Short term view - choppy start of the week than higher.

Intermediate term view - still up... probably another week or two, but watching closely now for reversal signs.

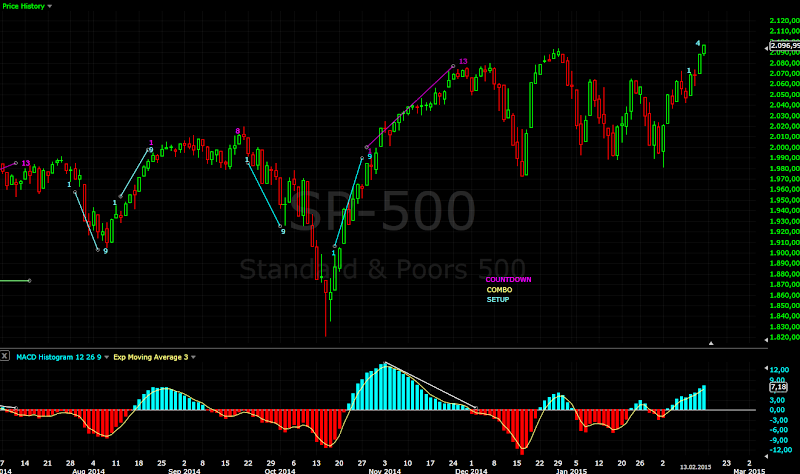

As expected the move up continued after a pause for a day. The charts and indicators are still pointing higher so the expected minimum of 2-3 weeks higher will be achieved:) After that I will be careful.

Short term the move up does not look finished and I think we will see more to the upside but nothing huge...

Intermediate term - the indexes are moving higher that is not a surprise... everybody is bullish counting new ATHs, break outs.... no so fast.

I think the move is weaker compared to previous moves from cycle lows, TomDemark setup had price flip in the middle another sign for a weaker move... market breadth is pointing higher but I think will see triple long term divergences on most of the indicators. I think this confirms my intermediate term view that a correction should start soon.

Below you can see the updated charts Russel2000 and DJTA. I wrote two months ago about expanded flat and wave 4 and since than nothing has changed and I do not see a reason to change the forecast at the moment.

Look at Russell2000 - the moves are with corrective nature, I do not see impulses and I think this is an expanded flat.

What if I am wrong - the move higher will accelerate and we will see higher prices SP500 around 2240... would you complain about some extra money?:)

TECHNICAL PICTURE

Short term - choppy start of the week before continuing higher. Any move lower should stay above the support level 2065-2070. Move below it will be bearish.

Intermediate term - the targets with Fibo extensions....(the first target is 2135-2140 of course:)

Long term - no change. Momentum is still up but I expect to see another divergence - MACD, RSI, histogram

MARKET BREADTH INDICATORS

The Market Breadth Indicators - still pointing up, yes the move up is not over, but I think the indicators are weaker and we will see triple long term divergence on many of them.

McClellan Oscillator - lower high at the moment.. strength is missing.

McClellan Summation Index - buy signal, I expect another lower high.

Weekly Stochastic of the Summation Index - buy signal.

Bullish Percentage - buy signal. I expect to see a triple divergence.

Percent of Stocks above MA50 - moving higher. I expect another lower high.

Fear Indicator VIX - expect to see another higher low when the move is over an triple divergence.

Advance-Decline Issues - the same story moving higher, but I expect lower high and triple divergence.

HURST CYCLES

At day 10 of the current 40day cycle.

At week 2 of the current 20 week cycle. Following closely the current 20 week cycle... when it tops the indexes should move lower to 18 month cycle low and the low for the year.

Tom Demark SEQUENTIAL AND COUNTDOWN - this technique spots areas of exhaustion.

There was a price flip on Monday and we have again 4 of a setup. As I have mentioned I expect to see a weaker move compared to previous bottoms.

DJ Transportation Average - I still think it is in wave 4.

Russell2000 - I think it is an expanded Flat.

Subscribe to:

Post Comments (Atom)

Hi krasi, if you could help me see the Indonesian market (JCI)? if you can, how do you think the current pattern.Thanks

ReplyDeleteI found a chart on yahoo - JKSE, I suppose it is the right index:)

Delete- I see 5 waves higher from August 2013

- MACD,RSI triple divergence weekly and monthly

- prices are rising volume is dropping, momentum is flat - typical for wave 5

Not good for the bulls - I suspect the 4000 area will be tested, which is important support and roughly 38% Fibo from 2009.

Confirmation that something has begun is move below 5250. Such a move will be in sync with the major US indexes.

how for next week? whether they continue to rally? Thank you so much krasi for the response.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteI really hope you can give me a short-term targets for jkse for next week, according to how much you can wave 5 will end.very2 thank you so much krasi.Gbu

ReplyDeleteI do not have intraday charts and it is impossible to forecast something for the next few days.

DeleteJust an observation - if you draw a trend lines , the price is at the upper trend line and momentum is rather flat.

The index could climb a little bit higher, but I would be surprised to see something strong or acceleration to the upside.

maybe I could email? Tq

ReplyDeletehourly chart from the last two weeks with macd and rsi... texasin@abv.bg

DeleteThanks krasi

Deletecan you send the the two weeks hourly price action on one chart else I can not compare it..

DeleteIt looks like ED... a little bit higher for the start of the week, than pullback and test of the highs.

Deletecarnap:

ReplyDeleteHi krasi, I have posted a weekly outlook on my blog.

The file can be downloaded from drop box.

https://chartbuster.wordpress.com/

Thanks for the update:)

DeleteXAU is interesting, I was wondering what it could be... it is not an impulse.

EURUSD - I think we have a double zigzag from 1.60 and the current wave lower is extended wave 5 from C from the second zigzag.

If you measure the previous zigzag, the previous leg from the second zigzag and the target for extended wave 5 they all give pretty close targets between 1.05-1.10.

I think after wave 4 and 5 of 5 we will see a major bottom.

Carnap:

DeleteXAU is very complex. Have look at XAUEUR. There a new bull market could be on the way already. And that is what will follow in the XAUUSD also but with a timely shift. But near term I suppose we will see an up move towards 1300.

EUR/USD: considering the roles for the ZZ standard pattern I follow a ZickZack pattern from the high at 1.60365 is not possible unfortunately because the first Z has been retraced over 0,618, therefore only a Flat pattern is possible. Next targets 1.0815 and normal extension 0.9833.

Ok krasi,JKSE today close 5325 (-48pts) -0,90% and i am buy today in the closing.tq

ReplyDeleteI hope it will work out....

DeleteHi Krasi,one of my happiness today, jkse all-time high of 5415 and 4 shares that I bought when I gain correction 26/2 on average above 6% .i already selling everything in closing earlier.Thanks U so much Krasi.Gbu

DeleteCorrection: 2/16 not 26/2

DeleteGreat:) am I glad to hear that.....

Delete