One day fireworks and four days nothing this is not trending move just part of a bigger pattern. The problem is the pattern is still a guess - different indexes look different, cash and futures are not in sync, it is a mess at the moment. Waiting to see completed pattern.

Overall we had daily cycle low and now the next daily cycle made a higher high as expected. At least cycles keep us on the right side:) Now it is higher until this daily cycle makes a top and reverses lower. If I am right it will be left translated and fail to rally turning lower into June for the 4y cycle low.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - you can count impulse and reversal(red), but for some indexes this does not work. I am skeptical about this, when you are trying to find a pattern it is just not there. When a pattern is completed you just see it.

With continuation higher there is two options - b/B for a flat or z wave... or even 3/C of a big ED. Guessing continues and waiting patiently for the moment.

If I have to choose it is wave z to around 3050.

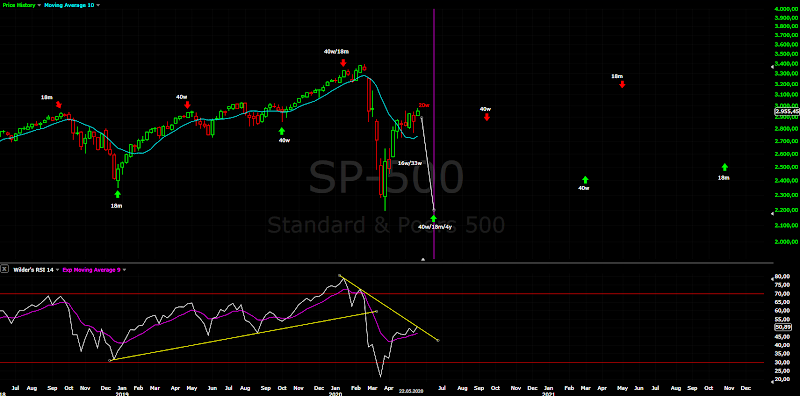

Intermediate term - the indicators look ripe for reversal RSI/MACD with divergence, MA200 almost tested, price trapped between MA50 and MA200. Waiting to see what happens next.

Long term - the same now the indicators have the right look for reversal - the histogram moved above zero and RSI touched the trend line what I wrote 2-3 weeks ago.

Resistance/MA50/62% is being tested, now we should see a leg lower to complete the correction.

MARKET BREADTH INDICATORS

Market Breadth Indicators - first signs for a trouble, the indicators are not following higher and some with divergences.

McClellan Oscillator - multiple short term divergences.

McClellan Summation Index - possible double top.

Weekly Stochastic of the Summation Index - turning lower, possible sell signal.

Bullish Percentage - double divergence.

Percent of Stocks above MA50 - strength above 75.

Fear Indicator VIX - divergence higher low.

Advance-Decline Issues - another lower high and divergence, weak pointing lower.

HURST CYCLES

Daily(trading) cycle - the signal is still buy, but the price and RSI are not showing a lot of strength. This is the expectations from the beginning that this daily cycle will fail as left translated.

I want to pay attention to something, which is very helpful for trading - every 7-10 trading days their some kind of interaction between price and M10, which could be just 1-2 sideways days for MA10 to catch up or test of the MA10 or close below it(should not be for more than a day)

I think this corresponds to 10 day Hurst cycle lasting 7-9 trading days. In the begging or the middle of the longer cycles this are good entry points to add in the direction of the trend.

The current daily cycles illustrates this very good. I see 4 such cycles for the previous daily cycle and now we have the first one for the current daily cycle. Ideally we should see down on Tuesday to touch MA10 and turn higher for a few more days.

Hurst cycles - this sharp move higher is from cycle low I doubt it is 80d low too short for that, most likely it is 40d low and the next 40d cycle running.

Week 16 for the 20w cycle. It is starting to take too long, if we do not see the high next week considering alternate option - March 20w low this corresponds to A-B pattern(green first chart)... again March is not 40w low there is no 40w cycle with length 25 weeks.

Subscribe to:

Post Comments (Atom)

Krasi,

ReplyDeleteThank you for your timely update.

Great work as always.

Dear Krasi,

ReplyDeleteThank you for sharing your work!

Would like to ask, what do you think would be most probable alternative, in case in March it was not 20W low?

Have a nice weekend!

I do not have such. The only two options are shown above.

DeleteDo you know about Peter Elliades work? He has cycle projections that bring us back to ATH. His system is fairly accurate. He could be wrong but I'm trying to reconcile if he is right.

ReplyDeleteHe was correct in predicting we would go past ATH shortly after bottoming in Dec 18'.

https://www.youtube.com/watch?v=wxoYyKC7yT8

Yes, I know.... nothing more than projecting FLD cross, nothing special or magical.

DeleteI know this from the cycle guys long ago. I do not have the software to draw the FLD lines(like sentient trader) or I can give you any target you want:) - it is first grade calculation project the same amount of points below FLD above it and the opposite.

It works, but some times not - like every tool. There is no guarantee that a projection will be met. I bet this time the projection will not be hit.

Dear Krasi, thank you for your work i would ask you what is the target of the correction of the WTI...perhaps 25 like MA 20?

ReplyDeleteAt least 50% correction.

DeleteThanks but do you think today is the top or can continue up to 37 or 41?

DeleteWith another push to 37 it will look better for completed impulse and divergence.

DeleteThen decline to the 20-23 area.

Thank you

ReplyDeleteTarget for SHOP?

ReplyDeleteTop and lower 400-450.

DeleteThanks Krasi, do you have any opinion on TLT?

ReplyDeleteI would say one more push higher double top and lower to the 140 area.

DeleteThanks Krasi!

DeleteKrasi, you say that if march was 20w low then it will be A-B to 2700. So C to 3200 for end June and 4y low for end July?

ReplyDeleteSomething like that with a low in August.

DeleteNot a big fan of this scenario. This is just the best alternate pattern which I can see.

C to 3200, that scenario isn't in your charts above Krasi ?

DeleteIt is the A-B(green)

DeleteKrasi,

DeleteLook like ES is doing what you proposed last week where c=a 3000 or 3050.

Krasi, your green scenario will confirm that March was a 40 week low and the next major low (your C wave down) will be around election time late October very early November. Sorry couldn't help it once again.. Thank you for all the work you provide.

ReplyDeleteNo, it will not confirm 40w low. It will confirm 20w low.

DeleteAgain there is no 40w cycle with length 25 weeks.

Perhaps if August was a 40w low, it is only a suposition

DeleteThat reply above about the August 40w low is not me. I stand by March being a 40 week low and the next 40 week low is projected for late October / early November. We will see. I will initialize my replies from now on. Thank you.

DeleteJP

First - it is third wave, it will go much higher - it did not work.

DeleteSecond time - last chance it will go much lower, calculating targets 1500, exotic expanded triangle - it did not work.

Third time - 40w cycle it will take so long - guess what it will not work.

Why is this happening? Because everybody getting fooled by the amplitude and twisting the rules.

The rules has not changed, stop twisting them. EW/cycle theory has not changed - the amplitudes have changed get used to it.

I have nothing to do with "first time" and "second time" all I am saying and have said so far is that March was a 40 week low and the next 40 week low is expected in late October / early November and I stick with it. Time will tell.

DeleteJP

Could you take a look at oil and TSLA?

ReplyDeleteThank you

Discussed already - both cut in half.

DeleteChipotle ($cmg) half too?

DeleteMost likely, what goes vertically higher comes the same way lower.

DeleteKrasi,

ReplyDeleteLast week you mentioned that it looks like a wave classic textbook wave 4 with wave 5=1 and c=a target 3002-3004 or 5=0.618x(1to3)=3040.

Do you think it still applies now?

Thank you in advance

Krasi,

ReplyDeleteThe reason I asked iis because it looks like what is actually happening.

A typical 5 wave sturucture and it fits your timing cycles too.

It looks more like a-b-c now instead of move up for fifth wave we have longer sideways move

DeleteKrassi, Can you post a chart on this? I was looking at this being topped out 3045 and no higher than 3090 by the end of the week and then to 2700 min target by the end of June.

DeleteNothing special another zig-zag - https://invst.ly/qxqub

DeleteFor the people who trade the dax, analysis in:

ReplyDeletehttps://www.labolsadepsico.com/dax-llegando-a-zona-importante/

Hey Krasi, just realized that the timing of SPX hitting 200DMA is so much aligned to the charts that you had posted about 6-8 weeks ago.The up, down, up hasn't happened much and it has just been up and up but it is very impressive to see your analysis align so well with the timing of these cycles.

ReplyDeleteSimple TA closing the gaps and testing MA200. I doubt many believing it back then.

DeleteThis is for those who think TA/EW/cycles do not work anymore - they work perfectly fine just the amplitudes are bigger.

wow this is frustrating. All signs point to us breaking through this area of major resistance. This is some type of complex WXYXZ correction since March bottom and there are no signs we are at a major top. Maybe a pullback to 2800 at the most from here. Just my two cents.

ReplyDeleteNothing bullish another zig-zag

DeleteJust look at the NDX... tech stocks and FOMO darlings like SHOP and CMG

The leader NDX does not look good - https://invst.ly/qxqyg

ReplyDeleteUgly wedge the upper trend line hit 5 times, 4h charts multiple divergences , ugly daily candle.

The gains are for the rest - all the lagging stocks.

DeleteRight on time DJT,RUT,NYSE squeezed a higher high today to synchronize the patterns with DJ,SPX

Looks very tight/narrow up there..

Deleteagain reminds me of 2019 when wedges broke and we would find support

Deletei thought it was beautiful!

DeleteThis reminds me of 2019 where every resistance we meet and drop bears called the top. The scary thing is VIX is hardly down today, which means to me there really is no complacency yet.

ReplyDeleteTher is higher high in s&p bun not new low in the vix, this is divergence

ReplyDeleteThe chart from yesterday the a-b-c, today the line where c=0,618xa was hit with 1h divergence - https://invst.ly/qy0u2

ReplyDeleteNow we can think about a top - first short 1/3...

What I noticed in the last few days was that stocks that were too far from 200DMA were starting to turn bullish. You mentioned two months ago that SPX was "too far away from 200dma and I applied the same theory and guessed banks/airlines etc were left behind and would now rally to make up. That was good learning. Thanks. Though I agree that this is just temporary and reversal may be around the corner.

ReplyDeleteI was wondering too, it was looking impossible XLF so weak and other indexes like NYSE or RUT.

DeleteBut here we are the tech stocks are red two days in a row and XLF twice +5% and now all indexes are aligned:) just on time.

Btw Krasi, when you enter a short, do you fully close your long? May be a stupid question but just wondering how you handle a trade when you switch from long to short or other way around.

ReplyDeleteLongs are closed, when I enter short there is some reason so I am out and not chasing the last squiggles.

Deletekrasi what would your target be on uvxy ?

ReplyDeleteAt the moment I do not know. If I am right about another leg lower around 90-100.

DeleteKrasi crude made a lower low in April but sp not, like crude and sp have the same cycles, gives you any clues to fit the cycles?

ReplyDeleteThis with crude was anomaly not a normal price behavior. I would stick with the next low as the cycle low.

Deletewhat is your target for gold in the coming correction?

ReplyDeleteThe previous lows around 1450

DeleteKrasi, when you expect a drop or big movement up, Eliott Wave doesnt take news into consideration?

ReplyDeleteThe waves are strictly based on counts?

Yes, news does not matter.

DeleteOne of the possible counts I was watching was a-b-c with target 3050 - https://invst.ly/qybac

ReplyDeleteI has not mention it the last week because we had corrective zig-zags. Maybe we have the reason - it looks like ED for c. Today we will have our answer - either the pattern from the March low is completed or not.

b/B is dead, extension bigger than 138%.... not that I have believed it is likely.

DeleteSo what now?

DeleteNow waiting to see if reversal confirms it or not.

DeleteCounting impulse or B wave does not work, what I am following for many weeks fits the best - corrective move from the March low as a-b-c or w-x-y.

Close was nice for bears but futures could save again

DeleteKrasi yesterday was what you told of price touch ema10, the first cycle of the new daily cycle?

ReplyDeleteIt is possible day 8. I do not dig so deep into cycles and I do not have a way to confirm it.

DeleteIt's looking like an extended wave. Blow-off top. Might even go up tomorrow. Next week looks super bearish.

ReplyDeleteIt just feels like blow off like 2019 even the shape is very similar.

DeleteI think we have w-x-y fits better with most of the indexes and currently 3/c/y so one more down and up to complete the pattern.

Everything starting to align, all the indexes are synchronized now.

All stock indexes are also now running into long-term resistance, specifically, the MONTHLY (EMA,8,high) on Stockcharts, which served as a potent roadblock previously - see second half of 2015 for instance. This led to a retest of the previous lows. Food for thought.

DeleteIt is 5 waves from the bottom you can count that as an A wave which means we get a B wave then C wave to retest ATHs. I don't think we will retest bottom until fall.

ReplyDeleteAlso, you can make the case that this is a WXYXZ but this is much more rare and no high probability we topped yet.

DeleteEW is more than counting to five. There is no impulse.

DeleteGo through the indexes it is obvious.

Krasi,

DeleteI am sorry I cannot follow your comment that this looks like the blowoff like 2019 as could not see any major drop in 2019.

Would you pls let me know which month in 2019 that this wave looks like?

Thank you in advance.

like what? It's clear whatever method you are using to count waves is not working. You say that the market will drop like you did most of 2019 and then when we did drop you said how right you were but you missed most of the move. I can see you are making the same mistake again.

DeleteSomeone asked that for a top the "experts" are missing.

DeleteThere you are the clueless experts are again here. The same old song over and over again like a broken record - my count is wrong and I missed it.

You can not count waves. At the low the target was MA200 nothing missed. The experts brave and smart at the top and silent at the bottom shitting their pants when I repeated three times look for opportunities.

2019 will not repeat I will not waste my time. If you want you can post chart with your count other comments like the one above will be deleted.

Krasi,

ReplyDeleteYou are right. You are one of those few who caught the bottom of MAC 23.

I saw your counts posted. I am amazed as I am no EW guy.

So as I understand 1 more down and 1 more up.

Any target for the down( like filling the GAP below at 2750??) or something more than that?

And 1 more up ( this I have no idea what is the target, need your expertise)

Thank you for your blog as I think you are one of the few EW with timing cycles and it make you different in a good way.

I am talking about very small down and up waves to complete c/y.... or we have the high already.

DeleteKrasi,

DeleteThank you for your clarification and your time.

I think August for the 4y low is too late because this 40w cycle would last too long (45-46 weeks).

ReplyDeleteI think there are two options for the 4y low: end of June or end of July.

I heard this theory about a low in August from David Hickson. It is not mine and I do not agree with it.

DeleteFor me the low is in June... or the first week of July.

For that march had to be 10w low and january 20w low?

DeleteEither that or March is 20w low with length 25 weeks.

DeleteDavid Hickson counts another 20 weeks until August which is wrong for me. From experience when we have a cycle longer than the usual the next one is shorter to compensate. So the next one should be shorter like 14-16 weeks.

Short said my current count will end up like 17+22/23 weeks or you can take March as 20w low and expect something like 25+15 weeks - I do not see a big difference.

I wanted to explain all this tomorrow:)

the problem is that between 31 of january and 23 of march there are two 5w cycle very short and if 14 may is also 5w low is more long.

ReplyDeletelooking forward to your update as I have no idea wtf is going on

ReplyDeleteLOL, good point!!!

DeleteThe big picture is getting more clear, but short term it is really a mess.

DeleteI like 5 up on Russell 3000 in place and 10% down imminent....

ReplyDelete