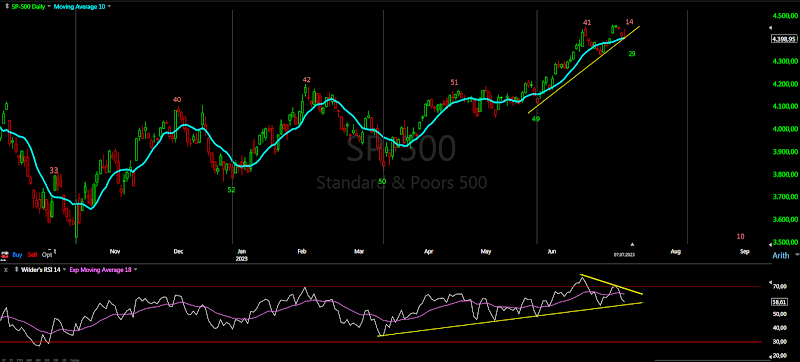

Turn lower into 20d low as expected, a few more days for short term low. Some indices made higher high some lower high so it is not clear is this the top or b-wave high, maybe both depending of the concrete index. For the SPX I would say b-wave high as suggested last week.

Topping process has begun, most likely lasting through the summer. I have the feeling it will be rounded top and not a crash.

TRADING

Trading trigger - neutral.

Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low.

P.S. - for a trade both analysis and trigger should point in the same direction.

TECHNICAL PICTURE and ELLIOTT WAVES

Short term - lower for a few days to complete a-b-c, then higher. When we see the size of the moves we can make some conclusions.

Intermediate term - some kind of w-x-y/B. Waiting to see the next few weeks where to pinpoint the top. I will not be surprised if it is behind us.

Long term - most likely huge double zig-zag from the 2009 low. If we are lucky this is lower degree b-wave(green) and there is one more high. If not multi year decline has started.

MARKET BREADTH INDICATORS

Market Breadth Indicators - it looks like topping begun and there is important divergence with the previous high.

McClellan Oscillator - around zero.

McClellan Summation Index - buy signal.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - touched overbought and turned lower.

Percent of Stocks above MA50 - touched overbought and turned lower.

Fear Indicator VIX - big spike higher.

Advance-Decline Issues - in the middle of the range with miltiple divergences.

HURST CYCLES

Short term cycles - lower into 20d cycle low, probably a few more days then higher into 20d high. The longer cycles are not very clear. I think we have 10w high mid-June and now declining into 10w low.

Week 6 for the 20w cycle. We do not have clear 40w low... probably this three longer 10w cycles are part of something bigger. Maybe instead 2x40w cycles we will see 3x20w longer cycles 5-5.5 months each overall 15-16 months which is the average length for the 18m cycle. By the way it is the same with the highs - important high every 5 months +-2 weeks too.

Subscribe to:

Post Comments (Atom)

Most likely another fake secondary high - https://invst.ly/10ltte

ReplyDeleteDAX cycles - https://invst.ly/10ly9r , the US indexes are not different the same extended 10w cycles.

ReplyDeleteNow we have zig-zag lower, the pattern usually completes at cycle low - most likely extended 5w cycle with high probability part of the fourth extended 10w cycle.

Thanks Krasi

ReplyDeleteThanks Krasi for your time, dedication to inform and patience.

ReplyDeleteI've been following Krasi for years. And I'm irritated at the trolls criticizing him. In a market dominated by algos, machines, flash boys and whales, relying on only one indicator/analysis and expecting perfection is mindless. I just did a one year back test of Krasi's work. When the market starts to change, indicating a change in pattern or a key cyclical point, Krasi changes with it. While there were some whipsaws, the key was to look at his work over a period of 2-3 weeks and I use his work to confirm my other indicators. What I saw in this back test was Krasi following the lead of the market. I found his trigger buy/sells very helpful when used in this manner. My test of his trigger buy/sell signals showed the following: In July 2022, he was correct being on a consistent "buy" trigger signal. The week of Aug. 20, 2022, he went to neutral and then "sell", getting out soon after the top. He switched to a "buy" the week of Oct. 23, 2022 after the SPX bottomed Oct. 13 and confirming my indicators' buy signal on Oct.21. He went to a "Sell" Dec 10 and back to "buy" Jan 4, 2023. To "sell" Feb 11 ( I count his tepid "buy" Mar 11 trigger as minor whipsaw). Then "buy" Mar 25 (confirming nearly all my indicators) and stayed on a "buy" (except for one neutral) until June 24, 2023. He was simply a little early going to "sell" June 24. He is appears correct with his trigger signal being "neutral" in his July 8 blog given all the potentially market moving info due out this week. We need to see what happens this week and then react quickly. Thank you, Krasi, for providing an important and effective market timing tool. The trolls are simply blaming you for their ignorance and laziness.

ReplyDeleteWell said Larry - quite eloquent. I agree with you whole-heartedly. Cheers.

DeleteThe US equity markets lately have been looking like they are running in sand, uphill, wearing a 50-pound backpack. Cue up the Sisyphus meme ...

ReplyDeleteWaiting for the Cliff?…

DeleteGoogle "Sisyphus"

DeleteDude, the buy and sell signal is a 10 day moving average. Close above you buy. Close below you sell. Close on line neutral. You obviously didn't do a back test. Take 100 shares of SPY. A simple back test from today going back one year would have been 45 trades. You would have lost ($7823). Please stop with your "I back tested". Of course Krasi would say the analysis has to match the trade trigger. It never really does. Take last week. Trade trigger was a buy. The analysis was :Analysis - long term sell the rips. Intermediate term - topping, important high completing the correction from the October low." Yeah, good luck with that. It's one thing to prop someone up and another to lie. If I'm wrong then you guys show your trading statements? Show the trades were your beating the market. Make us all believers.

ReplyDeleteMy reference was to the trade trigger. And no, it didn't flip 45 times. I almost amended my entry to say "review" instead of "back test" but figured it didn't really matter. The process was the same. I didn't refer to Krasi's analysis. Any other false accusations you want to make? And if you think Krasi is so wrong, why are you reading his blog...or are you just trolling it?

ReplyDeleteLatest call has been move down since 4150 but has not happened

ReplyDeleteThis is going to an ATH. End of!

ReplyDeletekrasi said zero probability sheep. you will be wrong.

DeleteI suggest you get fully on margin sheep. Get a booster while your at it.

DeleteBig collapsing coming…yeah right wrong again and again

DeleteIt will go lower before it goes higher like it or not. I can say the same for the brainless bulls - oooo 6000 coming wrong again and again...

DeleteYes big crash is coming, the life as you know it - it is over. It will get really ugly. The era of globalization and abundance is over. You feel it but refuse to accept it. That is why you have to feel better and the relief Krasi is wrong again and again so nothing bad will happen.

Ignorance will not help you.

Tbf krasi said this will be a rounded top, which will round slowly upwards and after a few more zig zags probably continue to round higher until we hit 6000

ReplyDeleteNo. Krasi has said zero probability. He has also called anyone a sheep who believed an ath would happen before the drop. Now we are close to the top and all a sudden it’s rounded?

DeleteAnon1 - I am listening this 6000 for years on every top since 2018 - where is it? Maybe this time.... but I am constantly wrong:)))

DeleteAnon2 - Why should it be always a crash, no the top will be tested? And I am not talking long term.

You mean top will be tested or will not be tested?

DeleteThe current high for the B-wave will be tested(not from 2021) not a crash style reversal like 2020.

DeleteThis is a joke right?…6000 rounded top

ReplyDeleteCome on switch your brain and start reading. The current move will not end with a crash the top will be tested. No not the long term.

DeleteWhy the fuck when I say lower it should be a crash..... was 2021 top a crash or rounded top

So now you admit the 4850 top will be tested and the possibility of a new ATH with it. Some back tracking there, Krasi

DeleteNot that high, the current high for the B-wave.

DeleteThere is no current high, a new high is being formed each day!

DeleteThe same bullshit every two years on every top - I am so wrong and SPX 6000.

ReplyDeleteIt will end as the previous three times - it will go lower before it goes higher.

Good luck to the believers in bull markets of five stocks.

Krasi, the top one among the five is NVDA. Is this the top or breakout from the double top and headed much higher? :-)

DeleteNeither break out nor the top - https://invst.ly/10ob-m

DeleteThe best pattern I can see, the corrective waves 2/4 alternate and it is aligned with the indices. This leg lower to complete 4 is not exact measurement just showing lower, it could be running flat which means higher low.

Tesla seems to support this idea - https://invst.ly/10occj

DeleteWhat do you think about the DEXY, it's break the support 100.8

ReplyDeleteWhat id DEXY?

DeleteWhat next after the break 100. 8 support , week dollar Strong indexes

ReplyDeleteSo, what's your dexy analysis

ReplyDeleteHigher 111

DeleteNDX - https://invst.ly/10ocws

ReplyDeleteRead it carefully, some are starting to grasp what is coming. The author is trying to be cautious, but looking at history the long term cycle is not completed and for a drop to average values SPX has to decline to 1500.

ReplyDeleteThere is still a few years, after the high in 2025 it will get ugly - see the NVDA/TSLA charts above.

https://www.zerohedge.com/markets/market-cycles-and-why-bull-isnt-dead

Watch the banks!

ReplyDelete