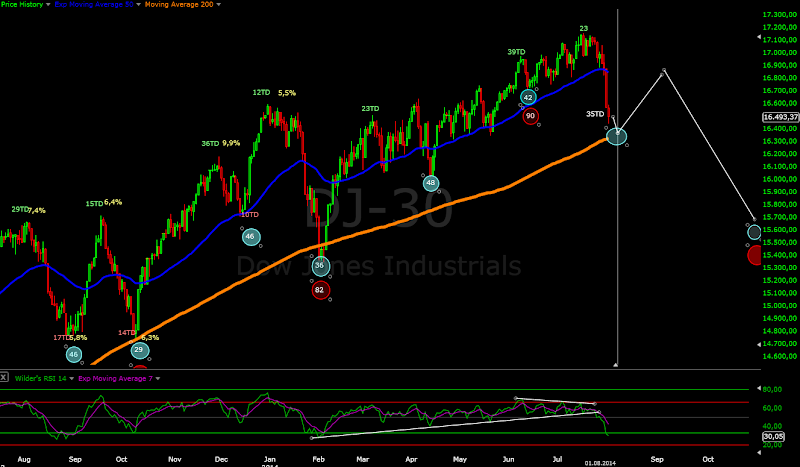

Short term view - down and up working on waves 4 and 5 to finish the first leg lower.

Intermediate term view - I think at least standard correction 8%-10% has started.

Well the last two weeks I was warning you that a top is coming. Targets were 1900-1925 and here we are. I was wrong this is not just a pullback it will be at least standard correction 8%-10%. As I wrote last week if this occurs just say thank you mister market and adjust the charts, that is what I will do.

Lets start - important top or "THE TOP"? I do not know, there is enough arguments for both cases. In hindsights the answer will look easy, but now if you ask me it is pure guessing. My thoughts - if you look at the weekly and monthly charts the price is way too far from important moving averages and the price will snap back to the MAs and bounce. When we see the bounce we will know what is happening and we will have a chance to position for the long run if this is "THE TOP".

Why not a bottom and pullback is over? - because we have strong impulse lower, too many technical damages, huge weekly bar which is the beginning of a move and not the end(this is not an exhaustion bar there is no previous sell off so huge bar has just ignite the selling). SP500 one bar wiped out 8 weeks gains... make your conclusion.

How much lower?- I think program minimum is correction which points to the 1800-1815 area(see the second charts), lower targets if we see something deeper are 1750 and 1650 (see the last chart).

Lets look through different angles:

- Technical analysis - Monthly momentum points lower with divergences, Weekly MACD trend line broken divergence and the histogram moved bellow zero, Daily the same story. I think something bigger has just begun and we will see a snap back to long term moving averages. Short term nearing oversold levels and a bounce is expected soon.

- EW - the move is of a bigger degree and to label it right you must go back all the way to 2011... there is a room for a lot of interpretations and I am not so good with EW:) so I do not have a count. There is no a lot of good EW guys out there... the two which I follow are expecting wave 4 for the move since 2011 and 38,2% Fibo points to around 1650. I do not have an opinion and I will just follow the market. For the short term I think we have an impulse with extended wave 3. The measurement and internal waves look very good so no reason to doubt at the moment.

- Cycles - the 40 day cycle should bottom soon but it made lower low which means we should see a lower high. I think the 40 week cycle has topped out. The average length is 31-36 weeks currently we are at week 26 so we have 5-10 weeks before a bottom. Short term we should see a bounce soon, but more to come to the downside. Bottom somewhere between mid September to mid October... it will be adjusted with time.

- Market breadth - I do not see a clue for the long term. For the short term we are near or at oversold levels and bounce is expected next week.

- TomDemark - as I wrote the daily chart was telling us to expect something to the downside and there we have it. Now the monthly chart... finished combo and countdown at 12 - enough reason to worry. The previous occasion was 2011 and you know what happened.

My conclusion - next week the indexes will start working on a bottom than we should see a rebound, but I do not think the sell off is over.

TECHNICAL PICTURE

Short term - extended impulses are not easy to follow... how do you measure fear? But for now it looks good so we will track the 4's 5's and try to spot short term bottom. When you can count 9 distinct waves then the extended impulse will be over:)

Intermediate term - I see minimum A-B-C to around 1800 later we will adjust the target if necessary. Around 1885-1900 we have support and the trend line so I expect a bounce from this area. If I am right we should see a bounce higher and it should be weak. If I am wrong expect rocket launch.

See when the histogram reaches extremes... it is a sign of a fear. Notice that the bottom does not occur when there is fear it comes later with lower low. That is simple psycholgy and the indicator is consistent with what I expect another lower low.

Long term - I was repeating for months that the divergences will play out some day and it will look nasty. This day has come. Almost 10 weeks wiped out and negative for the year. Now we watch how deep the move will be. I suspect bounce from MA50 and lower to support and trend line around 15500.

MARKET BREADTH INDICATORS

The Market Breadth Indicators - near oversold levels.

McClellan Oscillator - oversold level reached and outside from BB - bounce expected.

McClellan Summation Index - sell signal

Weekly Stochastic of the Summation Index - oversold... bounce for 2-3 weeks?

Bullish Percentage - sell signal

Percent of Stocks above MA50 - near to the lower range 25. One more push lower and probably we will have short term bottom.

Fear Indicator VIX - went crazy.... what do you expect when it was 10 and no fear at all.

Advance-Decline Issues - nearing oversold level one more push lower to finish the move and a short term bottom.

Percent of Stocks above MA200 - how strong is the market when after a few percent sell off only 59% of shares are above 200MA?

HURST CYCLES

Day 35 near to a 40 day cycle low... consistent with technical analysis and EW that we see a short term bottom. The cycle made lower low as the previous one and we should expect now lower high.

The 40 week cycle has toped out. I think we have between 5 and 10 weeks before the bottom for the cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

At day 5 of a buy setup... high probability that it will be finished unless we see the prices close above the huge bar.

Monthly chart more interesting than the weekly - with finished combo and countdown at 12 I think we will see a meaningful correction like in 2011

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment