As expected at least a week was needed for w5 to be completed. Now time and pattern look mature and waiting for reversal signs. Interesting if we will see another few days before reversal for perfect cycle high the middle of next week.

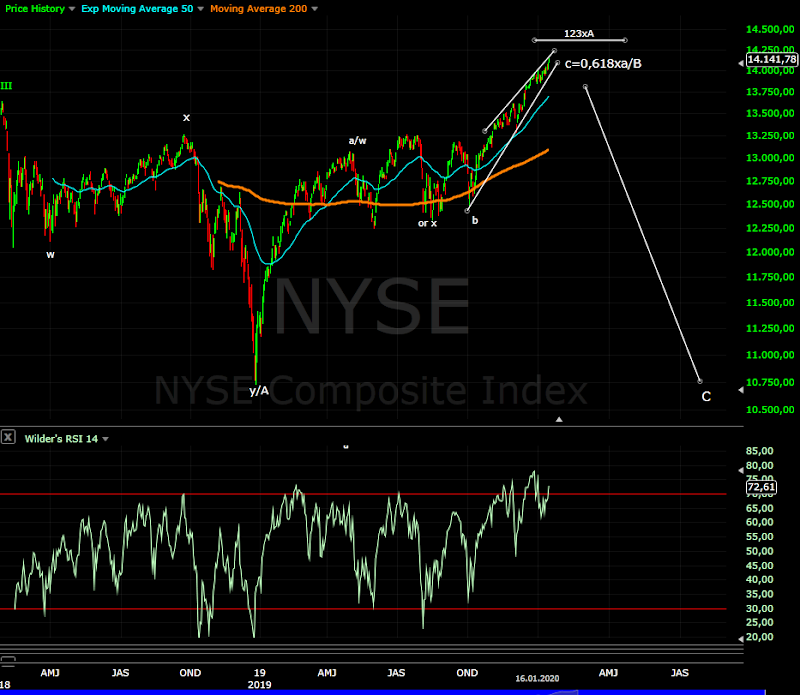

The top of this w5 should be the top of wave c/B and the charts below show why I still stick to this count....

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - it will be great to see one more down up with RSI divergence, but it is not a guarantee. Looking at AAPL we have the minimum for v/5 - ED making higher high so I will not be surprised to see the indexes lower on Monday. If we see the channel broken(red) with high probability the move from 6th of January is over.

Intermediate term - as explained impulse with extended first wave 3=0,618x1 5=0,382x1, on intermediate term scale c=0,618xa and long term B=1,618xA.... three different degree of Fibo measurements converge to the same target - I would not ignore this message.

The first wave lasted 40 trading days, the third wave 20 trading days and the fifth wave is now 10 trading days long so time and price measurements are satisfied.

Long term - at the top of wave B, after that expect sell off to begin and to continue into Q2.2020. It will complete the correction which begun in January 2018.

Many said where is my alternate scenario so here it is - according Neely wave B with such size are not fully retraced so three waves decline for C triangle or impulse C for running flat... the decline will be only 25% not 30%:))))

MARKET BREADTH INDICATORS

Market Breadth Indicators - mixed signals some are strong some with divergences.

McClellan Oscillator - turned lower with divergences.

McClellan Summation Index - buy signal with long term divergence.

Weekly Stochastic of the Summation Index - buy signal, in the overbought area for a while.

Bullish Percentage - strong, buy signal.

Percent of Stocks above MA50 - buy signal, it looks like double top.

Fear Indicator VIX - higher low and divergences.

Advance-Decline Issues - another lower high and divergences.

HURST CYCLES

Daily(trading) cycle - the price is above MA10 the signal is still on buy, RSI with divergence oscillating around MA18 - the trading cycle should turn lower soon, triggering a sell signal will take a while most likely breaking below MA10 and testing it.

Week 15 for the 20 week cycle, week 37 for the 40 week high-to-high cycle - 4 year cycle high is imminent.

The charts below are showing what I am explaining for two years and I do not see a reason to change my mind because the pattern has not changed - a bunch of corrective waves, there is no third waves.

If you think this is wrong just buy because according to the bulls we are in the middle of the third wave. The self proclaimed EW god Avi Gilburt sees 100 point lower and another 600+ points higher.

My opinion is SP500/NDX will follow the rest of the world and not the opposite the rest of the world following AAPL(a few tech stocks distorting this two indexes).... by the way look at AAPL just test of the break out now support zone around 220 is already 30% correction. What do you think will happen with the indexes if AAPL is down 30%? So good luck.

EUROPE

JAPAN

EMERGING MARKETS

NYSE

DJT

RUSSELL2000

XLF

CYCLES

Subscribe to:

Post Comments (Atom)

I see two errors in your long term count. b of A exceeds the high of wave III and a of B completely goes back to A

ReplyDeleteIn any case it is more likely that the A wave started in October 2018, not in January 2018.

I see another possible count, it is still v of III and then down in abc to 2200 for the wave IV

I will stick to the pattern which is everywhere I look.

DeleteThree months in 2018 or five months now in 2020 for IV is way too short to correct 6-7-8 years wave III so counts how III is still running or V has begun are wrong for me.

Hello Krasi,what do you think about Palladium?

ReplyDeleteI do not see reliable EW pattern and too short price history for cycles so I can speak only about simple technical analysis.

DeleteDaily chart RSI very overbought which means first strength and second time for correction. After the correction is over expect higher high with RSI divergence.

On the weekly chart RSI is building already divergences and when this down and up moves are finished expect bigger correction to at least the 1300-1600 area which is support and interesting Fibo measurement.

Thank you

DeleteKrasi 2 january cycle high of 5 weeks and 6 january cycle low of 5?

ReplyDeleteI do not follow this cycles.... I would say 26.12 the high and 6.01 the low.

DeleteI look at the chart of BA...looks complete for a big gap down...if Ba goes down 20%...as it should,that will have some implications on the indexes as well...any thought?

ReplyDeleteDifferent shares are at different stages of their correction, but the message looks the same - leg lower, which means the indexes will decline and not just a few percent.

DeleteExample BA,MCD should decline to complete c/A or AAPL,MSFT should start their correction.

Hi Krasi, on EWT Avi posted his long term count. A member astutely pointed out that his price chart is semi log scale, and his Fibs are computed in arithmetic scale.

ReplyDeleteSo there's no way iii could be where he put it. 1.62x of i and ii in log scale is at 3345, so iii should be close to where we are.

What do you think?

https://imgur.com/RtxSvfj

I do not think it should be mixed, but most likely just a mistake with the labels.... I do not see 1 and 2. Probably i is 1 and ii is 2. This way it makes sense the chart and on semi-log scale 3=1,618x1.

DeleteHe changed the place of this wave 3 so many times.... what I do not like is he sells EW analysis and does not care about waves at all. Just putting labels somewhere to satisfy his Fibonacci pinball. Sometimes I saw such bullshit that I was wondering if he can count EW at all.

Huge B wave measurements stretched a lot and he decided to follow the Fibonacci and ignore waves and everything else, but no problem the alternate scenario is already on the chart:)

Krasi made clear no 3. Why keep bringing up? Trust in the count Krasi has offered. Avi doesn't know anything.

ReplyDeleteJust buy it Avi is EW god and he is always right.

DeleteGrand Supercycle https://s3.tradingview.com/a/aSQ7cMnE_mid.webp

ReplyDeleteI do not think so... there is no happy days ahead.

DeleteKrasi, if these charts of AAPL are correct, how much of correction can we expect? I'm a long term investor in apple.

ReplyDeletehttp://studyofcycles.blogspot.com/2020/01/an-apple-day.html

https://tvc-invdn-com.akamaized.net/data/tvc_dd7936ecd183db0fbddb6eb364a9210f.png

The first chart I see the same, the second one... I am not convinced, I think it is wrong.

DeleteUse simple technical analysis instead of trying to guess the pattern - open monthly chart with RSI and MA50. What do you see? Every time when RSI is so overbought significant correction follows. Every time when the price moves too far from MA50 it declines back to it. Moves that go vertically higher come back down the same way.

There is two support levels around 220-230 and 170-180. The second level is at MA50 and if AAPL has the same A-B-C pattern like the indexes C=1,38xA at this level.

For technical perspective we should see significant correction and this second level is more likely...

Thanks Krasi. If apple goes down to 189 where the 50 day moving average on the monthly is, it's going to feel like the end of the world for the markets.

DeleteCorrection of such magnitude happened already three times since 2012 this will be the fourth one - nothing new. The alternative is two years sideways move for MA50 to catch up with price.

DeleteI heard that this is the 4th most historically overbought market, or something like that. It's going to be interesting how fast the down move unfolds.

DeleteEven one of the ultra bulls is telling people to take profits up here.

I think the chart is telling the same - time to take profits.

DeleteKrasi, if i am not wrong, we see bull flag again with ABC to the doun

ReplyDeleteZig-zag is not a bull flag... and zig-zag is not confirmed in the first place.

DeleteYup same old story, small downside seen that will lead to more upside. New ATH by tomorrow no doubt!

ReplyDeleteToday's lows almost wiped out, onwards and upwards we go.

DeleteKrasi you say 40w cycle high in april 2019, why not in July?

ReplyDeleteBecause the pattern was finished in April and the next one has began... easy to spot if you look at most of the other indexes above. Verification with price and RSI crossing the corresponding MA.

DeleteIt is shorter because the price moves down and up are extreme.

Krasi,the DAX is over ATH

ReplyDeleteAnd? Is this changing something?

DeleteGuess it's not changing the continuing uptrend in Indices

DeleteThen buy it because the trend is not changing.

DeleteBought 300 points ago, awaiting an actual topping signal

DeleteAnd S&P

ReplyDeleteOne hour chart, ABC again to the doun

ReplyDeleteKrasi, look at the nice canal from 2009, we have to arrive the top, 3500

ReplyDeleteThis is the top with ED.

DeleteNo disrespect, buy you say "this is the top" a lot and it continues higher.

DeleteMaybe someone out there has developed a "Krasi Indicator", which is when he says, "this is the top", it is a signal to buy :)

DeleteDont you think we are on W3 of 3?

ReplyDeleteThere is no sign they are stop running

ReplyDeleteED in Nasdaq 100 to but we have to break the canal for short

ReplyDeleteTrump afferma che il taglio delle tasse della classe media sarà annunciato entro tre mesi

ReplyDeleteadesso dritti sui 3800

Krasi, if now it is 4 years high and june will be 4 years low then there is a 20w cycle low and a 20w cycle high between them, shouldn't there be anything cycle between the high and the low of the 4 year cycles?

ReplyDeleteI do not know what you mean with "anything cycle".... the cycles are fine, quick sell off for 6 months is ok.

DeleteI mean if the 4 year high and the 4 year low must be more near between them, without any other cycle between them

ReplyDeleteNo, there is no rule how much time should be between 4 year cycle high and low.

DeleteThe rule is between two 4 year cycle highs should be one 4 year cycle low and the opposite. This is true for all cycles f the same degree.... it is logical.

Krasi ur opinion on tvix thanks

ReplyDeleteThe perfect pattern will be one more decline to around 37.

DeleteMaximum troll action, I am now quietly confident on my short positions...

ReplyDeleteStill the 1/3, taken small pain but can hold.

Now you can enjoy medium pain. Congrats.

DeleteHappy to feed the dogs the last few cents from longs, enjoy

Delete5W doun in 1 hour chart

ReplyDeleteThere is enough waves for a top, but it could be just iv/5 flat... we will see today.

DeleteNow it look like reversal...

DeleteWhy do you call reversals so quickly when they always just amount to small intraday moves?

DeleteWhy do you call ATH so quickly when they just amount to small intraday moves?

DeleteShould I remember you comments from the last two days?

Why should I justify trying to comment intraday moves with some one. There is possible impulse lower running Lady S comments it I answer. Where do you see a call the top is in we have confirmed reversal? There is possible one watching it that is all. Do you read the next comment?

You have become a troll - one useless comment after another. If you do not have something useful to say please spare me the noise.

Just wondering why you are so quick to call it is all, given how relentless this upward trend has been for so long.

DeleteThat said, I really do wish you get that real reversal, for your conviction alone.

DeleteGo up again

ReplyDeleteYes not confirmed with impulse lower.

DeleteI think it is 2,5 week cycle low then 5-6 days going up still for the 4 year cycle high

ReplyDeleteThere is no need to be higher high... 2.5 week cycle low with lower high will be valid too.

DeleteBy the way one more higher high and the third wave will get killed - https://invst.ly/pm0r0

ReplyDeleteTwo legs higher with the same size and 0,38 retracement in the middle...

the probability of top is what it is and there is no probability that it is longer than the high cycle of 4.5 years already has the top

ReplyDeleteCycles vary it could be a few months shorter or longer. Given that the indices are at week 19 for the 20w cycle and 38 for the 40w cycle plus the pattern I would say the probability to extend for another 2-3 months is very low.

DeleteKrasi tvix target still 37

ReplyDeleteYes, maybe between 36-37... I have to see how high SVXY will move 70-71.

DeleteI still think one more high is needed for a complete pattern.

If we close like this, maby we saw 1,2 and now 3

ReplyDeleteIt looks more like c of a-b-c to me. Yesterday it failed to confirm reversal with impulse.

DeleteWe will see if it continue to accelerate....

A 1% drop in the indexes after an eon and it is quiet here...:-)

ReplyDelete