong signal.... confirming the EW pattern a high, fascinating:)

Dec 14, 2019

Weekly preview

We saw corrective moves this week as expected so I still think that ED is running and most likely we saw wave iii/5. Looking at Europe,Japan,EEM I see the same everywhere - iii/5/c/B. The markets are close to the top for this move up from the Dec.2018 low.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - wave iii for the ED. Confirmation for reversal is a move below 3130 - support and the trend line. MACD and RSI with divergences - this is a top.

Intermediate term - the trend line touched one more time. MACD and RSI with divergences. According to my EW count the index is completing impulse from the October low and most likely this is c/B... or c/y/B it does not matter much.

Long term - close to the top of wave B. When it is finished expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - short term turned up, but nothing bullish the same old multiple divergences. The indicators has not been reset to suggest important low.

McClellan Oscillator - above zero with divergences.

McClellan Summation Index - turned up with divergences.

Weekly Stochastic of the Summation Index - in the oversold area.

Bullish Percentage - turned up, multiple divergences.

Percent of Stocks above MA50 - turned up, multiple divergences.

Fear Indicator VIX - higher lows and building divergences.

Advance-Decline Issues - in the middle of the range with divergences.

HURST CYCLES

Daily cycle trading - we have a cycle moving higher the price is above MA10 and RSI above MA18. For a short trade I want to see failed left translated cycle and RSI divergence.

Hurst cycles - the sine wave is 14 trading days long which corresponds to 20 day Hurst cycle. For the last several months it is running with pretty high accuracy. From the late August low you have 5 such cycles, from the October low 3 cycles. Neither bottoms is perfect for 80day/10w cycle low which needs 4x14 cycles. For now I will stick to my cycle count and I expect 20w cycle low the end of January(the arrow) with 8x14 cycles which corresponds to 2x80 daily cycles or one 20 week cycle.

Week 16, if we see a reversal next week I will stick to my cycle phasing, if we see continuation for another 1-2 or more weeks I have to change it to a 40w cycle low in October.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Week 8 for the sell setup. If the next week closes above 3110 we will have finished sell setup and 9-13-9 sequence from the Dec.2018 low.

Short term - wave iii for the ED. Confirmation for reversal is a move below 3130 - support and the trend line. MACD and RSI with divergences - this is a top.

Intermediate term - the trend line touched one more time. MACD and RSI with divergences. According to my EW count the index is completing impulse from the October low and most likely this is c/B... or c/y/B it does not matter much.

Long term - close to the top of wave B. When it is finished expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - short term turned up, but nothing bullish the same old multiple divergences. The indicators has not been reset to suggest important low.

McClellan Oscillator - above zero with divergences.

McClellan Summation Index - turned up with divergences.

Weekly Stochastic of the Summation Index - in the oversold area.

Bullish Percentage - turned up, multiple divergences.

Percent of Stocks above MA50 - turned up, multiple divergences.

Fear Indicator VIX - higher lows and building divergences.

Advance-Decline Issues - in the middle of the range with divergences.

HURST CYCLES

Daily cycle trading - we have a cycle moving higher the price is above MA10 and RSI above MA18. For a short trade I want to see failed left translated cycle and RSI divergence.

Hurst cycles - the sine wave is 14 trading days long which corresponds to 20 day Hurst cycle. For the last several months it is running with pretty high accuracy. From the late August low you have 5 such cycles, from the October low 3 cycles. Neither bottoms is perfect for 80day/10w cycle low which needs 4x14 cycles. For now I will stick to my cycle count and I expect 20w cycle low the end of January(the arrow) with 8x14 cycles which corresponds to 2x80 daily cycles or one 20 week cycle.

Week 16, if we see a reversal next week I will stick to my cycle phasing, if we see continuation for another 1-2 or more weeks I have to change it to a 40w cycle low in October.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Week 8 for the sell setup. If the next week closes above 3110 we will have finished sell setup and 9-13-9 sequence from the Dec.2018 low.

Dec 7, 2019

Weekly preview

Volatile moves with a zig-zag lower, zig-zag higher and flat for the week. The pattern which makes most sense to me is to count another w4 and ED to complete the move from October and the whole B wave from Dec.2018. In this case expect another two weeks and 30 points higher for the ED to be completed - the Christmas rally. This will be great Christmas present if we see a high with ED - probably the most reliable pattern.

P.S. When I write the analysis my assumption is that the reader/trader has some trading system and rules for entry/exit point.

Obviously this is not the case for many and there is confusion about analysis,trading,trading plan,entry points. When I draw some line lower/higher this is not a trade. That is why on the daily cycle chart I will focus on trading with simple trading system, which should help beginners and clear the confusion analysis<->trading.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - with some creativity ignoring upper trend line and candle shadow you can draw another trend line and count w4. The move up is another zig-zag so most likely ED.

Alternate scenarios are flat or triangle, but then the creativity will not help... the correction will be too big to be part of this rally.

Intermediate term - expect two more touches of the the trend line in the next two weeks before the ED is completed. The indicators - just more divergences, one day and a half is too short to reset the indicators and erase the divergences. This is not an important low so that the indexes can re-energize and continue higher, this is topping.

I find it interesting if you count w-x-y as shown on the chart you have a cluster of three different Fibo measurements in the same area. Such a cluster shows with very high probability the target area for a move and on top of this the count and measurements work for SP500/DJI/NYSE/NDX... fascinating, isn't it:)

Long term - close to the top of wave B. When it is finished expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - very weak for a long time and going nowhere with multiple divergences.

McClellan Oscillator - above zero with multiple divergences.

McClellan Summation Index - sell signal with multiple divergences.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - at the overbought level with multiple divergences.

Percent of Stocks above MA50 - at the overbought level with multiple divergences.

Fear Indicator VIX - spike higher as expected and now the low is tested, right on time for divergence and important high.

Advance-Decline Issues - in the middle of the range, preparing for another divergence.

HURST CYCLES

From now on I will focus on the cycle which I call daily cycle and stop mixing with Hurst cycles. This daily cycle is not Hurst cycle. Sometimes it corresponds to 80 day Hurst cycle sometimes not. It's focus is trading, it does not care about theory for example Hurst cycles if we have 40w low in August or October or EW what pattern we have etc. It is simple, objective and effective - above MA10 is up, below MA10 is down. The idea is for traders without experience to stay on the right side of the trade:) and to make difference between analysis and trading. I explain over and over that drawing some line up or down is not a trade and I hear all the time - missed the move, wrong all the time, lost money because of you etc.

Daily cycle trading - the price broke below the trend line and MA10, RSI broke below the trend line and MA18. We have strong right translated cycle and we should expect one more higher high and "failed"(left translated) cycle. Usually a strong move is followed by higher high and a cycle which makes a top early and reverses(left translated).

The price/RSI moved above the the trend line and MAs and it seems the next daily cycle begun. My positioning now is - waiting.

Monthly chart - the 4 year cycle consists according to the nominal Hurst model of 54 months and November was month 54. The indices are at 4 year cycle high - this is for those who think that the indices are going to accelerate north.... good luck with that.

Monthly chart TA look - bearish rising wedge, RSI broken trend line and testing it for the second time with double divergence again all this on monthly chart - the writing is on the wall.... for those who can read it.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Weekly chart sell setup at 7, add two weeks for the ED and you have 9.... fascinating, isn't it:)

Short term - with some creativity ignoring upper trend line and candle shadow you can draw another trend line and count w4. The move up is another zig-zag so most likely ED.

Alternate scenarios are flat or triangle, but then the creativity will not help... the correction will be too big to be part of this rally.

Intermediate term - expect two more touches of the the trend line in the next two weeks before the ED is completed. The indicators - just more divergences, one day and a half is too short to reset the indicators and erase the divergences. This is not an important low so that the indexes can re-energize and continue higher, this is topping.

I find it interesting if you count w-x-y as shown on the chart you have a cluster of three different Fibo measurements in the same area. Such a cluster shows with very high probability the target area for a move and on top of this the count and measurements work for SP500/DJI/NYSE/NDX... fascinating, isn't it:)

Long term - close to the top of wave B. When it is finished expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - very weak for a long time and going nowhere with multiple divergences.

McClellan Oscillator - above zero with multiple divergences.

McClellan Summation Index - sell signal with multiple divergences.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - at the overbought level with multiple divergences.

Percent of Stocks above MA50 - at the overbought level with multiple divergences.

Fear Indicator VIX - spike higher as expected and now the low is tested, right on time for divergence and important high.

Advance-Decline Issues - in the middle of the range, preparing for another divergence.

HURST CYCLES

From now on I will focus on the cycle which I call daily cycle and stop mixing with Hurst cycles. This daily cycle is not Hurst cycle. Sometimes it corresponds to 80 day Hurst cycle sometimes not. It's focus is trading, it does not care about theory for example Hurst cycles if we have 40w low in August or October or EW what pattern we have etc. It is simple, objective and effective - above MA10 is up, below MA10 is down. The idea is for traders without experience to stay on the right side of the trade:) and to make difference between analysis and trading. I explain over and over that drawing some line up or down is not a trade and I hear all the time - missed the move, wrong all the time, lost money because of you etc.

Daily cycle trading - the price broke below the trend line and MA10, RSI broke below the trend line and MA18. We have strong right translated cycle and we should expect one more higher high and "failed"(left translated) cycle. Usually a strong move is followed by higher high and a cycle which makes a top early and reverses(left translated).

The price/RSI moved above the the trend line and MAs and it seems the next daily cycle begun. My positioning now is - waiting.

Monthly chart - the 4 year cycle consists according to the nominal Hurst model of 54 months and November was month 54. The indices are at 4 year cycle high - this is for those who think that the indices are going to accelerate north.... good luck with that.

Monthly chart TA look - bearish rising wedge, RSI broken trend line and testing it for the second time with double divergence again all this on monthly chart - the writing is on the wall.... for those who can read it.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Weekly chart sell setup at 7, add two weeks for the ED and you have 9.... fascinating, isn't it:)

Nov 30, 2019

Weekly preview

We have the final wave for the leg higher from the October low, now we should see the indexes decline at least to MA50 on the daily chart. We still need confirmation on Monday for reversal, but looking crude oil and the pattern for RUT it is more likely that the rally from October is finished.

My opinion is clear this is the high of wave B of a big correction which begun in Jan.2018 and it will be completed with one more leg lower around mid-2020.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - no matter how you count - impulse,impulse with extended fifth wave or a-b-c all this patterns are complete now and we should see decline starting next week. Confirmation is break of the trend line and move below 3090.

Intermediate term - one more touch of the trend line like July, MACD adding short term divergence to the multiple intermediate term divergences, RSI testing the broken trend line.

Next we should see decline to MA50 or MA200 to test one of the support levels. This wave lower with its size and shape will give us more information what is going on.

Long term - at the top of wave B. Expect sell off to begin and to continue into Q2.2020 to complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same weak with multiple divergences.

McClellan Oscillator - above zero with multiple divergences.

McClellan Summation Index - sell signal with multiple divergences.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - at the overbought level with multiple divergences.

Percent of Stocks above MA50 - at the overbought level with multiple divergences.

Fear Indicator VIX - expect sharp rise higher after building base for a while.

Advance-Decline Issues - in the middle of the range with multiple divergences.

HURST CYCLES

Day 6 for the second daily cycle.

Week 14 for the 20 week cycle.

Short term - no matter how you count - impulse,impulse with extended fifth wave or a-b-c all this patterns are complete now and we should see decline starting next week. Confirmation is break of the trend line and move below 3090.

Intermediate term - one more touch of the trend line like July, MACD adding short term divergence to the multiple intermediate term divergences, RSI testing the broken trend line.

Next we should see decline to MA50 or MA200 to test one of the support levels. This wave lower with its size and shape will give us more information what is going on.

Long term - at the top of wave B. Expect sell off to begin and to continue into Q2.2020 to complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same weak with multiple divergences.

McClellan Oscillator - above zero with multiple divergences.

McClellan Summation Index - sell signal with multiple divergences.

Weekly Stochastic of the Summation Index - sell signal.

Bullish Percentage - at the overbought level with multiple divergences.

Percent of Stocks above MA50 - at the overbought level with multiple divergences.

Fear Indicator VIX - expect sharp rise higher after building base for a while.

Advance-Decline Issues - in the middle of the range with multiple divergences.

HURST CYCLES

Day 6 for the second daily cycle.

Week 14 for the 20 week cycle.

Nov 23, 2019

Weekly preview

Lower but we do not have an impulse yet to confirm reversal. I think reversal fits better, but until we see confirmation we have to assume that one more high is possible.... maybe something like the July high - one more touch of the trend line(see the daily chart).

The big picture is the same - I expect important high wave c/B to be completed and the final wave lower in to mid-2020 to finish the correction. Disclaimer: all this below are just fancy looking colorful pictures for fun:) Do not trade based on them. Do not blame me for your trades. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - if you think this is an "impulse" w4 is now running with one more high for w5. The price action the last three days is very choppy and overlapping and I do not see how this is a turn up again, more likely another move lower. As long as the price stays in the channel it is possible that this is c/4, but if the channel is broken we have reversal.

My feeling tells me this is not the right pattern. This count does not fit well with DJ and NDX and the message from RSI(see DJ below). This second part of the rally looks bigger and stronger creating the illusion for a third wave, when in fact it just takes longer and has the same size.

For DJ counting an impulse does not work so good - this is classical a-b-c pattern with "a" as a zig-zag, "c" as an impulse and a=c... or some are counting fifth extended wave(yellow). For this counts one more high does not look so good because you need small wave iv of c or 5 an it takes already too long. RSI says the movfe from the October low is finished we have broken trend line which is tested now.

Intermediate term - RSI hit overbought level and broke the trend line so either we have a top or one more touch of the trend line with divergences like in July. There is no more third waves or extensions what ever. We have three consecutive higher highs and MACD with lower highs multiple divergence, I do not see how this is not a top.

I explained above that this is probably corrective leg so in this case you can count expanding ED for c/B... better visible on the futures. This pattern is extremely seldom, I call it unicorn:) I have never seen one maybe this is the first time.

Long term - we are nearing the top of wave B and sell off into Q2.2020 should complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - weak and turned lower again.

McClellan Oscillator - below zero.

McClellan Summation Index - sell signal with divergences.

Weekly Stochastic of the Summation Index - sell signal with divergences.

Bullish Percentage - turned lower with divergences.

Percent of Stocks above MA50 - turned lower with divergences.

Fear Indicator VIX - building a base, spike higher expected.

Advance-Decline Issues - heading lower no signs of strength.

HURST CYCLES

Day 63, RSI and price broke the trend line and RSI broke below MA18 signaling daily cycle turning lower.

Week 13 for the 20 week cycle.

The big picture is the same - I expect important high wave c/B to be completed and the final wave lower in to mid-2020 to finish the correction. Disclaimer: all this below are just fancy looking colorful pictures for fun:) Do not trade based on them. Do not blame me for your trades. TECHNICAL PICTURE and ELLIOTT WAVES

Short term - if you think this is an "impulse" w4 is now running with one more high for w5. The price action the last three days is very choppy and overlapping and I do not see how this is a turn up again, more likely another move lower. As long as the price stays in the channel it is possible that this is c/4, but if the channel is broken we have reversal.

My feeling tells me this is not the right pattern. This count does not fit well with DJ and NDX and the message from RSI(see DJ below). This second part of the rally looks bigger and stronger creating the illusion for a third wave, when in fact it just takes longer and has the same size.

For DJ counting an impulse does not work so good - this is classical a-b-c pattern with "a" as a zig-zag, "c" as an impulse and a=c... or some are counting fifth extended wave(yellow). For this counts one more high does not look so good because you need small wave iv of c or 5 an it takes already too long. RSI says the movfe from the October low is finished we have broken trend line which is tested now.

Intermediate term - RSI hit overbought level and broke the trend line so either we have a top or one more touch of the trend line with divergences like in July. There is no more third waves or extensions what ever. We have three consecutive higher highs and MACD with lower highs multiple divergence, I do not see how this is not a top.

I explained above that this is probably corrective leg so in this case you can count expanding ED for c/B... better visible on the futures. This pattern is extremely seldom, I call it unicorn:) I have never seen one maybe this is the first time.

Long term - we are nearing the top of wave B and sell off into Q2.2020 should complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MARKET BREADTH INDICATORS

Market Breadth Indicators - weak and turned lower again.

McClellan Oscillator - below zero.

McClellan Summation Index - sell signal with divergences.

Weekly Stochastic of the Summation Index - sell signal with divergences.

Bullish Percentage - turned lower with divergences.

Percent of Stocks above MA50 - turned lower with divergences.

Fear Indicator VIX - building a base, spike higher expected.

Advance-Decline Issues - heading lower no signs of strength.

HURST CYCLES

Day 63, RSI and price broke the trend line and RSI broke below MA18 signaling daily cycle turning lower.

Week 13 for the 20 week cycle.

Nov 16, 2019

Weekly preview

Now we have the last two missing waves and the move from the October low looks complete. Next we should see move lower. The odds are high that this is the top for the rally from Dec.2018... I see so many indexes and shares with completed patterns. Confirmation will be an impulse lower at least to MA50

Some explanation - even with reversal the indexes will not plunge 200 points next week. There will be several entry points. First the indexes are well above MA50 and MA200 which means after the first leg lower i/1/C expect higher in December for ii/1/C. Second after the first wave lower is finished there will be a big bounce at least 2/3 for wave 2/C.

Wait for confirmation - ii/1/C or 2/C. The most profitable trade will be next year 3/C or c/Y what ever. This way you will not be caught on the wrong side.

Disclaimer: all this below are just fancy looking colorful pictures for fun:) Do not trade based on them. Do not blame me for your trades.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - wave 4 played out as a sideway move triangle lasting whole week followed by final burst higher. There is enough waves to count impulse for w5. Now waiting to see what happens next week. Brake below the trend line will confirm that the move from the October low is finished.

Intermediate term - the main scenario is important high w-x-y/B. The only way to extend the move higher is ED for c/B. This is the alternate scenario if we see only a zig-zag lower. In both cases next the indexes should test MA50 at least.

Impulse will mean reversal zig-zag more to he upside.

Long term - we are nearing the top of wave B and sell off into Q2.2020 should complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MACD and RSI - multiple divergences, third higher high with the indicators showing lower high.... smells like a top.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same... weak with multiple divergences.

McClellan Oscillator - below zero with multiple divergences despite the indexes "flying" higher.

McClellan Summation Index - multiple divergences, turned lower and sell signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - scratching the overbought level with multiple divergences.

Percent of Stocks above MA50 - scratching the overbought level with multiple divergences.

Fear Indicator VIX - bottoming, next we should see spike higher.

Advance-Decline Issues - weak in the middle of the range.

HURST CYCLES

Day 58, something lower expected.

Week 12 for the 20 week cycle. After a 40w cycle low I was expecting 3 months higher - now we have this three months. We should see a top soon.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Right on time for a high we have completed countdown. Early signal for reversal is price flip or close below 3080 at the moment.

Short term - wave 4 played out as a sideway move triangle lasting whole week followed by final burst higher. There is enough waves to count impulse for w5. Now waiting to see what happens next week. Brake below the trend line will confirm that the move from the October low is finished.

Intermediate term - the main scenario is important high w-x-y/B. The only way to extend the move higher is ED for c/B. This is the alternate scenario if we see only a zig-zag lower. In both cases next the indexes should test MA50 at least.

Impulse will mean reversal zig-zag more to he upside.

Long term - we are nearing the top of wave B and sell off into Q2.2020 should complete the correction which begun in January 2018. Alternate scenario a decline in three waves, but still a decline.

MACD and RSI - multiple divergences, third higher high with the indicators showing lower high.... smells like a top.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same... weak with multiple divergences.

McClellan Oscillator - below zero with multiple divergences despite the indexes "flying" higher.

McClellan Summation Index - multiple divergences, turned lower and sell signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - scratching the overbought level with multiple divergences.

Percent of Stocks above MA50 - scratching the overbought level with multiple divergences.

Fear Indicator VIX - bottoming, next we should see spike higher.

Advance-Decline Issues - weak in the middle of the range.

HURST CYCLES

Day 58, something lower expected.

Week 12 for the 20 week cycle. After a 40w cycle low I was expecting 3 months higher - now we have this three months. We should see a top soon.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Right on time for a high we have completed countdown. Early signal for reversal is price flip or close below 3080 at the moment.

Nov 9, 2019

Weekly preview

Now we know with very high probability that 40w low and b/B are behind us and the final wave from B is running.

What I see is a zig-zag higher from the August low... it does not really fit like 1-2-3. In this case we have w-x-y for B, alternate we have b/B early October and now c/B running. Looking other indexes DAX or NIKKEI for example and some shares the pattern is more likely w-x-y.

The bulls will disagree:) the bullish cases - 1-2 i-ii market breadth with multiple divergences and extreme sentiment does not support this case, w1 big triangle and now i/3... such shallow triangles are wave b not 2 and there is no triangle in the first place.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - I think we have zig-zag from the August low for y/B. For wave c ideally we should see a few days lower for 4 and another high to finish c/y/B.

Intermediate term - the two options which I have explained w-x-y/B or a-b-c/B, it is the same at the end.

A lot of divergences so I discard bullish patterns - we have three higher highs in a row and for each one MACD/RSI are making lower high. This is not bullish break out, this is a top around the corner.

By the way time looks interesting too - w/x/y from B have similar length 3-4 months each so balanced pattern. Even more interesting A/B have exactly the same length around the end of November.

Long term - the big picture is not changed, we are nearing the top of wave B and sell off into Q2.2020 should complete the correction which begun in January 2018.

I do not see how the price will go vertical to erase the divergences. The sentiment is already at extreme which you see short before the top and not at the beginning.

MARKET BREADTH INDICATORS

Market Breadth Indicators - nothing new weak with divergences, some turned lower, and extreme bullish sentiment Fear&Greed index at 91.

McClellan Oscillator - with divergences and below zero despite the indexes showing "strength".

McClellan Summation Index - buy signal with multiple divergences.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - trying to touch the overbought level, multiple divergences.

Percent of Stocks above MA50 - turned lower with divergences.

Fear Indicator VIX - staying between 12-13, probably we will see spike higher and higher low.

Advance-Decline Issues - pointing lower, no signs of strength.

HURST CYCLES

The charts adjusted for 40w low in August. It is questionable, but in October my indicators tell me this is one big nothing and indexes like DAX/NIKK with clear low in August so I have chosen August for 40w low. I explained once 35w is average length so it is ok. Do not try to find symmetry - most of the time you will be disappointed. It does not work this way probably that is why many think that cycles does not work:)

Day 53, decline for a few days should finish this daily cycle(80d or 10w Hurst cycle) and 2-3 weeks higher from the next 10w cycle before bigger sell off.

Week 11 for the 20 week cycle.

Short term - I think we have zig-zag from the August low for y/B. For wave c ideally we should see a few days lower for 4 and another high to finish c/y/B.

Intermediate term - the two options which I have explained w-x-y/B or a-b-c/B, it is the same at the end.

A lot of divergences so I discard bullish patterns - we have three higher highs in a row and for each one MACD/RSI are making lower high. This is not bullish break out, this is a top around the corner.

By the way time looks interesting too - w/x/y from B have similar length 3-4 months each so balanced pattern. Even more interesting A/B have exactly the same length around the end of November.

Long term - the big picture is not changed, we are nearing the top of wave B and sell off into Q2.2020 should complete the correction which begun in January 2018.

I do not see how the price will go vertical to erase the divergences. The sentiment is already at extreme which you see short before the top and not at the beginning.

MARKET BREADTH INDICATORS

Market Breadth Indicators - nothing new weak with divergences, some turned lower, and extreme bullish sentiment Fear&Greed index at 91.

McClellan Oscillator - with divergences and below zero despite the indexes showing "strength".

McClellan Summation Index - buy signal with multiple divergences.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - trying to touch the overbought level, multiple divergences.

Percent of Stocks above MA50 - turned lower with divergences.

Fear Indicator VIX - staying between 12-13, probably we will see spike higher and higher low.

Advance-Decline Issues - pointing lower, no signs of strength.

HURST CYCLES

The charts adjusted for 40w low in August. It is questionable, but in October my indicators tell me this is one big nothing and indexes like DAX/NIKK with clear low in August so I have chosen August for 40w low. I explained once 35w is average length so it is ok. Do not try to find symmetry - most of the time you will be disappointed. It does not work this way probably that is why many think that cycles does not work:)

Day 53, decline for a few days should finish this daily cycle(80d or 10w Hurst cycle) and 2-3 weeks higher from the next 10w cycle before bigger sell off.

Week 11 for the 20 week cycle.

Nov 2, 2019

Weekly preview

Final waves 4 and 5 were missing and this week not only SP500 all indexes were busy completing the pattern even DJI despite the weakness made a high above the September high for valid a-b-c from the August low. Only RUT is lagging a little bit, but no problem to complete the pattern on Monday. Now we have enough waves for complete pattern, indicators with divergences, weak market breadth and extreme greed so I expect reversal next week.

The big picture - no change I expect to see sell off to around 2780 to finish b/B.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - from August I see two legs higher with the same size so this is a-b-c for me.

If we have w4 this week the final w5 could extend another day or two next week. This count would be similar to RUT or XLF with normal size w3=1,618x1, on the other side NDX and DJI have too big declines in middle and in this case this should be the final v/5 - difficult to say which one.

MACD and RSI with divergences confirming that the fifth wave is running.

Intermediate term - I see completed a-b-c higher with divergences so next we should see move lower. The same pattern which I follow for weeks - corrective b wave and sell off to finish b/B .

Long term - at the moment I expect a correction to be finished in November. Then a rally for 3 months followed by final sell off to finish the correction which begun in 2018. There is too many alternate scenarios I will think about them if we did not see a sell off in November.

MARKET BREADTH INDICATORS

Market Breadth Indicators - are pointing higher, but showing weakness and divergences. Fear&Greed index showing extreme greed. The overall look is like for intermediate term high.

McClellan Oscillator - very weak with short term and intermediate term divergences.

McClellan Summation Index - buy signal, but with divergence.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - pointing higher, but multiple divergences not confirming new ATH.

Percent of Stocks above MA50 - pointing higher, but multiple divergences not confirming new ATH.

Fear Indicator VIX - the impulse lower to around 12 to touch the trend line was completed, now we should see spike higher.

Advance-Decline Issues - weak, could not reach overbought reading, divergences - not confirming new ATH.

HURST CYCLES

The next few weeks should show at last where to place the important low. For 40 week cycle low we should see strong sell off lasting 2-3 weeks below the August lows.

Day 55 turn lower is overdue.

Week 22 expect sharp sell off for 2-3 weeks. If we have 40 week cycle low the price should move below the August lows. For 40 week cycle low in August and daily cycle low/10 week cycle low the price should stay above the August lows.

To continue from last week with another two indexes with different pattern, but sending the same message - the most likely scenario is sell off for b/B. Very choppy declines for RUT and DJT, difficult to imagine that this is reversal. The w-x-y top theory does not work either.

IWM(RUT) one more push next week for a high above the September high will look perfect.

DJT already reversed with impulse lower and bouncing from MA50.

Short term - from August I see two legs higher with the same size so this is a-b-c for me.

If we have w4 this week the final w5 could extend another day or two next week. This count would be similar to RUT or XLF with normal size w3=1,618x1, on the other side NDX and DJI have too big declines in middle and in this case this should be the final v/5 - difficult to say which one.

MACD and RSI with divergences confirming that the fifth wave is running.

Intermediate term - I see completed a-b-c higher with divergences so next we should see move lower. The same pattern which I follow for weeks - corrective b wave and sell off to finish b/B .

Long term - at the moment I expect a correction to be finished in November. Then a rally for 3 months followed by final sell off to finish the correction which begun in 2018. There is too many alternate scenarios I will think about them if we did not see a sell off in November.

MARKET BREADTH INDICATORS

Market Breadth Indicators - are pointing higher, but showing weakness and divergences. Fear&Greed index showing extreme greed. The overall look is like for intermediate term high.

McClellan Oscillator - very weak with short term and intermediate term divergences.

McClellan Summation Index - buy signal, but with divergence.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - pointing higher, but multiple divergences not confirming new ATH.

Percent of Stocks above MA50 - pointing higher, but multiple divergences not confirming new ATH.

Fear Indicator VIX - the impulse lower to around 12 to touch the trend line was completed, now we should see spike higher.

Advance-Decline Issues - weak, could not reach overbought reading, divergences - not confirming new ATH.

HURST CYCLES

The next few weeks should show at last where to place the important low. For 40 week cycle low we should see strong sell off lasting 2-3 weeks below the August lows.

Day 55 turn lower is overdue.

Week 22 expect sharp sell off for 2-3 weeks. If we have 40 week cycle low the price should move below the August lows. For 40 week cycle low in August and daily cycle low/10 week cycle low the price should stay above the August lows.

To continue from last week with another two indexes with different pattern, but sending the same message - the most likely scenario is sell off for b/B. Very choppy declines for RUT and DJT, difficult to imagine that this is reversal. The w-x-y top theory does not work either.

IWM(RUT) one more push next week for a high above the September high will look perfect.

DJT already reversed with impulse lower and bouncing from MA50.

Subscribe to:

Posts (Atom)