Reading comments the bulls are everywhere again, very smart again.... buy every dip, free money, 3000 at least. The same shit like January all over again, the sheeple has very short memory. The market does not work this way.

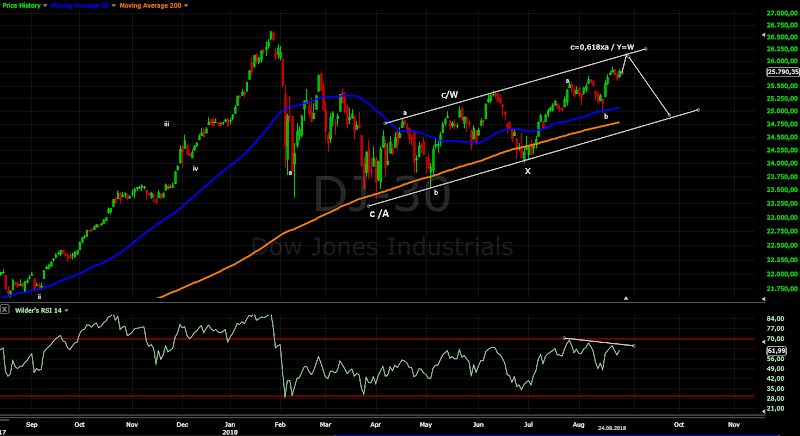

After the summer pause I am talking all the time about zig-zags , "yellow scenario" wave b etc. Below you can see the daily charts for NYSE/DJI/SP500 - all I can see is corrective waves. We can argue about w1 or w3 of ED or wave B, but I can not see an impulse. Unless we see a strong rally for iii of 3 breaking above the trend channels to prove me wrong this is just corrective crap period.

EW pattern looking close to be finished. Hitting the channel one more time with multiple divergences on the daily chart. Market breadth weak with divergences. RUT finished triangle and thrust higher for the final wave with RSI divergences daily and weekly.

The odds are higher that we are close to intermediate term top.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - expecting the trend line to be hit one more time and reversal to support and the lower trend line. MACD multiple divergences the bulls need strong move up above the upper trend line to clear the divergences.

Intermediate term - at first glance the three indexes look different SP500 strong managed to squeeze higher high and NYSE very week. If you count the waves and measure the Fibo levels you will see something different - the same pattern for all three indexes. I will dare too say they have the same pattern it is corrective and no NYSE/DJ will not catch up with SP500 as the bulls count already 3000. The opposite will happen.

Most likely the trend channel will be hit one more time with multiple RSI divergences and we will see at least a move to the lower trend line. I see corrective waves and possible patterns are wave 1 or 3 of ED and wave B which takes too long and I doubt it is part of wave 4 from the Feb.2016 low.

ED works for SP500/DJI but not for NYSE... curious what will happen in September and October.

NYSE - overlapping waves, weak angle of ascend, it looks like bearish flag. I see two zig-zags with the same size higher. Unless we see parabolic move up for iii of 3 the bulls will hold the bag again.

DJI - the same story, but stronger testing the March highs.

SP500 - the same story, the strongest testing the January high.

Long term - intermediate term high expected. It could be 4 year cycle high, but I do not think this is major top.

MARKET BREADTH INDICATORS

Market Breadth Indicators - the same weak with divergences, but holding for the moment.

McClellan Oscillator - showed strength up to the 40 level, now expecting lower highs.

McClellan Summation Index - buy signal, but lower high and divergence.

Weekly Stochastic of the Summation Index - turned higher.

Bullish Percentage - turned up, lower high so far and could not move into overbought territory.

Percent of Stocks above MA50 - several lower highs below 75. This is a sign of weakness unable to move into overbought territory.

Fear Indicator VIX - higher lows and divergences expected.

Advance-Decline Issues - lower highs, but still holding above the trend line.

HURST CYCLES

Day 7... this daily cycle looks weak so far, no strong rally and this is the way it should look like when the longer cycles are turning lower.

Week 8 of the 20 week cycle.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

Countdown and combo finished on the daily chart, waiting for some bearish sign like price flip on the weekly chart.

Subscribe to:

Post Comments (Atom)

Hi Krasi... from the charts above you expect s&p500 to drop about 100 points in the ED scenario or about 300 in wave 4 scenario, as the long term chart shows. Is this correct? Thank you for all your work.

ReplyDeleteKris

Roughly 100 points for w4 of ED, 200 points for w2 of ED and 300-350 for wave C.

DeleteThe next decline will be interesting to see how it will look like.

Hi Krasi, S&P may make a higher high, so why is it called 'corrective'? What follows this should be called 'corrective', right? Just trying to understand why a bullish run which occurred over the last few months would be called correction.

ReplyDeleteYou are making the association corrective->correction->lower.

DeleteWhat I am explaining is that despite the "strength" the price pattern is corrective - zig-zags. Corrective structure does not mean the price can not move up.

This has implications - for the bearish case this is not major top(enough bears expecting market crash), for the bullish case plenty of bulls expecting run to 3000 - not before a correction.

P.S. Ask your self why the strong bullish run needs 6-7 months to retrace 2 weeks sell off(NYSE/DJI still did not retraced it)? Why indicators/market breadth can not move into overbought territory?

The answer is simple internal weakness, corrective price structure.

Thank you for the explanation Krasi! It makes sense.

DeleteAnd what about Nasdaq you think?

ReplyDeleteNDX looks like v of 5 final wave from the Feb.2017 low.

DeleteFebruary 2017 or february 2016???

DeleteFebruary 2016 ....

DeleteKrasi,

ReplyDeleteWhat is your opinion of DXY and Nifty (Indian) index ?

DXY multi month correction running.

DeleteNIFTY looks like B wave from expanded flat.

Krasi.

ReplyDelete"The corrective shit" is crash up ATH.

No corrective, as impulse ago may... Final target 3100-3300.

Dax crash up 12450.

The 4 wave as a triangle finally in may... It is subwave3 of final wave 5.

I think ABC 2 weeks ago... But i say no crash down 2797, this is the moment to C wave... The moment past.

This moment is moment to up.

Salutations!!!!

You are wrong.

DeleteHi Krasi, It looks like we got an impulse and in the heart of a 3rd wave. any updates sir?

ReplyDeleteLook carefully the first chart. No need to update anything.

DeleteIt can be Krasi, I'm not saying no.

ReplyDeleteBut comment that had to break 2797 to be the C... 2 weeks ago approached 2805 and went upward and today we have doing ATH.

Also comment that if Dax exceeded 12450 would go upward.

"coincidentally " When SP fell to 2805 and went upward in Dax cut the fall in 12100 in a way that does not reach understand since the bearish structure of Dax had to follow its course.

These days ago Dax has made a flat wave that gives more elevations, today is in 12550 +-but if it exceeds the trend line bearish over 12800-12900 I hope to see it in 13000-13200.

And the rise alone would be the first wave of the medium term.

In the USA is different, and I think since May has made 2 waves and goes by Wave 3.

What's more, I'd say he's going for the SUB3 Wave 3 medium term.

And this is a lot of bull ahead... many months... half a year or more of continuous hikes.

Krasi...

Of course I can be mistaken, but remember that there are always 2 options.

You put a 4 yourself? Yellow in its graphic, however I think that the wave 4 end in May in triangle, ie ABCDE, the e in May... and from there, given the current circumstances would say that propels upward.

I was also very sure of that damn C, but 2 weeks ago "I saw it clear ", they would not fall.

Thanks from Spain... and good luck.

If we assume that we have a triangle than this is the top of wave 3 already.

DeleteIn this case it will not be just test of the high it will be higher high.

The caveat this does not work with DJ and NYSE and I think it is wrong.

Krasi are you expecting a dip in the S&P 500 short-term you're thoughts

ReplyDeleteI expect intermediate term high - lower 80-100 points test of the high and lower in October.

DeleteSounds about right I'm expecting the dippers well and then I moved back to the high and then a drop down in October thanks for your work I really appreciate it

DeleteHi Krasi. You had said USD INR would hit 67-66. It has broken the previous resistance and touching previous high and I believe it is going to make new high around 71.5. What is your opinion?

ReplyDeleteThe same this is the fifth wave from the August bottom to finish wave 5 for much bigger impulse from January 2018.

DeleteSame meaning it will make new high or retrace back to 67/66?

Delete?

DeleteThe same like the last time I wrote - USDINR should correct lower.

DeleteHI Krasi, Thanks for your Updates, the SP500 is breaking Resistance on your charts (could be Head fake), but if that continue to go higher then Can we conclude the Wave 4 bottom is already passed and we are going on Wave 5 on long term chart? (Top and End of Bulls)? Regards

ReplyDeleteThis is just touch of the trend line and a pause. We should see 30+ points candle for clear and convincing break out and the bulls overwhelming the bears.

DeleteAs I wrote breaking to the upside from the channel and clearing the divergences will mean this is wave iii of 5.

Krasi do you look at the vix ? I see a divergence, like January, where we have new highs in the indexes but vix is not confirming...still above 12.(august lows were below 11)...any thoughts?

DeleteIntermediate term top this are my thoughts. Just another indicator not confirming the move.

Deletesono sulla parte alta del canale come hai prevvisto krasi, adesso speriamo che scendono come pensi

ReplyDeleteKrasi.

ReplyDeleteIs an "impulsive shit".

No resistances, free ups ATH.

3100-3300 objetive 5 wave.

Definitely wrong.

DeleteAre what level will we have cleared the divergences nad turned more bullish?

ReplyDeleteThere is no specific level it should just continue higher and higher.

DeleteSo far nothing more than test of the trend lines - NDX slightly below, DJ touching it and NYSE/SPX slightly above. There is no decisive break out and I do no see it happening.

I'm with you Krasi

ReplyDeleteBuongiorno krasi quindi lei adesso si aspetta onda 4 sul canale inferiore e poi la 5 di nuovo sul canale superiore che porterebbe sp500 sui 30000

ReplyDeleteYes, this is one possible option if you count a triangle this should be wave 3 with 4 and 5/V to finish the whole move from Feb.2016.

Deletegrazie, speriamo che adesso vanno giu'

DeleteHi Krasi... what’s your estimate for the Russell 2000 IWM once it turns lower? Thanks

ReplyDeleteKris

Around 1600 it is a strong support area with three top around this level.

DeleteI agree...it seemed like the beginning of the correction may have started. It’s too early to say but iwm and Dow were wobbly on Thursday.

ReplyDeleteUsa up.

ReplyDeleteImportant support s&p 2880-2885 in diary format... Very Very important support.

Small surprise in dax... Crash down bull structure in 12480.

Go down first target 12100, second target 11700-11800... And again up to ATH.

Brent médium term target 90-100.

First down to 74,50+-... And again up to 90-100.

Eurusd posibility of HCHi... Buy in 1,15-1,1550 with first target anual máximums.

S&p 3100-3300... I say.

Anticipated thanks of your update of tomorrow Krasi.

Good trading !!!

I Sergio,i don't know if YouTube are italian like me so i continue talk in english. I Asl You please a comment on Sugar n.11 if You follow It. Thanks

DeleteOr we have pullback for wave 4, Europe finishes in the mean time triangle. Both indexes in US and EU make synchronized one more high(lower in Europe B/X wave) and decline together for 4 year cycle low.

DeleteIn the mean time Oil finishes the right shoulder of H&S pattern and declines with the indexes.

it looked like Russell 2000 put an intermediate top today. It felt like an exhaustion run. Do you agree Krasi? Thanks

ReplyDeleteWe have a break out of a triangle as expected and now I think RUT is in the last fifth wave of the impulse. It looks very choppy probably an ED for the last wave and a few more days grinding higher.

DeleteSP500 will look better with one more high and divergences so more likely a few more days and sligthly higher.

Hello Krasi according to your analysis in the SP500 we are near to complete wave 4 in the autumn and begin the wave 5 that Will finished around First quarter of 2019. I ask You if It is probable instead we have Just complete the 5 wave and the next nove is the starting of the big correction.

DeleteOne more high is missing for this scenario.

Delete